Personal Finance Manager 2025 (Free Excel Budget template)

This is a simple free Personal Finance management excel template that focuses on making it easy for you to know what’s happening with your financial situation especially when you have multiple bank accounts, credit card accounts and cash.

This Excel Budget template also helps you set budgets and see how you are actually doing against your budget.

With simple data entry, the template provides you instant access to actionable information in a consumable form that can answer key questions regarding your personal financial situation.

Specifically, the template helps you in knowing the following:

- How much money is in my different bank accounts?

- How much do I owe on credit cards?

- On what items am I spending my money on?

- Am I exceeding my monthly budget? If so, in which categories?

- How are my expenses trending over time?

- Am I spending more on any specific expense category over time?

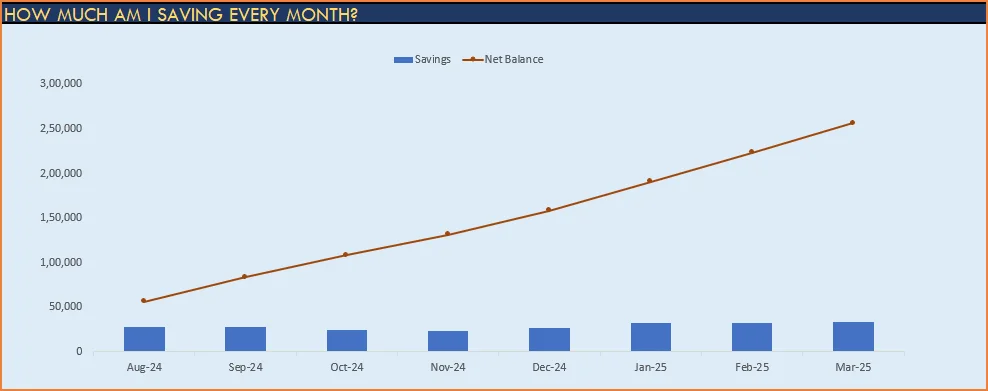

- How much am I saving every month? How does that add to my net balance?

Free Downloads

This version doesn’t use Pivot Tables and Slicers. 4 Charts that are available in Excel 2010 file are not available in this.

Requirements

Excel 2010 and above for Windows

Excel 2011 for Mac

Video Demo

How to track personal finances in Excel?

The template has 3 worksheets: 1) Settings 2) Transactions and 3) Report.

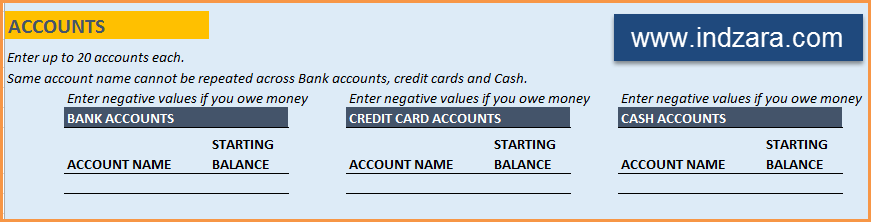

STEP 1: Enter information in Settings worksheet

- Enter Accounts (bank accounts, Credit Card Accounts and Cash Accounts)

- Set your starting balances of accounts

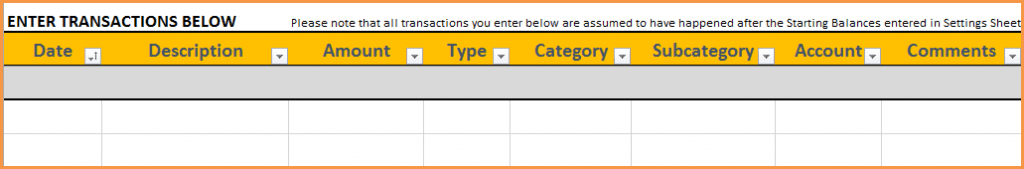

STEP 2: Entering transactions in the Transactions worksheet

When you open the template, there will be no records in the Transactions worksheet (as shown in the image below). Start entering your own transactions.

