Personal Finance Manager 2025 (Free Excel Budget template)

This is a simple free Personal Finance management excel template that focuses on making it easy for you to know what’s happening with your financial situation especially when you have multiple bank accounts, credit card accounts and cash.

This Excel Budget template also helps you set budgets and see how you are actually doing against your budget.

With simple data entry, the template provides you instant access to actionable information in a consumable form that can answer key questions regarding your personal financial situation.

Specifically, the template helps you in knowing the following:

- How much money is in my different bank accounts?

- How much do I owe on credit cards?

- On what items am I spending my money on?

- Am I exceeding my monthly budget? If so, in which categories?

- How are my expenses trending over time?

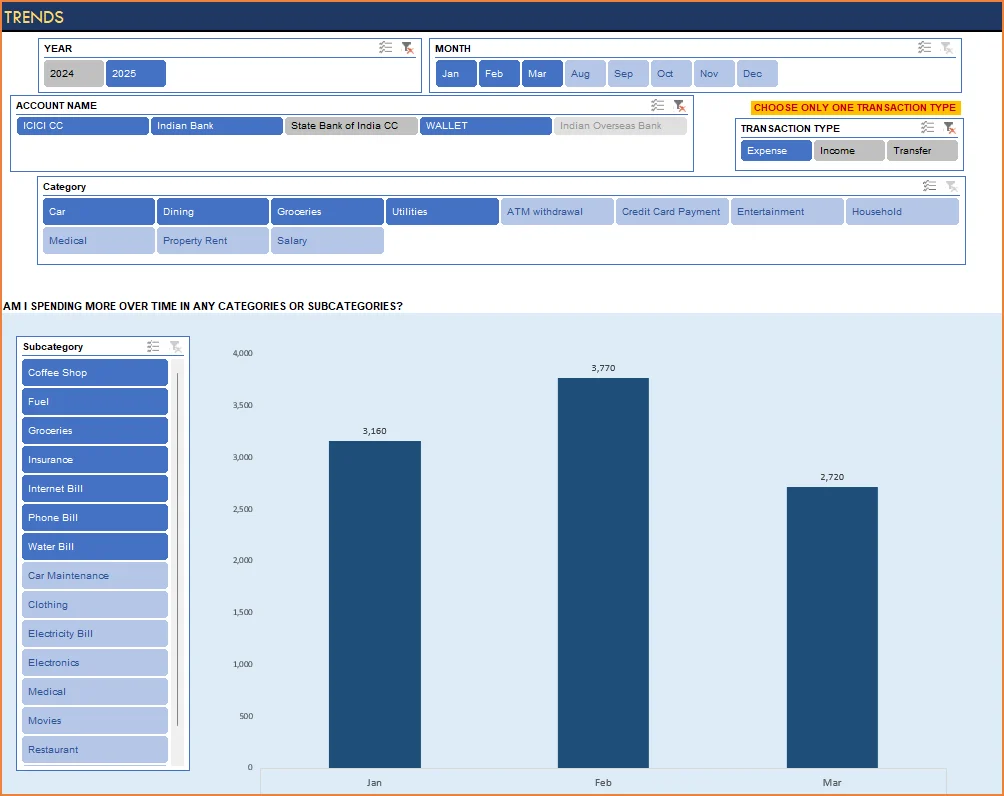

- Am I spending more on any specific expense category over time?

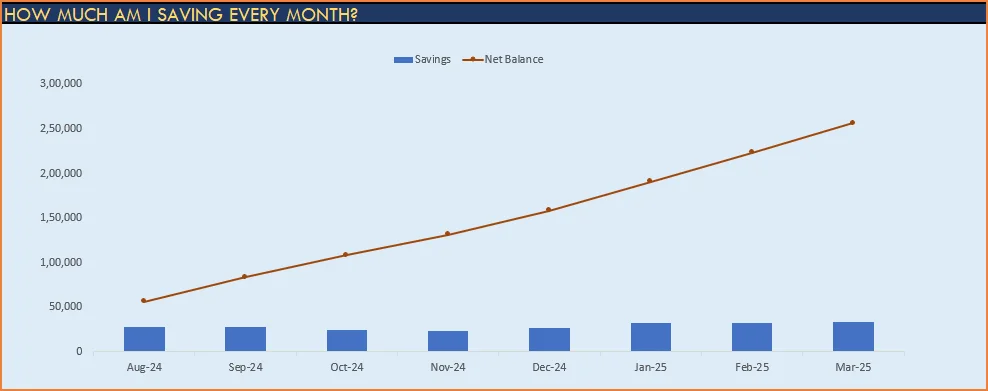

- How much am I saving every month? How does that add to my net balance?

