Personal Finance Manager 2025 (Free Excel Budget template)

This is a simple free Personal Finance management excel template that focuses on making it easy for you to know what’s happening with your financial situation especially when you have multiple bank accounts, credit card accounts and cash.

This Excel Budget template also helps you set budgets and see how you are actually doing against your budget.

With simple data entry, the template provides you instant access to actionable information in a consumable form that can answer key questions regarding your personal financial situation.

Specifically, the template helps you in knowing the following:

- How much money is in my different bank accounts?

- How much do I owe on credit cards?

- On what items am I spending my money on?

- Am I exceeding my monthly budget? If so, in which categories?

- How are my expenses trending over time?

- Am I spending more on any specific expense category over time?

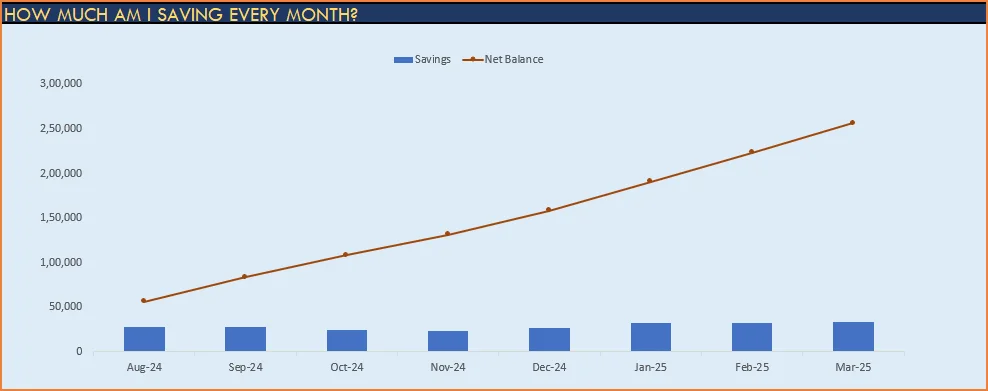

- How much am I saving every month? How does that add to my net balance?

Free Downloads

This version doesn’t use Pivot Tables and Slicers. 4 Charts that are available in Excel 2010 file are not available in this.

Requirements

Excel 2010 and above for Windows

Excel 2011 for Mac

Video Demo

How to track personal finances in Excel?

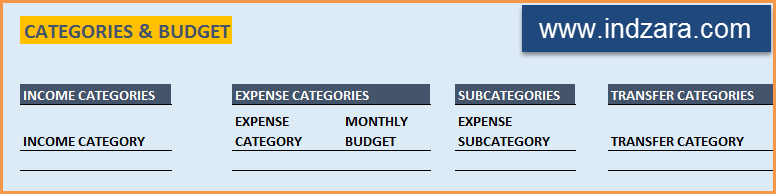

The template has 3 worksheets: 1) Settings 2) Transactions and 3) Report.

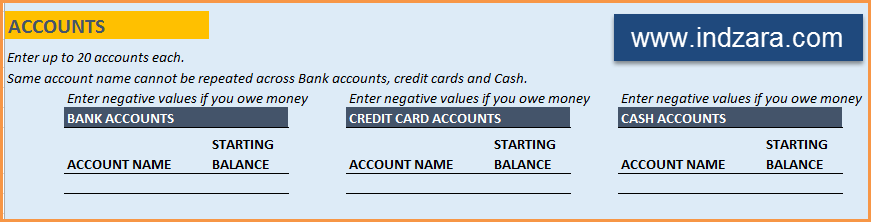

STEP 1: Enter information in Settings worksheet

- Enter Accounts (bank accounts, Credit Card Accounts and Cash Accounts)

- Set your starting balances of accounts

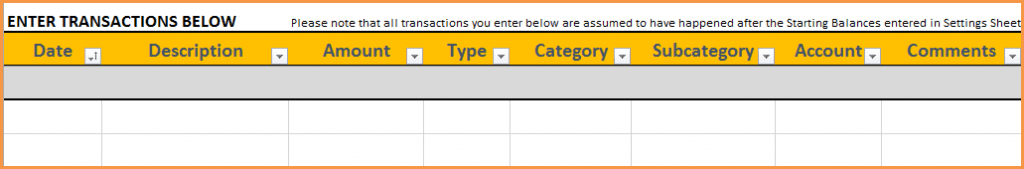

STEP 2: Entering transactions in the Transactions worksheet

When you open the template, there will be no records in the Transactions worksheet (as shown in the image below). Start entering your own transactions.