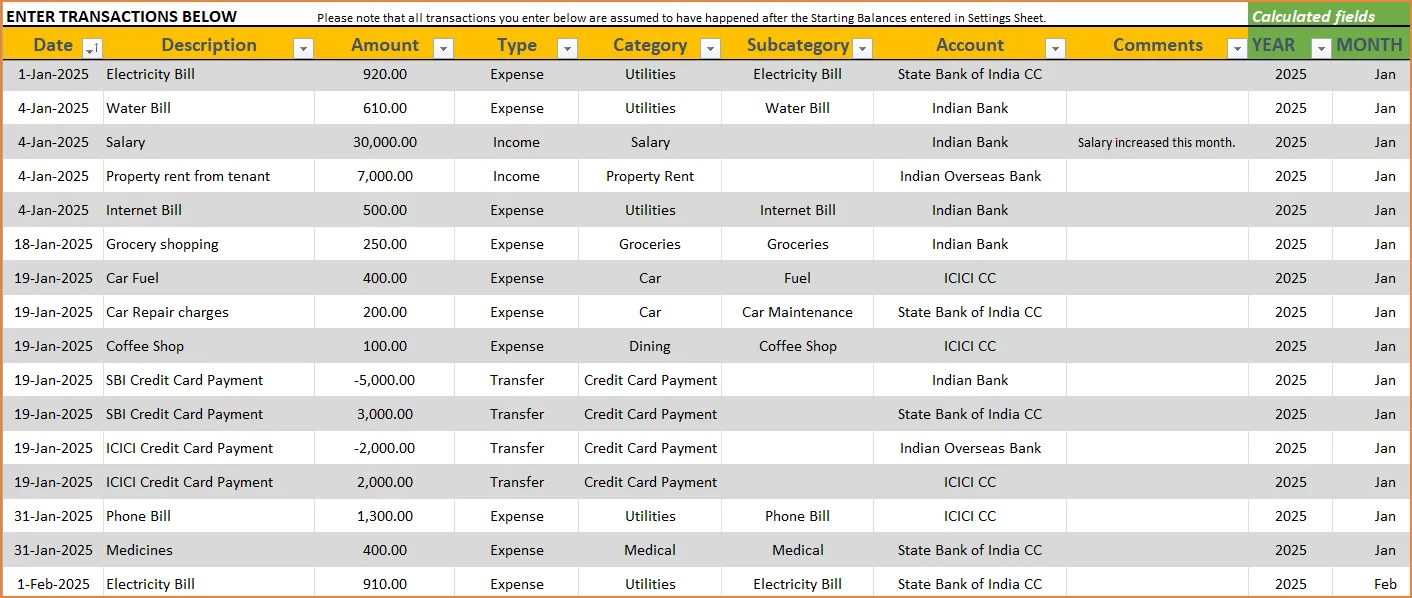

3 Types of Transactions

- Income and Expense: By default, all the Income and Expense transactions should be entered as positive amounts.

- Special case (Refund): If you purchased an item at a store, you would enter an Expense transaction with positive amount. If, a few days later, you returned the item to the store for some reason and get a refund, then you should enter the refund as a new Expense transaction with negative value.

- Transfer: When money is transferred from one account to another, create two records

- ‘Transfer’ type with negative amount from the account you are taking the money from.

- ‘Transfer’ type with positive amount for the account you are depositing the money into.

- Examples of Transfers are Credit Card Payment (transfer from Bank account to Credit Card account) and ATM withdrawal (transfer from Bank account to Cash)

- Drop down menus are available for easy data entry in these fields (Type, Category, SubCategory, Account).

After you enter your transactions, the Transactions worksheet would look like this image below.