Free Downloads

This version doesn’t use Pivot Tables and Slicers. 4 Charts that are available in Excel 2010 file are not available in this.

Requirements

Excel 2010 and above for Windows

Excel 2011 for Mac

Video Demo

How to track personal finances in Excel?

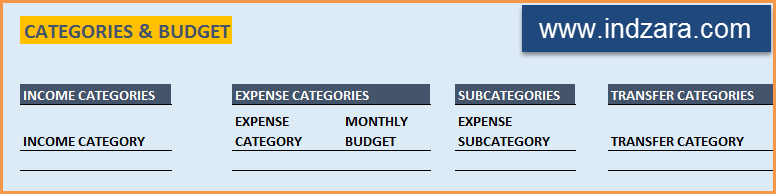

The template has 3 worksheets: 1) Settings 2) Transactions and 3) Report.

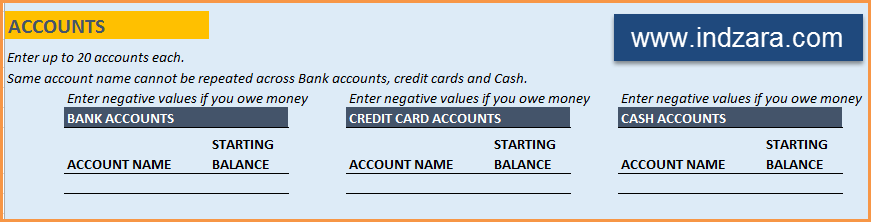

STEP 1: Enter information in Settings worksheet

- Enter Accounts (bank accounts, Credit Card Accounts and Cash Accounts)

- Set your starting balances of accounts

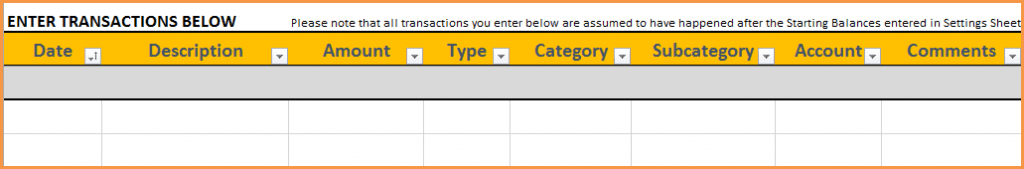

STEP 2: Entering transactions in the Transactions worksheet

When you open the template, there will be no records in the Transactions worksheet (as shown in the image below). Start entering your own transactions.

