Description

Want to simplify your RSI strategy backtesting? Our Google Sheets template makes it easy! Analyze, test, and refine your trading ideas, all within Google Sheets, no advanced tools needed!

What is backtesting?

Backtesting is testing your trading strategy using historical data.

Using real historical data, you can simulate the trading results as if you had used the specific trading strategy with specific stock.

You can not only identify if the strategy is a profitable one or not. You can also fine-tune your trading parameters and try to find a strategy that has been profitable.

Though the past results are not guaranteed to happen in future, your trading decisions will be based on past results and not just guess work.

Let’s take an example.

-

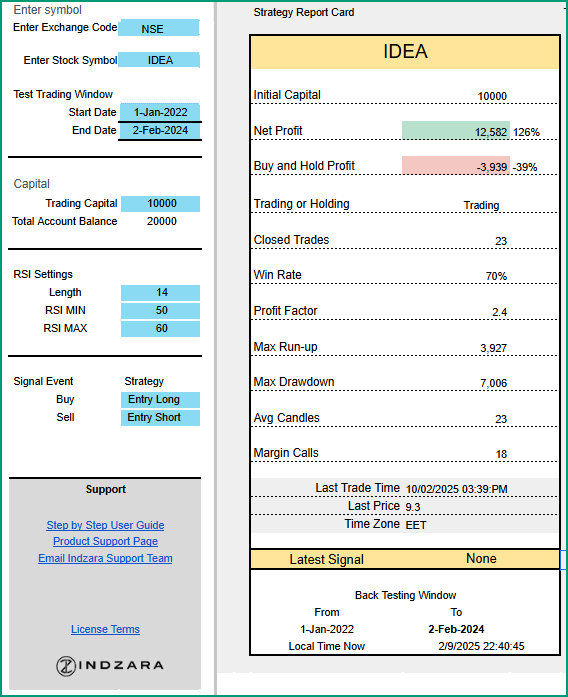

- Stock Exchange: NSE

- Stock Symbol: IDEA

- Testing period: From Jan 1, 2022 to Feb 2, 2024

- Strategy: Whenever there was a Buy Signal Line, I enter a long trade and when there was a Sell Signal Line, I enter a long trade.

