PTO Policy for Hourly Employees & How to calculate PTO Balance

In this article, we cover the common components of a PTO (Paid Time Off) policy for hourly employees. PTO Policy is an important part of a company’s Employee Benefits package. It is one of the factors being considered by candidates when they decide to join a company. An effective employee PTO policy will benefit both employees and employer.

We will go over each of the PTO policy components, explain them in detail and show examples to illustrate how PTO balances are calculated.

COMPONENTS OF A PTO POLICY

Typically, a PTO policy would address the following aspects and they are implemented in the templates from indzara.com.

- Probationary Period: Is there a probationary period for an employee where PTO is not accrued?

- Accrual Period: How frequently and when does the PTO accrual happen?

- Accrual Rate: How much PTO does an employee accrue during each period? Does it change by Tenure?

- Rollover Policy: Can balance from one year be rolled over to the next year? If so how much and when?

- Max Balance: Is there a maximum balance that an employee can carry at any time?

Now, let’s look at each of them in detail.

1. PROBATIONARY PERIOD

In some companies, employees may not be awarded any PTO for the first X number of days of employment. For example, employee does not earn any PTO during the first 90 days of employment. This period may be called as Probationary period. Work done during this period will not result in any PTO Accrual.

2. PTO Accrual Period

This is to define how often PTO is accrued. Most common options are Weekly, Every 2 Weeks, Twice a Month and Monthly. This is typically aligned with your pay periods.

Weekly: This option means that employee will accrue PTO once a week, provided he/she has worked enough hours (cumulatively) to meet the Accrual rate policy requirements. For example, accruals happen every Friday.

Every 2 Weeks: Every 2 Weeks policy is similar to weekly except it accrues every other week. For example, every other Friday.

Twice a Month: Accruals can happen 1st and 15th of every month. Or 15th and Last day of every month.

Monthly: For example, we can do accruals on 1st of every month or ‘Last Day’ of every month.

3. PTO Accrual Rate

This defines how much PTO hours are earned by the employee on each accrual day.

To explain this, let’s take an example policy: Employee would earn 1 hour of PTO for every 40 hours worked.

- If the employee worked 39 hours, he/she would not earn any PTO. But once the 40th hour is completed, he/she will earn 1 hour of PTO.

- The 40 hours do not have to be in the same accrual period.

- The employee accrues in multiples of 1 hour.

Another policy example: Employee would earn 4 hours of PTO for every 160 hours worked.

- For the first 159 hours of work, the employee does not accrue anything. But once the 160th hour of work is completed, the employee accrues 4 hours of PTO.

- The 160 hours are accumulated over periods.

- The employee accrues in multiples of 4 hours.

Companies may also have a tiered structure, where loyal employees (with more tenure) will earn PTO at a higher rate.

For example,

- Employees with <= 2 years of tenure at the company may receive an accrual rate of 1 hour of PTO for every 40 hours worked.

- Employees with >2 years of tenure at the company may receive an accrual rate of 2 hours of PTO for every 40 hours worked.

You can have more than 2 tiers as well. This may lead to improved employee loyalty.

4. ANNUAL PTO ROLLOVER POLICY

As an employee continues to accrue PTO every period, the balance keeps growing, assuming there are no PTO/vacations taken. Employees are encouraged to take regular time off to maintain a healthy work-life balance.

Also, companies may consider remaining PTO balance as cash that needs to be paid to employee if employee leaves the company. So, very high balance could mean more cash out the door for the company. These are reasons why there is usually a rollover policy.

This policy setting determines how many hours of PTO the employee can carry over from one year to the next year.

Let’s look at three flavors of Rollover policy.

- Zero Rollover: Employee loses all the PTO balance at the end of the year and starts from scratch in the next year.

- Rollover Limit: We can set a limit on how many hours are carried over. This is the most common practice among companies.

- Unlimited Rollover: Here the employee does not lose any PTO and will carry over everything to next year. This is unusual for a company.

ROLLOVER TIMING

With rollover policies, there is another aspect. Some companies may apply rollover at calendar year change (1st Jan of every year for all employees) or on work anniversary dates (which vary for each employee).