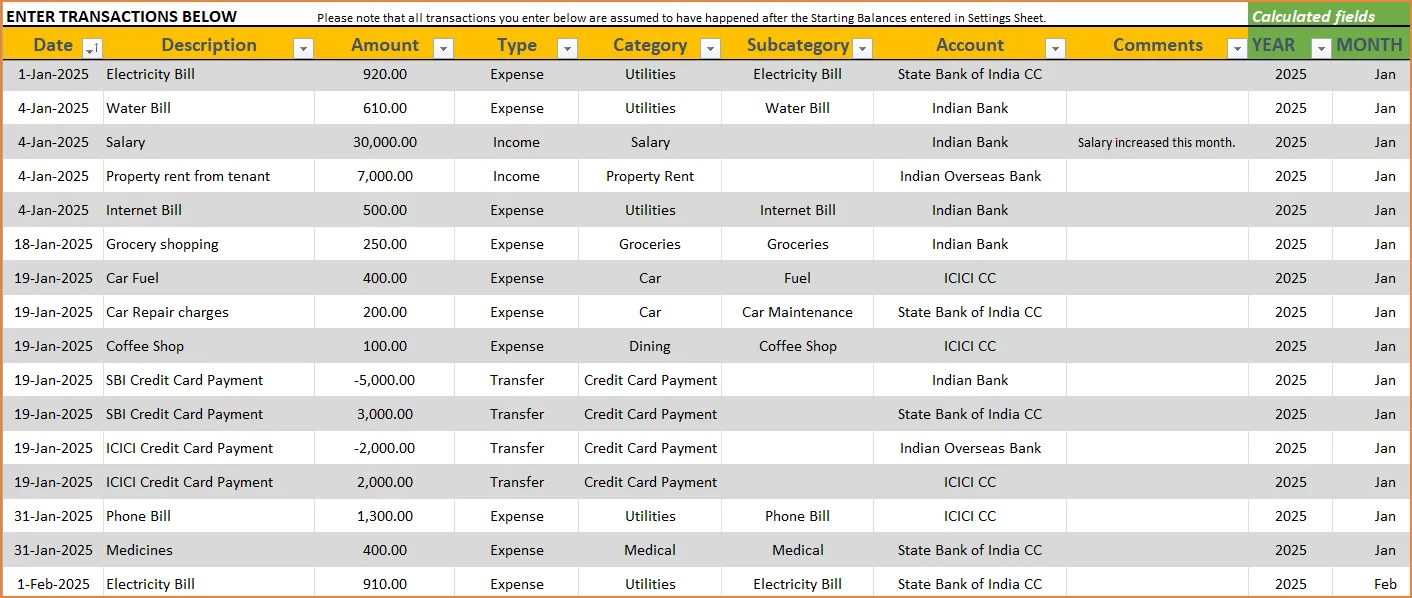

3 Types of Transactions

- Income and Expense: By default, all the Income and Expense transactions should be entered as positive amounts.

- Special case (Refund): If you purchased an item at a store, you would enter an Expense transaction with positive amount. If, a few days later, you returned the item to the store for some reason and get a refund, then you should enter the refund as a new Expense transaction with negative value.

- Transfer: When money is transferred from one account to another, create two records

- ‘Transfer’ type with negative amount from the account you are taking the money from.

- ‘Transfer’ type with positive amount for the account you are depositing the money into.

- Examples of Transfers are Credit Card Payment (transfer from Bank account to Credit Card account) and ATM withdrawal (transfer from Bank account to Cash)

- Drop down menus are available for easy data entry in these fields (Type, Category, SubCategory, Account).

After you enter your transactions, the Transactions worksheet would look like this image below.

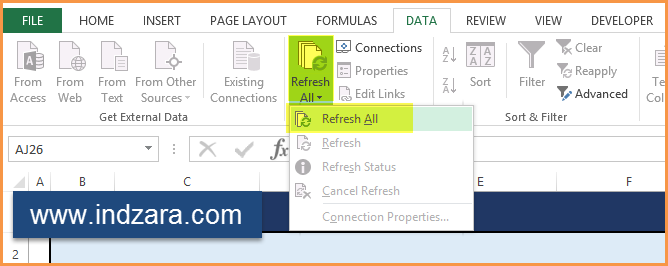

STEP 3: View Report

Since there are pivot tables and charts, please refresh the data by going to Data ribbon and refresh all (or keyboard shortcut Ctrl+Alt+F5) . This updates the charts with your new transactions.

Report sheet is locked to prevent accidental editing of formulas. To unlock, use password indzara

The report has four pages.

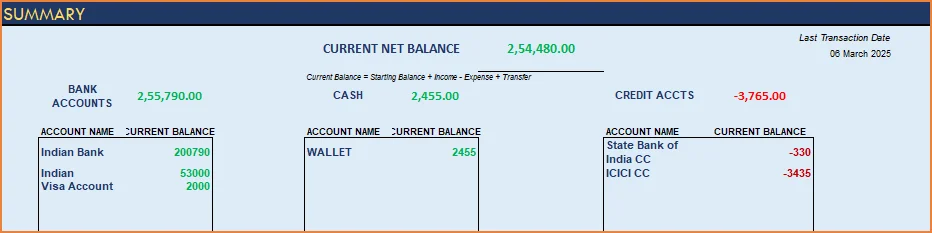

1) Summary

- Summary of your current financial status

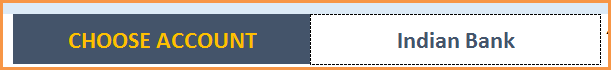

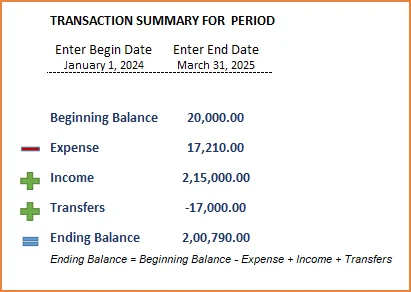

You can find balances for any period in each of your accounts using this personal account template.

