Personal Finance Manager 2025 (Free Excel Budget template)

This is a simple free Personal Finance management excel template that focuses on making it easy for you to know what’s happening with your financial situation especially when you have multiple bank accounts, credit card accounts and cash.

This Excel Budget template also helps you set budgets and see how you are actually doing against your budget.

With simple data entry, the template provides you instant access to actionable information in a consumable form that can answer key questions regarding your personal financial situation.

Specifically, the template helps you in knowing the following:

- How much money is in my different bank accounts?

- How much do I owe on credit cards?

- On what items am I spending my money on?

- Am I exceeding my monthly budget? If so, in which categories?

- How are my expenses trending over time?

- Am I spending more on any specific expense category over time?

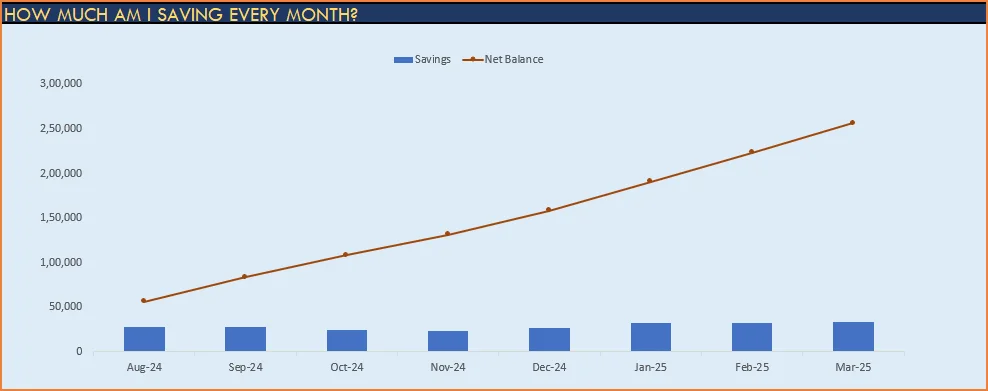

- How much am I saving every month? How does that add to my net balance?

Free Downloads

This version doesn’t use Pivot Tables and Slicers. 4 Charts that are available in Excel 2010 file are not available in this.

Requirements

Excel 2010 and above for Windows

Excel 2011 for Mac

Video Demo

How to track personal finances in Excel?

The template has 3 worksheets: 1) Settings 2) Transactions and 3) Report.

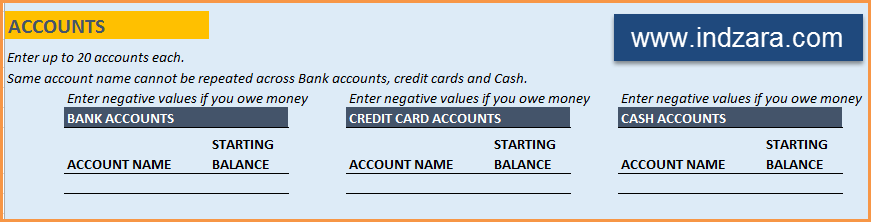

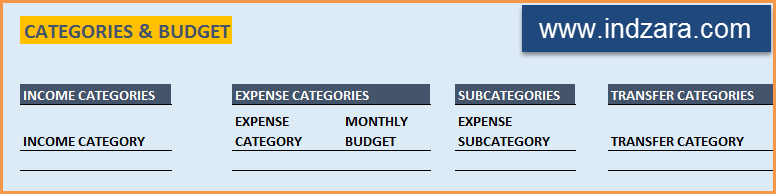

STEP 1: Enter information in Settings worksheet

- Enter Accounts (bank accounts, Credit Card Accounts and Cash Accounts)

- Set your starting balances of accounts

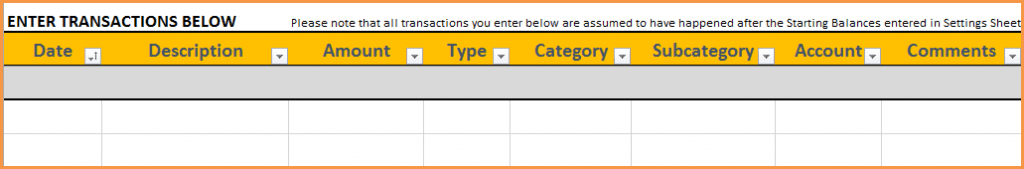

STEP 2: Entering transactions in the Transactions worksheet

When you open the template, there will be no records in the Transactions worksheet (as shown in the image below). Start entering your own transactions.