- Capital invested: ₹ 10,000

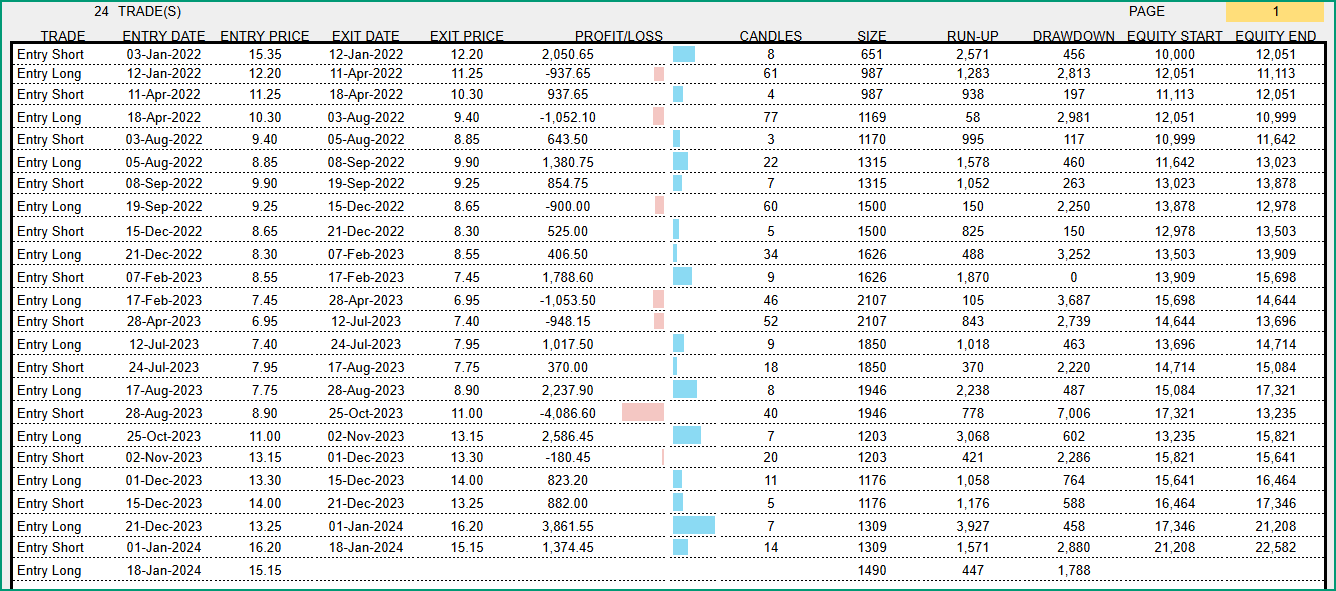

If I had used the above simple trading strategy using RSI (Relative Strength Index) indicator to drive my trading decisions, I would have made ₹ 12,582.

I would have closed 23 trades, with a win rate of 70% and Profit factor of 2.4

What if we bought and held the shares instead of trading?

If we had not done these 23 trades and we had just bought IDEA shares worth ₹ 10,000 we would have lost ₹ 3,880. It would have not been profitable compared to Trading strategy. In this specific example, trading would have been a better strategy.

This is just to illustrate the tool’s capability. This does not mean that trading is always the better strategy. Other examples might prove that buying and holding may be the better strategy.

Why backtesting?

-

- This is a risk-free method to test your strategies on real historical data as you are not using real money to trade.

- You can try many different strategies to find one that works for you.

- You can be more confident with your trading decisions in future.

Disclaimer

We do not offer financial or trading advice. Our template is another tool to help you make smarter data-driven trading decisions. Our template automates the calculations based on your own strategy inputs. Indzara.com is not responsible for any trading decisions taken.

Easy to Use

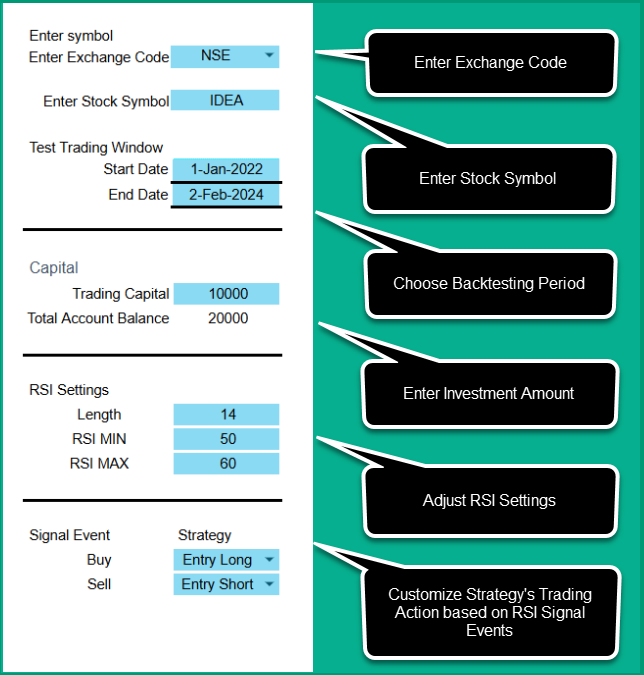

Enter 6 Simple inputs (exchange, Stock symbol, Test window, RSI settings, Trading strategy and Capital Investment) and view the backtesting results instantly.

Customizable/Flexible

-

- Each trader has a different approach when it comes to trading strategy and the template allows you to customize the settings for the RSI indicator.

- You can also choose what trading action you would like to take based on the signal events from the RSI indicator. For more on RSI Indiator, please see this article ·

- The template supports Long and Short trading

Accuracy

For traders, having accurate data is very crucial and we have verified our calculations with the results from Tradingview.com website.

Designed for Insights

Charts and calculations are designed and presented in a way to aid quick and confident decision-making.

Metrics included in the template

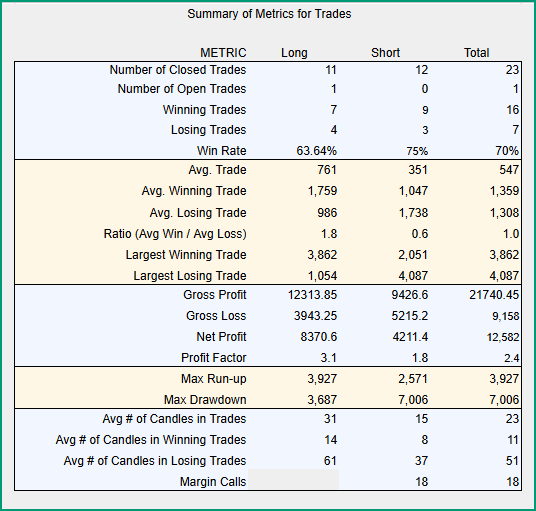

1.Number of trades (Closed/Open)