This can be helpful when your bank statements and credit card statements actually have their billing cycles different from calendar months. This allows you to compare your statements with the data you have in this template and confirm that you have not missed any transactions.

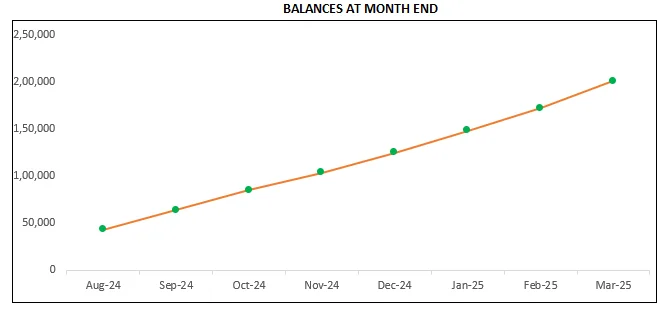

The chart shows the trend of month-end balances in the account chosen.

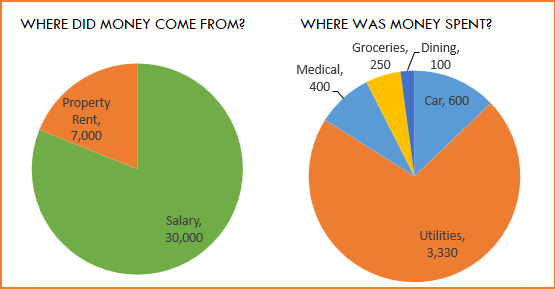

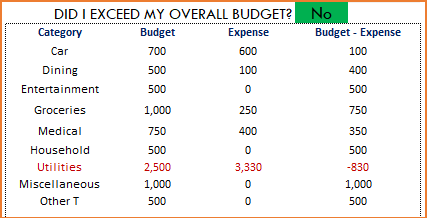

2) Monthly Financial Analysis

This multiple bank account management excel template can also help in monthly financial analysis. Please choose one month at a time using the slicers at the top.

View total Income, expense and savings

Understand where the money came from and where it was spent, in the month

- Track whether you have exceeded the monthly budget.

- Also see the comparison of expenses to budget by each category

- Categories that exceeded budget will be highlighted in red

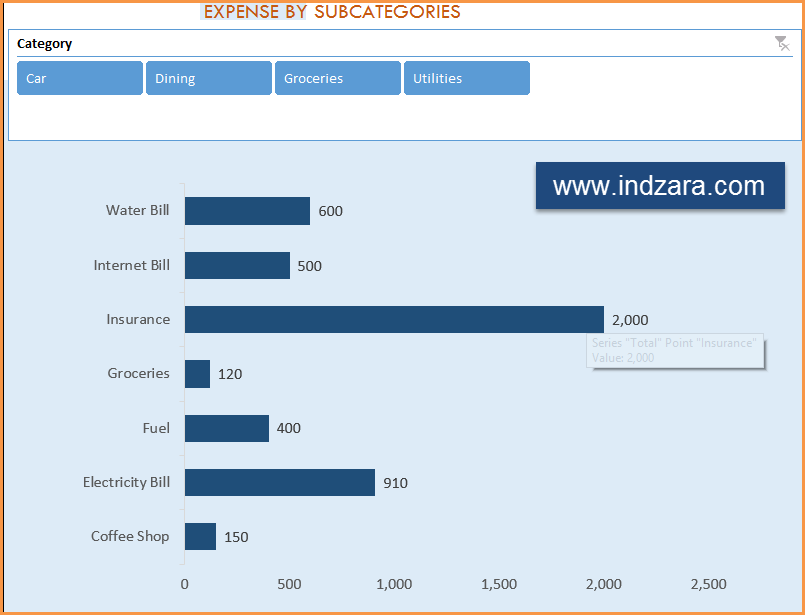

Understand expenses by Subcategories.