3 Types of Transactions

- Income and Expense: By default, all the Income and Expense transactions should be entered as positive amounts.

- Special case (Refund): If you purchased an item at a store, you would enter an Expense transaction with positive amount. If, a few days later, you returned the item to the store for some reason and get a refund, then you should enter the refund as a new Expense transaction with negative value.

- Transfer: When money is transferred from one account to another, create two records

- ‘Transfer’ type with negative amount from the account you are taking the money from.

- ‘Transfer’ type with positive amount for the account you are depositing the money into.

- Examples of Transfers are Credit Card Payment (transfer from Bank account to Credit Card account) and ATM withdrawal (transfer from Bank account to Cash)

- Drop down menus are available for easy data entry in these fields (Type, Category, SubCategory, Account).

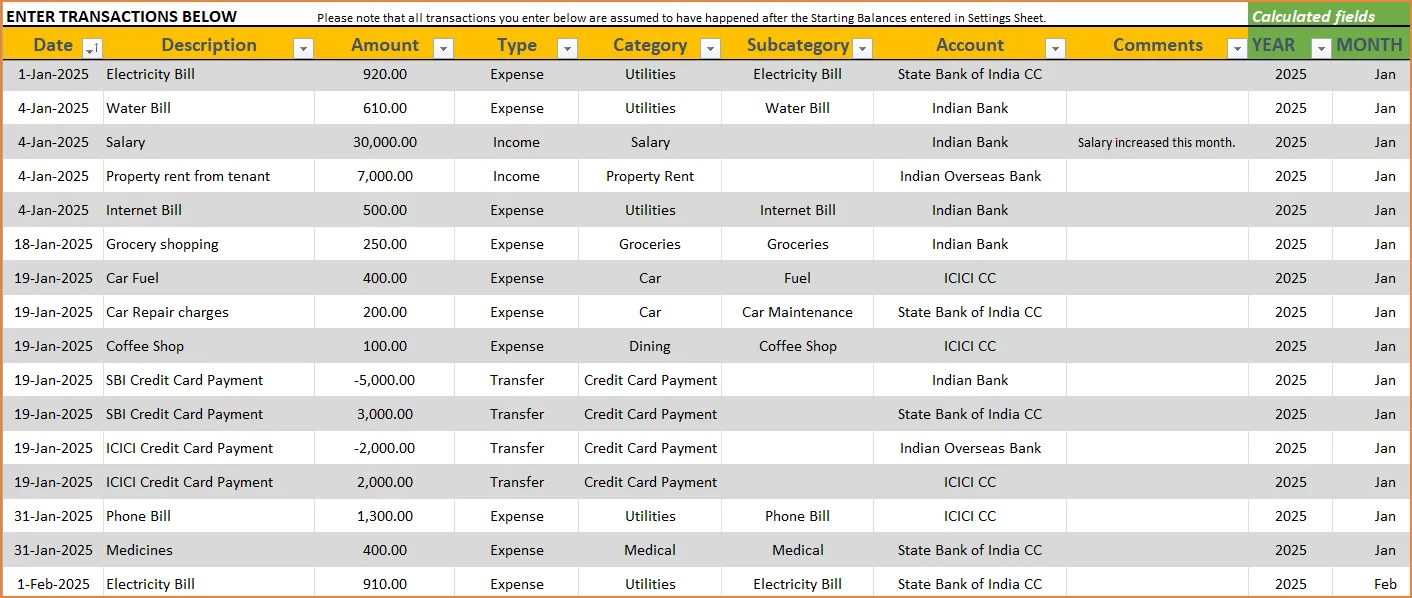

After you enter your transactions, the Transactions worksheet would look like this image below.

STEP 3: View Report

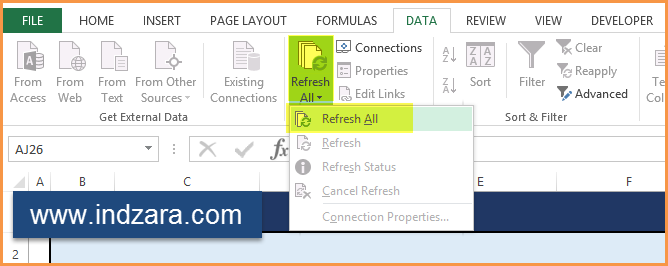

Since there are pivot tables and charts, please refresh the data by going to Data ribbon and refresh all (or keyboard shortcut Ctrl+Alt+F5) . This updates the charts with your new transactions.