5. MAXIMUM ALLOWED PTO BALANCE

The rollover limit only applies to the end of the year balance. Some companies can set an additional limit on maximum balance at any time during the year, to ensure that there is a limit to PTO accrual. This would mean the employees may have to take regular PTO throughout the year, instead of accumulating towards year end.

This is referred to as the Maximum Allowed PTO Balance.

ILLUSTRATION

Now that we defined the key factors, let’s take an example employee and illustrate how these components work and how to calculate PTO policy for an hourly employee.

EMPLOYEE DETAILS

Let’s assume an employee with the following details for this illustration.

- Works 8 hrs every weekday

- Hire date: 3 July 2019

- Probationary Period: 90 Days

- Rollover limit: 10 Hours on 1st Jan

- Max PTO Balance: 30 Hours

- PTO Taken: 1 hour on 25 Oct 2019, 7 May 2020 and 8 May 2020

- Accrual Rate:

o <= 9 Mths Tenure: 1 Hour PTO per 40 Hours Worked

o >9 Mths Tenure: 2 Hours PTO per 40 Hours Worked

PROBATIONARY PERIOD

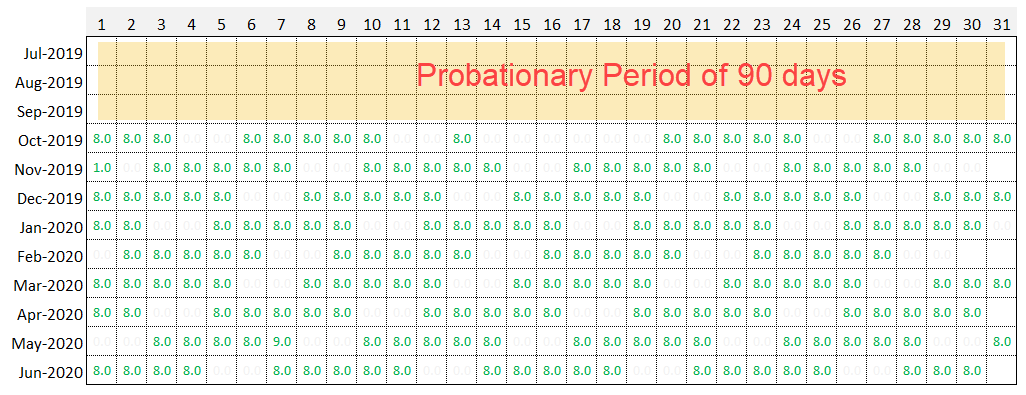

As the employee was hired on 3rd July 2019, the employee will not be eligible for PTO accrual until Sep 30th.

First day of eligibility will be Oct 1, 2019

The image above shows the number of hours worked by employee, that are used for calculating PTO accrual.

Though the employee may have worked during the probationary period, the work does not lead to PTO accrual. Only work done from Oct 1st will be used for PTO accrual calculations.