STEP 3: View Report

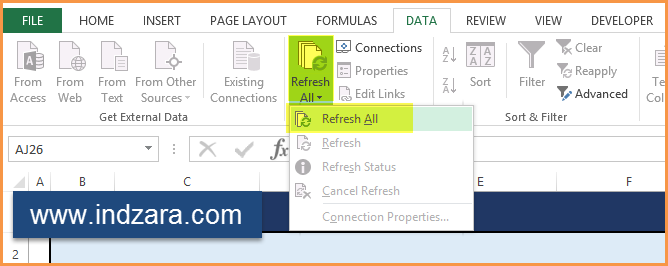

Since there are pivot tables and charts, please refresh the data by going to Data ribbon and refresh all (or keyboard shortcut Ctrl+Alt+F5) . This updates the charts with your new transactions.

Report sheet is locked to prevent accidental editing of formulas. To unlock, use password indzara

The report has four pages.

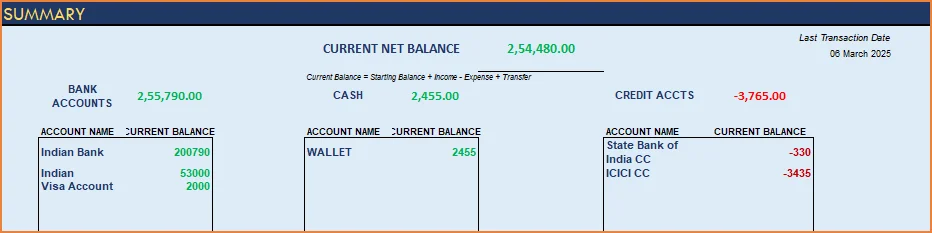

1) Summary

- Summary of your current financial status

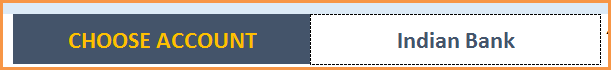

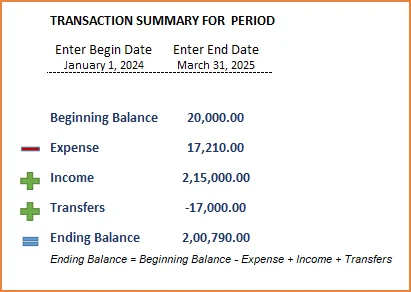

You can find balances for any period in each of your accounts using this personal account template.

This can be helpful when your bank statements and credit card statements actually have their billing cycles different from calendar months. This allows you to compare your statements with the data you have in this template and confirm that you have not missed any transactions.

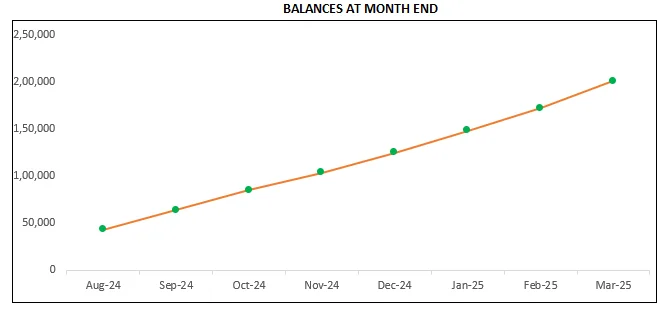

The chart shows the trend of month-end balances in the account chosen.

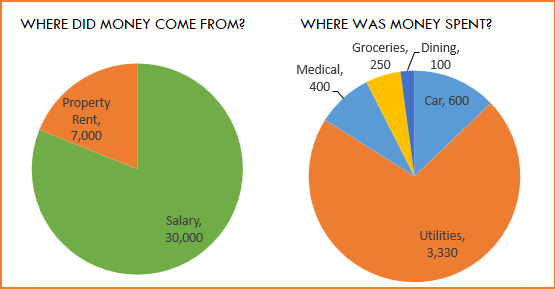

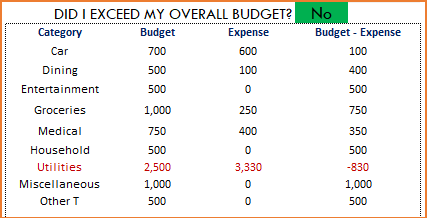

2) Monthly Financial Analysis

This multiple bank account management excel template can also help in monthly financial analysis. Please choose one month at a time using the slicers at the top.