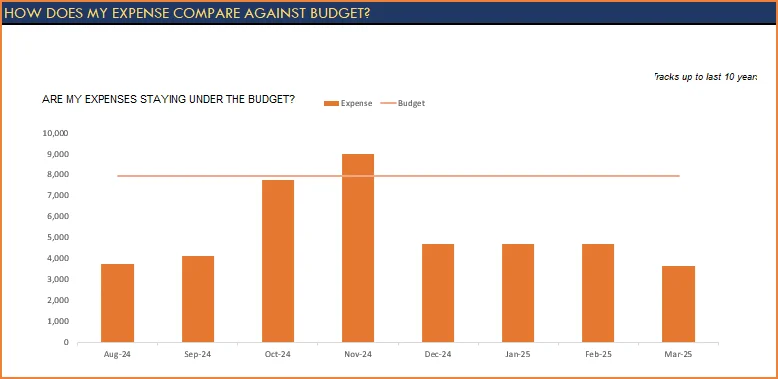

3) Trends of expenses, savings and net balance

Trend of expenses over time and comparing against monthly budget

Trend of savings and net balance over time

4) Trends of transactions by Categories and Sub Categories

I hope you find this personal finance management template excel useful in managing your personal finances easily.

346 Comments

That’s a wonderful article, friend!

I have recently found a website, which will actually take care of all your bill payments.

Finovera provides an automatic bill pay service will pay your bills on your behalf. So, you will never have to worry about paying your bills.

It will be done on time, every time!

Finovera will send you an alert if a bill is unusually high or if you need to transfer funds to cover it.

Track household bills online using a safe and ultra-secure billing system, which will definitely get you rid of pain!!

You can manage all your financial statements and that is stored safe in Finovera.

Finovera is absolutely free to use and always will be!!!

on the report tab when i insert the expenses and everything and refresh the data the year colum disapears and the month is on days.

this happens on the last thing on the report tab.

I apologize if I have not responded to your comment. I somehow seem to have missed this one. Please e-mail at indzara at gmail, if you are running to any issues with the template. Thanks.

I have commenced entering data from 1-4-14 and as on today 28th april ,Under reports- page 2 shows the details date wise and not Year and month wise. under report page-4 shows only the date of 4th april. I have done refresh etc. I dont know whether the data would be corrected after completion of april 14. Please clarify.

When the transactions table in the ‘Transactions’ sheet is emptied (deleted all data) and then the sheet is refreshed, this can happen. Month and Year slicers you see are dependent on the Date field. If date field is empty, Excel doesn’t remember that it needs to create Year (and so it removes the slicer completely) and Month (Month becomes dates). I see that in your screenshots, this is exactly what has happened.

Please download the template again. After downloading the template, it is recommended that you enter some of your transactions (especially the date field) and only then do refresh. That would keep everything functioning correctly.

Thanks,

Hi,

I had been working on the example temple, but I can make the year- moth window work. It giving the reports by day

Thanks for using the template. Please clarify which version of Excel and which template you are using. Also, if you can e-mail me (indzara at gmail) the screenshots, I will take a look.

transfers to cash not working 🙁

unless if u call “cash”

Are you saying that the CASH summary in page 1 of the Report was not calculating correctly? Please clarify.

I have updated the templates (all versions of Excel 2010 and 2013) and they should work regardless of what you call CASH. Please let me know if this addressed your need. Thanks.

Thank you Indzara.

That was very helpful. I was looking for the refresh date button but couldn’t find it. I was looking in the actual spread sheet. My wife came over and refreshed the page in the date then refresh all. lol She saved the day thanks to your reply.

Thanks again, looking forward to your up date for 2010 excel. Have a great day.

Carlos.

Hello Carlos,

I have created a version that works in Excel 2010 for me. I had to modify page 3 (‘Trends of expenses, savings and net balance’)in the report by removing the slicers and having the charts update dynamically by another method. There is a slight loss in functionality (you can’t filter for specific years/months in page 3), but it is not a huge deal. None of the other pages or charts have been changed.

Please provide your feedback whether everything works as expected for you in Excel 2010.

Thanks for your help.

Hello Indzara,

This is Carlos. Thanks for your help the results are good. I was able to make it work. Thank you for your time.