Report sheet is locked to prevent accidental editing of formulas. To unlock, use password indzara

The report has four pages.

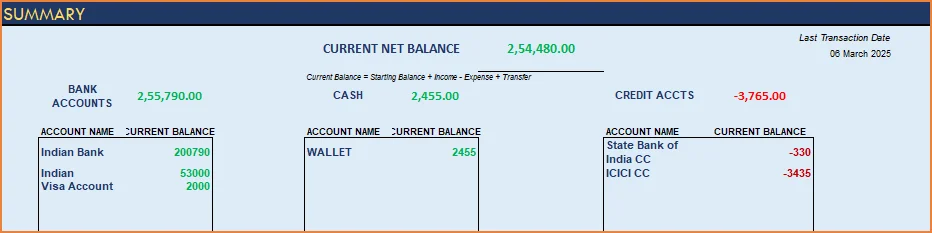

1) Summary

- Summary of your current financial status

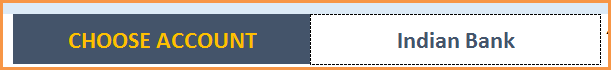

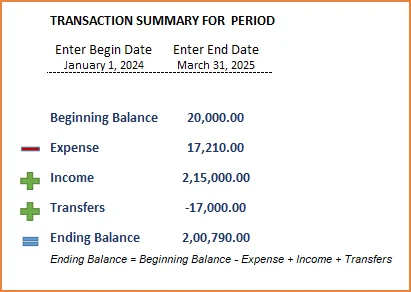

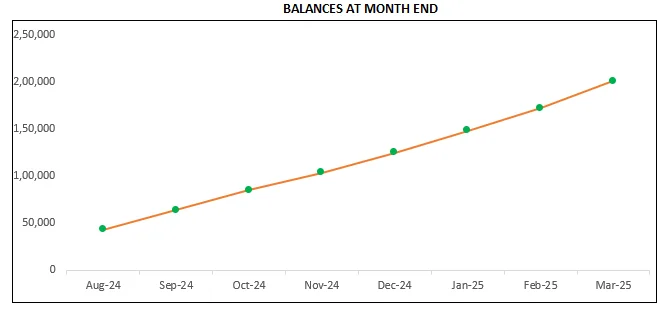

You can find balances for any period in each of your accounts using this personal account template.

This can be helpful when your bank statements and credit card statements actually have their billing cycles different from calendar months. This allows you to compare your statements with the data you have in this template and confirm that you have not missed any transactions.

The chart shows the trend of month-end balances in the account chosen.

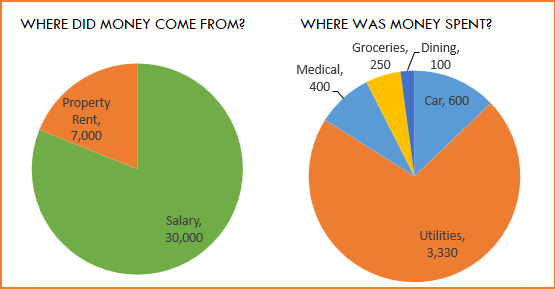

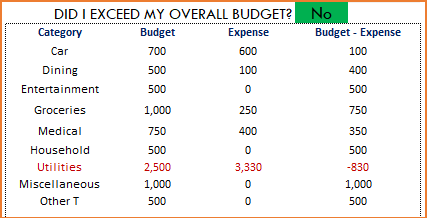

2) Monthly Financial Analysis

This multiple bank account management excel template can also help in monthly financial analysis. Please choose one month at a time using the slicers at the top.

View total Income, expense and savings

Understand where the money came from and where it was spent, in the month

- Track whether you have exceeded the monthly budget.