View total Income, expense and savings

Understand where the money came from and where it was spent, in the month

- Track whether you have exceeded the monthly budget.

- Also see the comparison of expenses to budget by each category

- Categories that exceeded budget will be highlighted in red

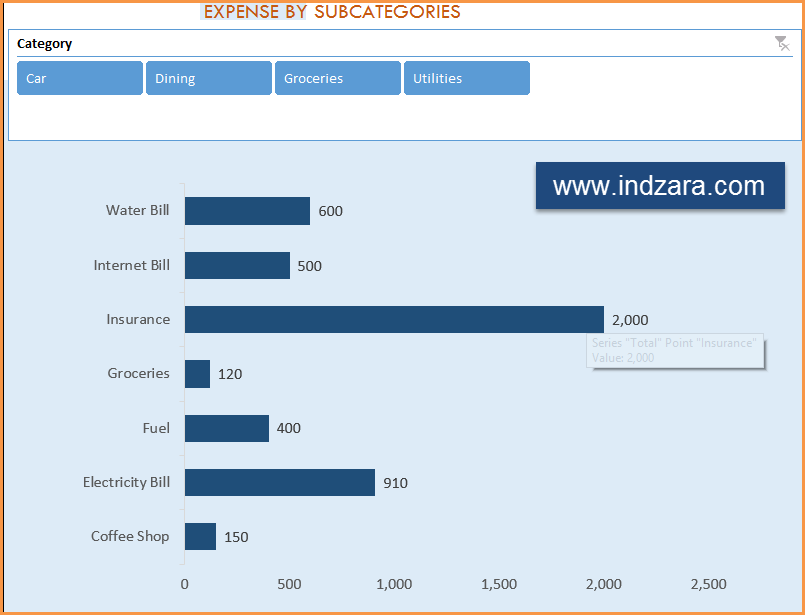

Understand expenses by Subcategories.