ACCRUAL PERIOD

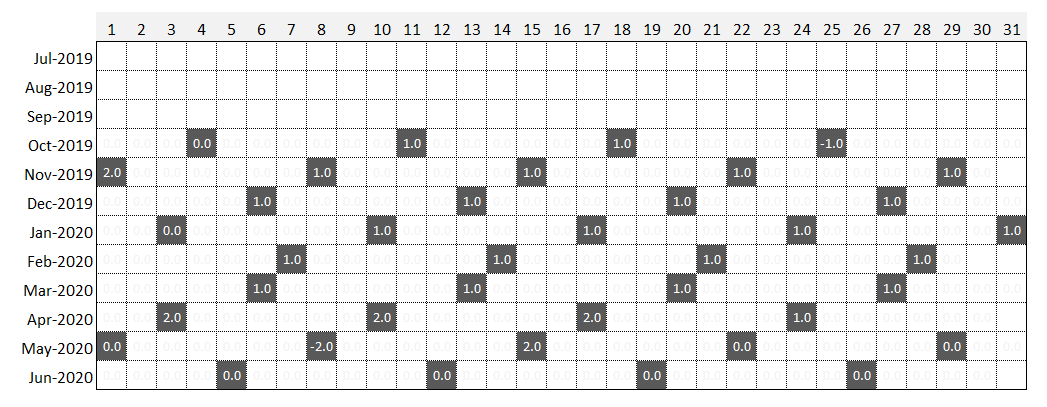

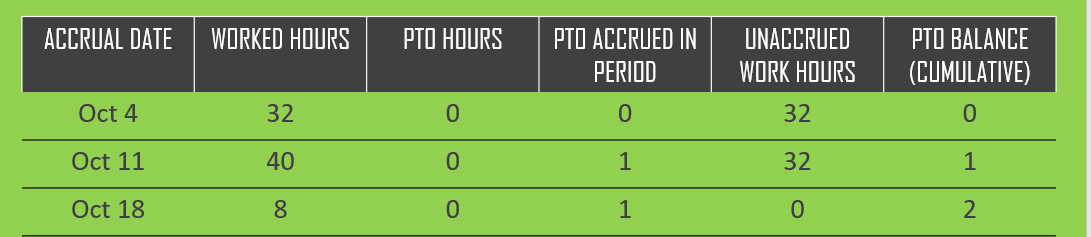

Since our employee accrues PTO every week, you can see the accrual calendar below where accrual happens on Oct 4, 11, 18, 25…..

First accrual day is Oct 4th.

The numbers above refer to how much PTO balance changed each period. We will get to how we calculated that shortly.

ACCRUAL RATE

We will begin with simpler calculations and layer in more complexity later.

WEEK 1

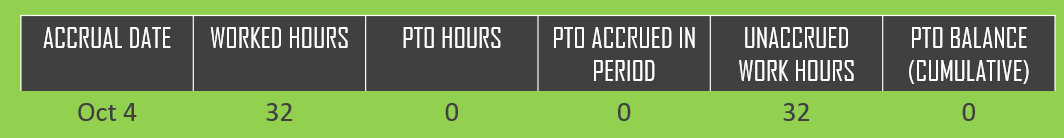

Let’s take the first accrual period ending Oct 4th.

There are 2 key inputs needed. Hours Worked and PTO Hours used.

- Employee worked for 32 hours from Oct 1st (first eligible date) to Oct 4th (Friday).

- Employee didn’t take any PTO.

For every period, we calculate 3 output.

- PTO Accrued in Period: How much PTO has employee earned in this period alone?

- Unaccrued Work Hours: How much hours did the employee work that have not converted to PTO yet?

- PTO Balance at end of period: How much is the PTO Balance at end of period, available for employee to use?

PTO Accrued in Period

= (Hours worked in this period + Any unaccrued Work Hours from Previous period) * Accrual Rate

= (32+0)* Accrual Rate = 32 Hours *Accrual Rate

= 0 hours of PTO accrued + 32 work hours unaccrued.

PTO Accrued in Period is 0 since employee has not reached 40 work hours yet. However, the 32 hours should count towards the following week’s balance calculation. So, we store that in the ‘Unaccrued Work Hours’ column.

PTO Balance

= Previous Period Balance + PTO Accrued in Period – PTO Used

= 0 + 0 – 0

= 0 hours

PTO Balance for the employee at the end of Oct 4th is 0 as the previous balance is 0 and no PTO was used during the period.

WEEK 2

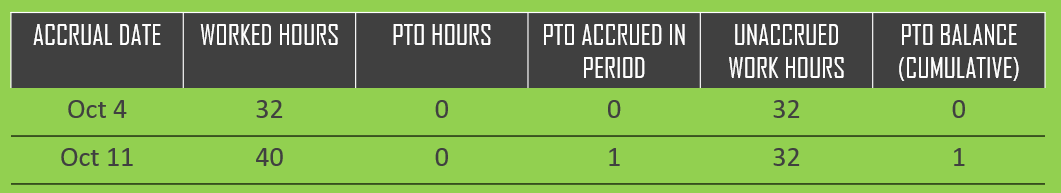

Let’s move to the next week – ending on Oct 11th.

Inputs:

- Employee worked for full 40 hours.

- No PTO taken.

PTO Accrued in Period

= (Hours worked in this period + Any unaccrued Work Hours from Previous period) * Accrual Rate

= (40+32)* Accrual Rate = 72 Hours *Accrual Rate

= 1 hour of PTO accrued + 32 work hours unaccrued.