- Also see the comparison of expenses to budget by each category

- Categories that exceeded budget will be highlighted in red

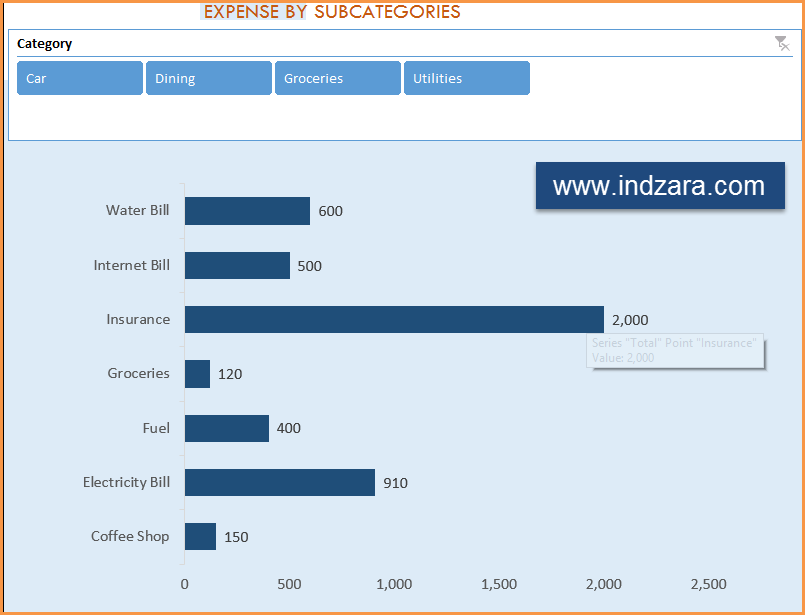

Understand expenses by Subcategories.

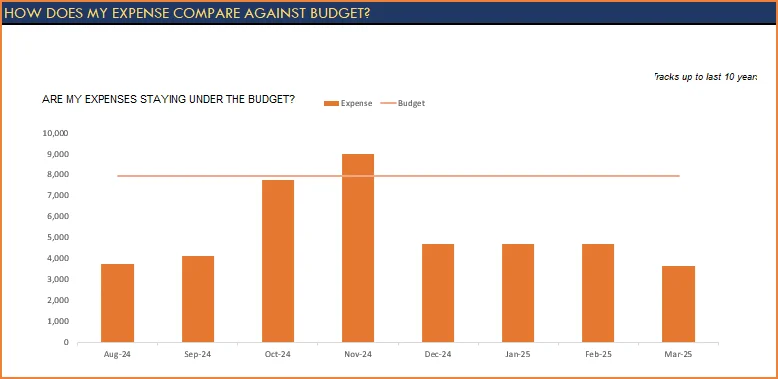

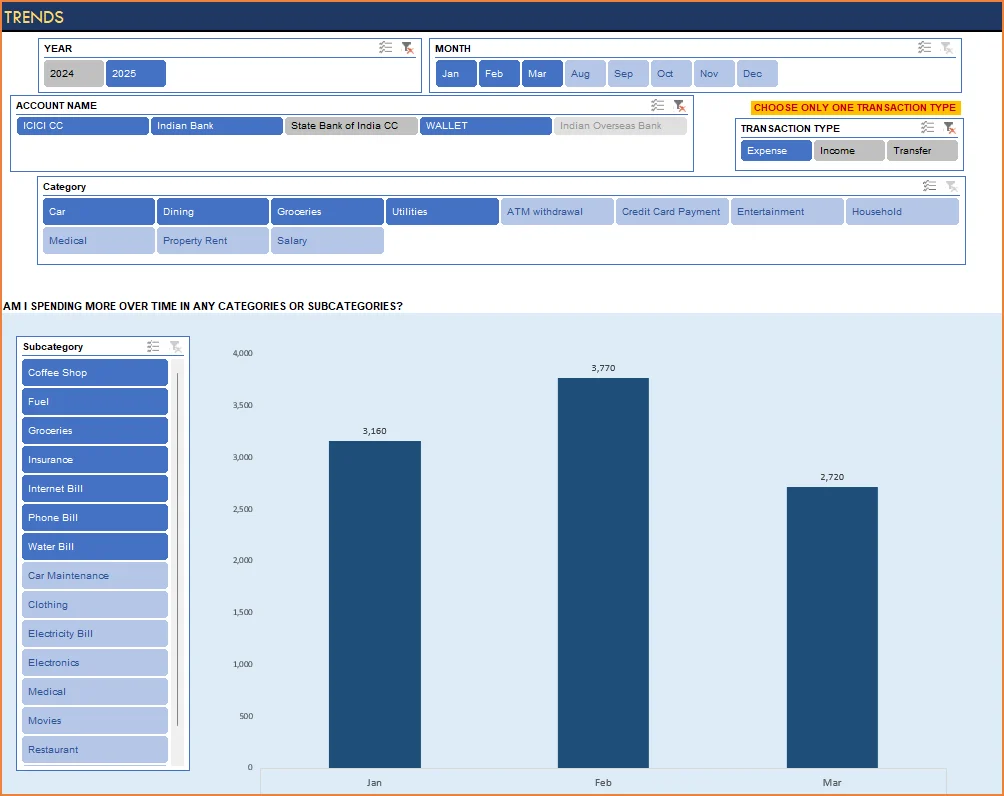

3) Trends of expenses, savings and net balance

Trend of expenses over time and comparing against monthly budget

Trend of savings and net balance over time

4) Trends of transactions by Categories and Sub Categories

I hope you find this personal finance management template excel useful in managing your personal finances easily.