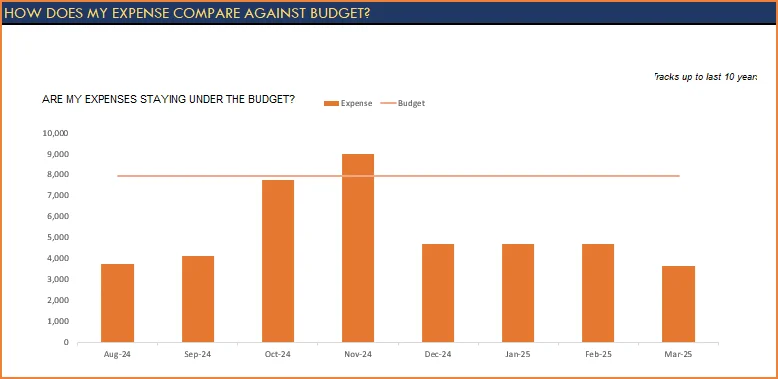

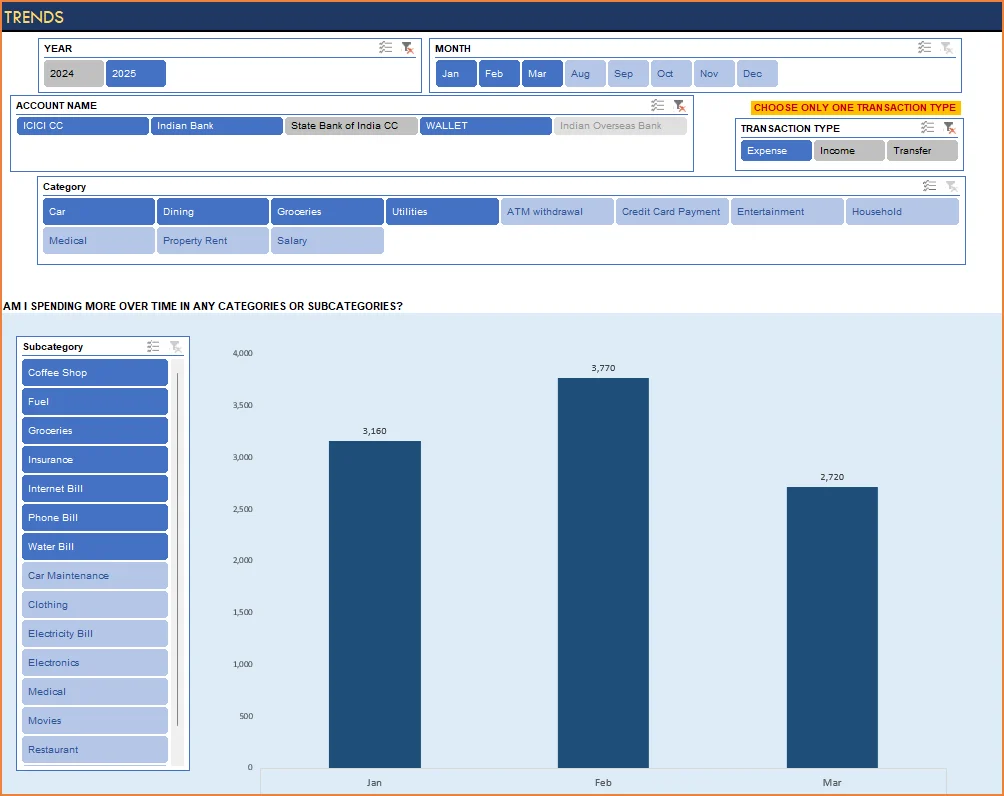

3) Trends of expenses, savings and net balance

Trend of expenses over time and comparing against monthly budget

Trend of savings and net balance over time

4) Trends of transactions by Categories and Sub Categories

I hope you find this personal finance management template excel useful in managing your personal finances easily.

346 Comments

Very nice template but I needed multi currency template to track two different currency as I working out of India

Can you try to builtin a feature where you take your bank account statements and auto populate the transactions rather than entering every transaction one by one.

Thanks for using our template.

We have not used any kind of automated features like macros in our templates yet. We will try to incorporate your suggestions in our next release.

Best wishes

In Personal Finance Manager, how can we change monthly budget to annual budget? this would be helpful for annual planning?

Thanks for using our template.

Annual planning is not a feature yet. We will try to add it in the next release.

Best wishes

Will this template work in MacOs “NUMBERS”?

Hello

Our templates are designed to work on MS Excel 2013 or later on Mac OS.

Best wishes

Thank you ! 🙁

The “calculated fields” don’t seem to be calculating which is affecting the monthly financial analysis, please provide direction on how to make them calculate the date. Otherwise great spreadsheet!

Hello

Please ensure that all the formulas are intact and their sequence is not broken. In case it still does not work, please email the file along with the list of issues to contact@indzara.com.

Best wishes

your template is very useful, but i am facing some problem.

whenever i save and close the program, message shows “excel has stopped working”.

what to do now.

Please help.

Thank you.

Hello

Please ensure that you have adequate disk space to save the file. Also, the template is designed for Excel 2010 or a later version.

Thanks

Hi Team Indzara.

Liked your template very much. your works has benefited me a lot as compared to many accounting software. its ease of use. i just wanted to request you that can i modify reports sheet as per income, expense, category and sub-category wise. i am having 10,000 entries and i find it to be difficult to see.

Hello

Thanks for your feedback.

Please share more details on what is difficult to see.

Thanks

please add the savings column for FD , LIC etc.

Thanks for feedback.

Best wishes.

Hi

I want to ask you “Why I can’t see the account names, subcategory, and transaction type in the Trends?

Thanks for sending the file. It appears that the field names in the Transactions sheet have been renamed and that broke the pivot table. I have sent the file to you by email.

Best wishes.

Hi

please provide password

Hello

The password is indzara.

regards