2.Win Rate %

3.Avg. Trade Profit/Loss

4.Avg Win/Avg Loss Ratio

5.Net Profit

6.Profit Factor

7.Max Run-up

8.Max Drawdown

9.Avg # Candles per trade

10.Margin Calls

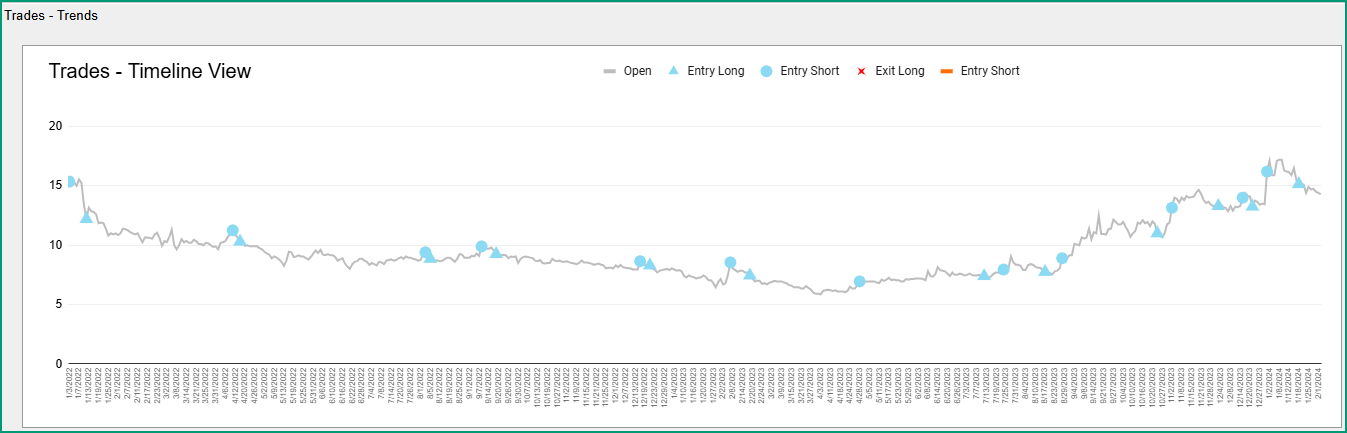

Timeline View

View the trades on a timeline chart showing exactly when and what type of trades are made based on strategy.

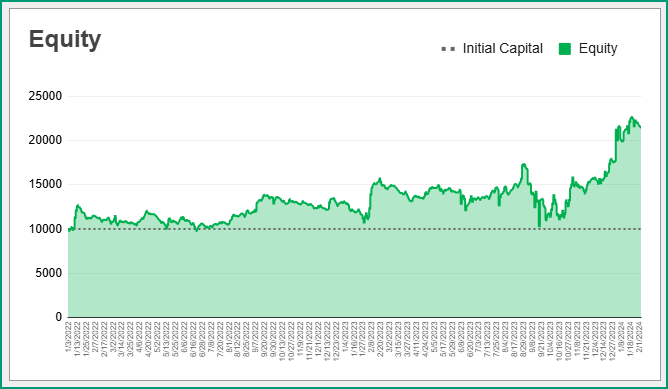

Equity Trend Chart

View the trend of your equity over time during the backtesting period.

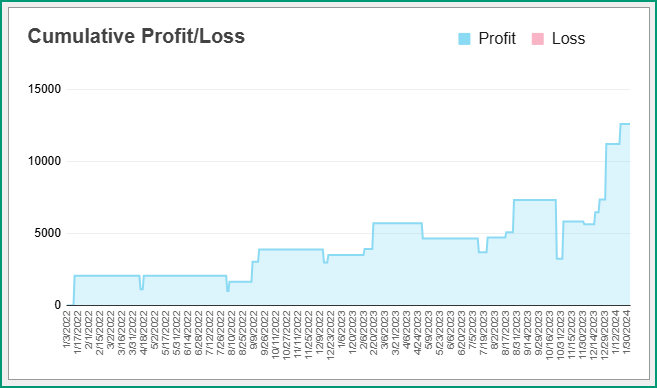

Cumulative Profit/Loss Chart

View the trend of profit/loss over the backtesting period.