PTO Accrued in Period is 1 since employee has reached 40 work hours cumulatively. The 32 unaccrued work hours from previous week get added to total hours worked.

PTO Balance

= Previous Period Balance + PTO Accrued in Period – PTO Used

= 0 + 1 – 0

= 1 hour

WEEK 3

Now, third week comes along.

Inputs:

- Employee only worked for 8 hours in that week.

- No PTO Taken

PTO Accrued in Period

= (Hours worked in this period + Any unaccrued Work Hours from Previous period) * Accrual Rate

= (8+32)* Accrual Rate = = 40 Hours *Accrual Rate

= 1 hour of PTO accrued + 0 work hours unaccrued.

PTO Balance

= Previous Period Balance + PTO Accrued in Period – PTO Used

= 1 + 1 – 0

= 2 hours

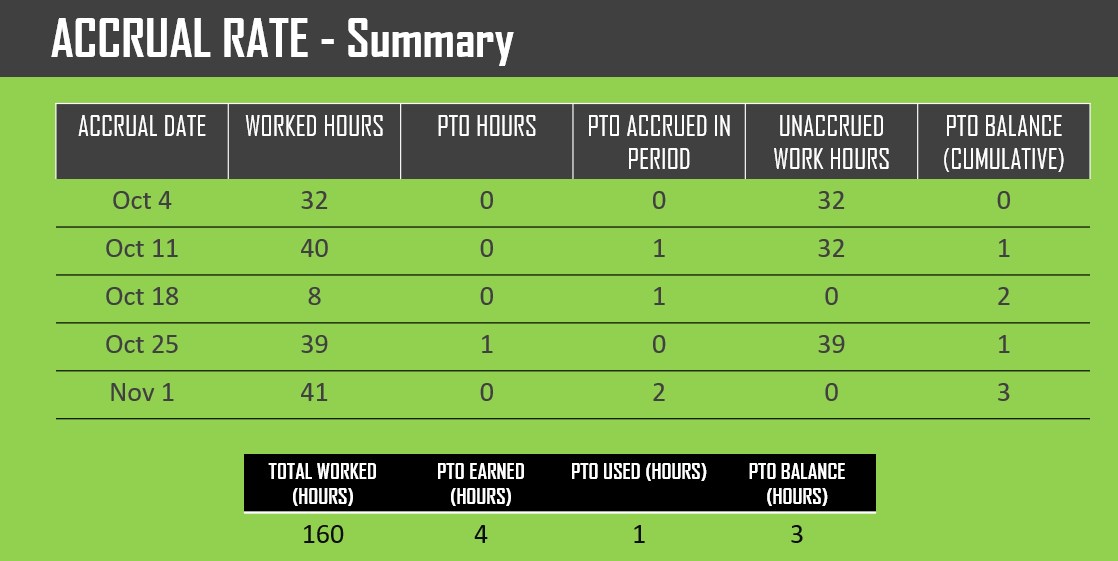

WEEK 4

Now, on to the fourth week .

Inputs:

- Employee takes 1 hour of PTO and works only 39 hours.

Though the employee does get paid for 1 hour of PTO, for our PTO accrual calculation that 1 hour of PTO will not be used. Essentially, an employee’s PTO time does not earn him more PTO accrual.

PTO Accrued in Period

= (Hours worked in this period + Any unaccrued Work Hours from Previous period) * Accrual Rate

= (39+0)* Accrual Rate = 39 Hours *Accrual Rate

= 0 hours of PTO accrued + 39 work hours unaccrued.

PTO Balance

= Previous Period Balance + PTO Accrued in Period – PTO Used

= 2 + 0 – 1

= 1 hour

WEEK 5

Now for the 5th week.

Inputs: Employee does overtime and works for 41 hours. No PTO Taken.

PTO Accrued in Period

= (Hours worked in this period + Any unaccrued Work Hours from Previous period) * Accrual Rate

= (41+39)* Accrual Rate

= 80 Hours *Accrual Rate

= 2 hours of PTO accrued + 0 work hours unaccrued.