I will recoment this to many friends.. Take Care

Thank you, Carlos. Please share the blog with your friends. Several other templates are also available.

If you have any suggestions for new templates, please let me know. I am looking for ideas for templates that will be useful for the community. Thanks.

Hello I am also looking template that works for Excel 2010 page three.

Please provide the link

Hello Dorian Morla,

I have updated the post with 2 new versions – one uses USD as currency and one without any currency formatting. They are compatible with Excel 2010. Please let me know if you see any issues with the new versions. Thanks.

Hello Dear,

This is jignesh with you. Page-3 in excel 2010 still not reflecting the month and year for tables.

Can u please help in this regard?

Thanks

My name is Carlos,

Can you link the one that is working on a comment. for some reason its not working for me. Could it be that I’m using excel 2010. I’m just running out of reasons. I have downloaded all three version and had no luck when i look at my report..Could there be something I’m doing incorrectly or not doing when I’m entering expenses. I am the person having the same problem as Paul Gernale was having. Sorry for taking so much of your time. Thank You.

Hello Carlos,

I tested https://indzara.com/uploads/indzara_Personal_Finance_Manager.xlsx in Excel 2010 today. I am noticing that the ‘Monthly summary’ page in the report works fine. However, the 3rd page ‘Trends of expenses, savings and net balance’ in the report does not work as designed. The table slicers I used for this page works only with Excel 2013. I need to change the design to make it work with Excel 2010. I will post an update as soon as I can, since I would like this template to be useful to as many as possible. Thanks for bringing this to my attention.

And a general tip: Before you hit Data-Refresh, make sure that there is data in the table in the transactions worksheet. If there is no data, the slicer for Year disappears (as Paul Gernale pointed out).

this is the problem I’m having. The report with the graphs aren’t working. Just like Paul Gernale. it means allot to me that your helping people with this blog. its awesome! Thank you very much.

https://farm8.staticflickr.com/7315/8985309328_d87d8cfb25_b.jpg

The new versions of the template in this post do not have this problem. Can you please re-download the templates and try again? Paul Gernale has confirmed that there are no problems now. I look forward to hearing from you.

Im getting the same problem as Paul Gernale. Cant find the updated one

Please clarify which template has the problem. I have tested the ones in this blog post and they work fine for me. Please post a screenshot or explain the problem you are facing. I will do my best to address it.

Thank you.

i m not getting drop down menu while entering data in transactions, please help

Yogesh Agrawal

yogesh@asharam.co.in

Hello Yogesh Agrawal,

Please see my video https://www.youtube.com/watch?v=9CkqYUbHDLY about the drop down menus. Please let me know if you still have any problems with the drop down menus.

Thanks for using the template.

Hi! How can I see years and months in the report? mine is not showing..look at this, please reply asap. Thanks!

https://farm8.staticflickr.com/7315/8985309328_d87d8cfb25_b.jpg

Hello Paul Gernale,

Thanks for pointing out this bug. I will look for a better solution to this.

For now, please try using the Sample data file and delete all transactions but any one record. That leaves the Year and Month filters/slicers in place. Then, you can overwrite that one record with your own transaction data and continue entering more records as usual. Please reply if this resolves this problem.

Hi indzara,

I wanna thank you so much for this very very awesome program that you just made, i have been searching for a long time for a great program like this atlast i found it, it is very useful, easy to use and almost everything that i need is here.

I just want to ask a permission by using your program, i would like to add some VBA codes for easy data entry and to refresh it automatically because most of the time i forget to refresh everytime i input something.

Thanks again and more power

MikeLP

You are very welcome. I am glad that the template is helpful. Please feel free to edit the file and make it more useful to you.

Best wishes,

Hello Paul Gernale,

I have updated the template and this blog post. Please read the section “Step 2: Entering transactions in the Transactions worksheet” above. Now, when you download the template, start entering your transactions by replacing dummy data in the first row with your own data. That should allow all the filters and slicers in the ‘Report’ worksheet function without any issue. Please take a look and let me know if you still have any problems with the template.

I appreciate your feedback. Thank you.

Hi ind zara! It’s working great now! Thanks for responding to our problem very quick. Thanks for sharing this template worksheet, simple, awesome and very helpful. Great job! Wish you all the best!