346 Comments

Bhai download nahi ho raha hai download link bhejo na plz..

The links are above. I tried again just now. The link words. Can you please clarify what is the error message? Which browser?

Thanks. Best wishes.

Can I alter the language on the sheets without altering the funcionalities?

It depends on what words are going to be changed. If they are used in the formulas, we need to change them in the formulas too. Sorry that I can’t give a definitive answer without knowing what words are to be changed.

Best wishes.

Hello,

Thanks for the awesome tool. I have been using this since last year replacing a complex tool. This has been awesome but I found out this month that 2017 is not showing up in the report pivot table (Monthly financial analysis-Year). It only has 2016 in display now where as I have filled transaction for whole of January. Only when I delete all the 2016 transactions, 2017 appears.

Please help.

You are welcome.

If you are referring to the filter at the top left, it should automatically show new years. I will email you about this. If you can reply with the file or screenshots, I can take a look to see why this happens.

Best wishes.

hi…

if i lend money to my friends and they pay me in 3 month (installment) … how to record it ?

thanks

Lending can be one expense transaction. Then, when it is returned, it is an income transaction. If there are 3 installments, they will be 3 income transactions.

Best wishes.

Love this template. As suggested before, it would be great to have a more flexible budget. For example where I live the water company payments come every two months, so some months I expend less than the budget and the next one more.

Also it could be great to have different budgets for different periods.

Thank you for the feedback.

I completely agree that having varying budget across months would be useful. It brings along potential restrictions, but I will look into ways to address them.

Thanks. Best wishes.

Hi,

I have two tipes of money euro and my countryes money, in cash and alsow at the bank

I wish if you could implement in the template a second money and with a courency to convert the euro from my accounts to a local money => the balance of all my money showing in the local money.

Thanks

Thanks for the feedback. I will definitely consider this when I work on the next version of this. As of now, I don’t have a time frame yet.

Best wishes.

Hello,

Is there a template that I can use to manage a real estate rental portfolio?

Thank you

I am sorry. I don’t have such a template. Are there any details on what the template should accomplish? Thanks & Best wishes.

Help, unable to save

Please let me know the version of Excel and operating system. What error message do you receive and when? Thanks.

version 2010,

operating system is i5, window 7

i was unable to save and close the excel after i make any changes on the template, i even try to delete and download, but it goes the same every time.

i tried the 2007, 2010 and sample version

Excel 2010 in Windows 7 should be compatible. I am very sorry that I don’t know why Excel would not allow you to save the file. Can you try saving (while downloading) to a different folder in your computer? Thanks.

Further to my above suggestion, I would like to add that under REPORTING, we should also have an option to select the period for YEARLY PIE-CHARTS (like JULY 2014 – JUNE 2015 OR JAN 2014-DEC 2014). This will also help for people to calculate their expenses/income for Income-tax purposes as well.

Thank you for the feedback. Best wishes.

Hi .. I have observed that though the design of this template is excellent, needs some improvement.

SETTING : (1) While setting Expense Categories (EC), it should also allow to set sub-categories for that EC. This in turn should help recording transactions. (2) It should also allows us to set Monthly Budget for each sub-category, which in turn SUMS-UP for Expense Category as Monthly Budget.

TRANSACTIONS : While recording expense transactions, when we select an Expense Categories (EC), the corresponding sub-categories (set for that EC) only should appear and not all (as is the case now) which will facilitate correctly recording the expenses.

REPORTING : There should also be another page having 2-PIE CHARTs reflecting (1) Yearly INCOME – Category-wise; (2) Yearly EXPENSES – Category-wise; (3) and List of Income and Expense Categories with Amount below the Charts (like in monthly analysis)

With these improvements, your this EXCEL TEMPLATE will be more attractive and useful.

Thank you for the observations. I will definitely consider your feedback when I work on the next version. Thank you.