PTO Balance

= Previous Period Balance + PTO Accrued in Period – PTO Used

= 1 + 2 – 0

= 3 hours

SUMMARY

In summary,

Employee worked 160 hours in 5 weeks, earned 4 hours of PTO (1 hr per 40 hours worked) and used 1 hour of PTO. The Balance as of Nov 1st is 3 hours of PTO.

Key Takeaways:

- PTO Accrual is based on cumulative work hours and not just hours worked in that period.

- Unaccrued work hours are tracked to be used for next week’s calculation

- PTO used will be deducted from balance

- PTO hours do not yield PTO accrual

- Formulas:

- PTO Accrued = (Hours worked in this period + Any unaccrued Work Hours from previous) * Accrual Rate

- PTO Balance = Previous Period Balance + PTO Accrued in Period – PTO Used

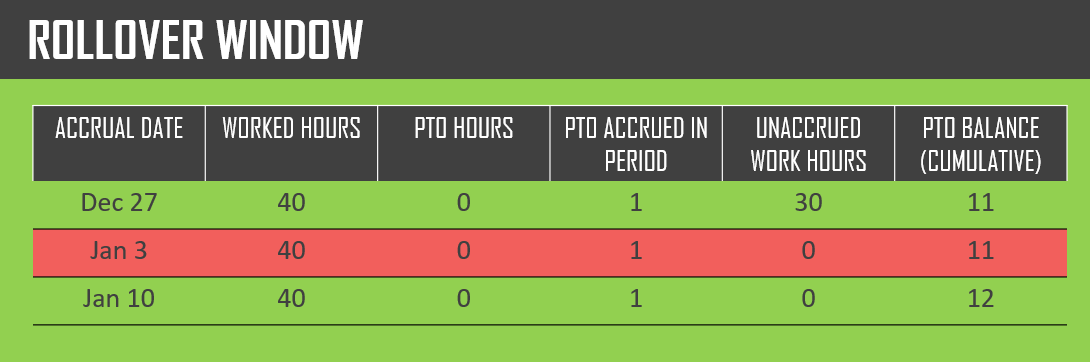

ROLLOVER POLICY

Rollover limit was 10 hours and it was applied on calendar year end. So, the first accrual date in Jan 2020 (Jan 3rd, 2020) will see the rollover policy implemented.

The formula we used for calculating balance in the previous section gets an upgrade only for rollover periods.

Assuming balance as of Dec 27th was 11 and 30 unaccrued work hours.

Calculating the balance for Jan 3.

PTO Accrued

= (Hours worked in this period + Any unaccrued Work Hours from previous) * Accrual Rate

= 40 * Accrual Rate

= 1 Hour of PTO Accrued + 0 unaccrued work hours

PTO Balance

= min(Rollover limit, Previous Day Balance) + PTO Accrued in Period – PTO Used

= Min (10,11) + 1 – 0

= 10 + 1 – 0

= 11 Hours

Only 10 hours get carried over from Dec 27th Balance due to the rollover limit of 10 hours. If the rollover policy was 0 rollover, then all 11 hours will be lost. In case of unlimited rollover policy, all 11 hours will be carried over.

So, the new balance as of Jan 3rd is 11 hours.

From Jan 10th again, the employee will carry over the balance over to the next week as usual without any rollover limit. The limit is applied only on rollover windows once a year.

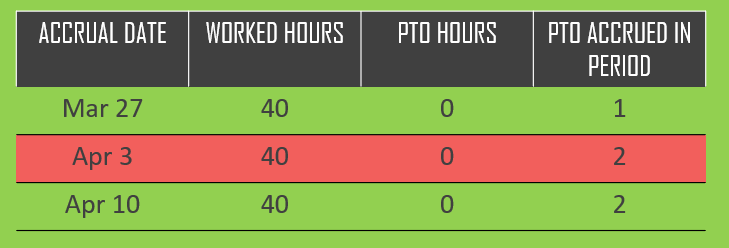

TENURE BASED ACCRUAL RATE

As the employee continues to work at the company, he/she reaches the 9 month tenure period where the accrual rate increases to 2 hours of PTO for every 40 hours worked.

Employee completes 9 months on Apr 2nd and on Oct 3rd will be eligible for the new rate.