List of Trades

In addition to the summary metrics and charts, you can view the specific trades in detail.

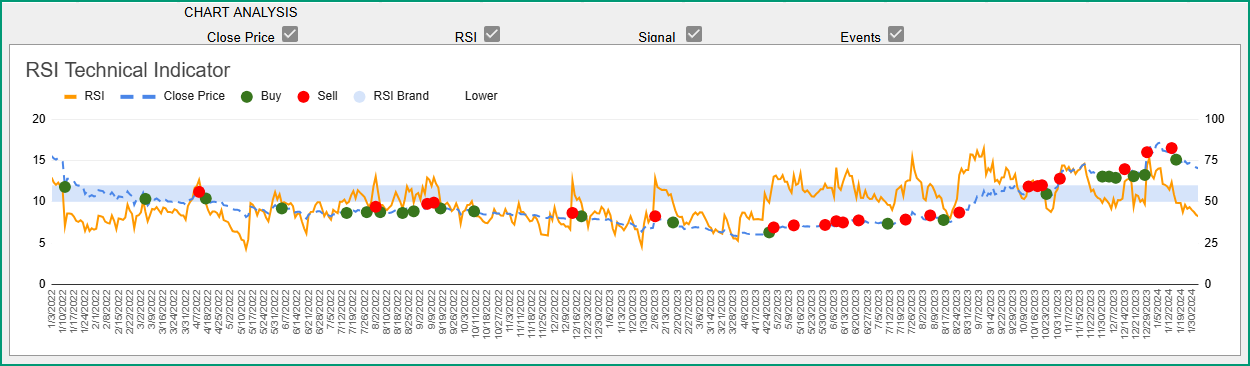

RSI Chart

A customizable RSI chart that shows the RSI line, Signal line and Histograms. You can also enable the signal events.

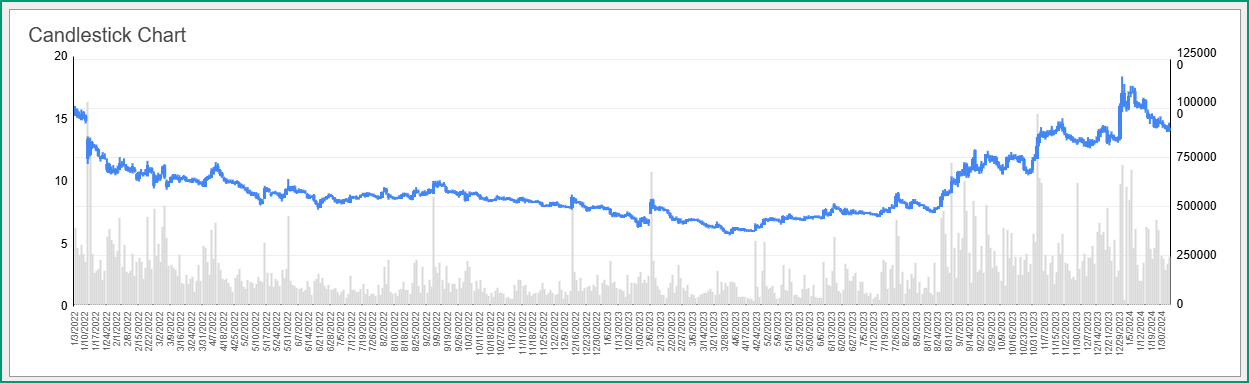

Candlestick Chart

A standard candlestick chart that shows the candles, along with the volume bars.

Requirements

To use this solution to backtest RSI trading strategies, you need the following three.

To use this solution to backtest RSI trading strategies, you need the following two.

1. Google Sheets template

Purchase the template from this page here for an affordable one-time fee. Our template uses the Market data and automates all the calculations involved in backtesting.

2. Internet connection

You need to connect to the internet to get market data.

Application / Limitation

-

- The template can be used for Swing Trading using daily market prices. The template cannot be used for intra-day trading. Google services do not provide data at minute or hourly intervals. For any queries please contact us contact us..

-

- Since the template uses market data from Google services, only the stocks, indices and currencies that are available in the Google service can only be analyzed. Not all symbols are available from Google.

Reviews

There are no reviews yet