As shown above, the employee earned 1 hour per 40 hours worked on Mar 27.

From Apr 3rd, the employee earns 2 hours of PTO for 40 hours worked.

Note: New rate applies to all hours worked during transition week (Mar 28th to Apr 3) regardless of the exact date when the rate transition happened.

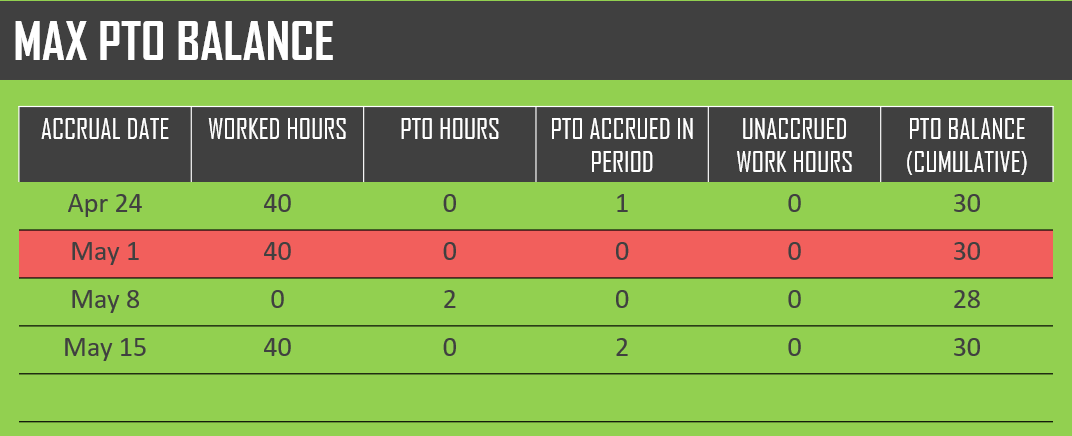

MAX PTO BALANCE

Now, for the last setting: MAX PTO BALANCE of 30 hours.

The employee continues to earn more balance over time and on Apr 24th the balance reaches 30 hours.

The employee worked 40 hours as usual during the next week.

PTO Accrued = (Hours worked in this period + Any unaccrued Work Hours from previous) * Accrual Rate

= 40 * Accrual Rate = 1 Hour of PTO Accrued + 0 unaccrued work hours

PTO Balance = min (Max PTO Balance , (Previous Day Balance + PTO Accrued in Period – PTO Used))

= Min (30,30+1-0) = Min (30,31) = 30 Hours

Note: Though the PTO accrued should be 1 hour, it is represented as 0 in the image above, in order to avoid confusion. Employee does not actually get the benefit of that 1 hour as it will exceed the Max PTO Balance Policy limit.

When the employee uses 2 hours of PTO during the week ending May 8th, the PTO balance becomes 28 hours.

In the following week, the employee will restart accruing new PTO as 28 is less than 30 (max limit).

CONCLUSION

I hope the above example illustrates how PTO balance can be calculated for hourly employees. The 5 key policy factors we discussed can become complex to implement due to various flavors possible and the calculations are not very easy to build. I spent quite a bit of time writing the formulas to accommodate the various scenarios.

I am happy to inform that you don’t have to spend your time building these formulas. I will be publishing a free Excel Template that comes pre-built with the formulas. You can implement your PTO policy and start calculating balance for an hourly employee within 5 minutes.

Please post your feedback in the comments below. Thank you.

2 Comments

Please give insight how you interpret the change of tenure.

At 11 months worked the employee goes into the next increase for years 1-2 correct?

Then after working 24 months, they go into their next tier, correct?

I get confused if it’s after having worked 2 years and 11 months or if it’s going into the 3rd year that their next tier begins.

Years of service based on Jan 1st.

Prorated if less than 1 year

Years 1 – 2 80 hours earned

Years 3 – 5 120 hours earned

6 Years 144 hours earned

Thank you for showing interest in our template.

In the shared scenario, hours earned is missing for two timeframe 2 – 3 years and 5 – 6 years. If there is no missing timeframe then it should be as shown below:

Months (Hours Earned)

12 (80)

36 (120)

72 (144)

Best wishes.