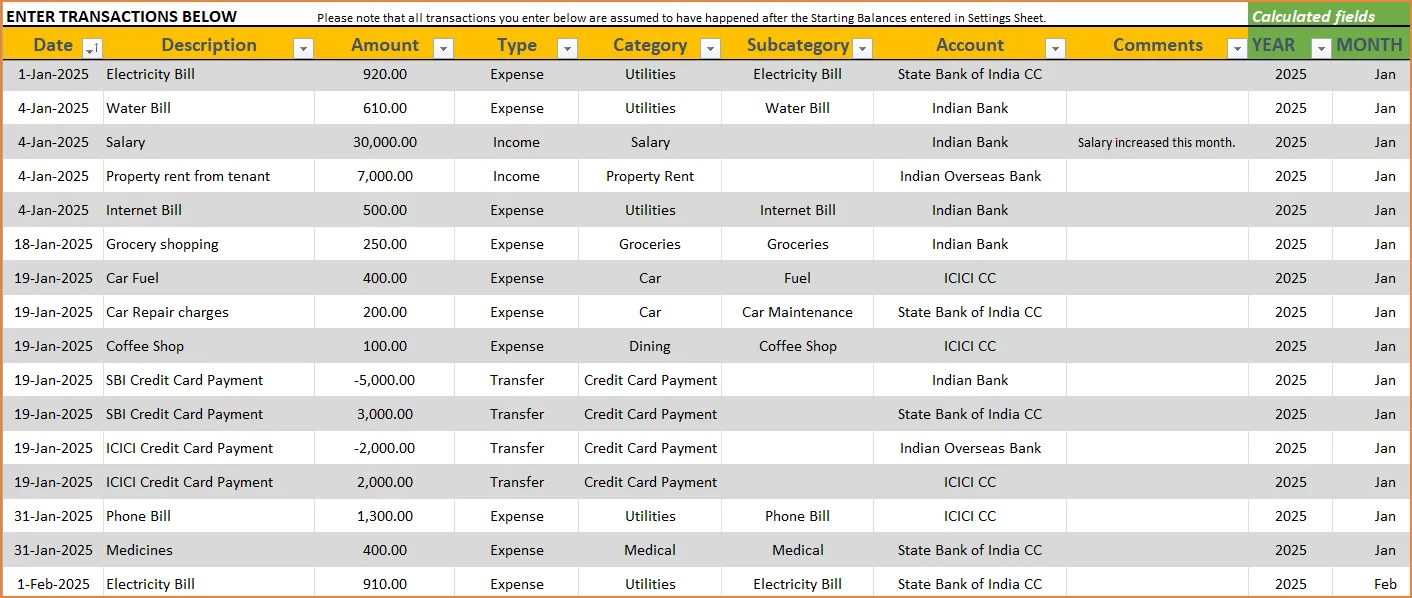

3 Types of Transactions

- Income and Expense: By default, all the Income and Expense transactions should be entered as positive amounts.

- Special case (Refund): If you purchased an item at a store, you would enter an Expense transaction with positive amount. If, a few days later, you returned the item to the store for some reason and get a refund, then you should enter the refund as a new Expense transaction with negative value.

- Transfer: When money is transferred from one account to another, create two records

- ‘Transfer’ type with negative amount from the account you are taking the money from.

- ‘Transfer’ type with positive amount for the account you are depositing the money into.

- Examples of Transfers are Credit Card Payment (transfer from Bank account to Credit Card account) and ATM withdrawal (transfer from Bank account to Cash)

- Drop down menus are available for easy data entry in these fields (Type, Category, SubCategory, Account).

After you enter your transactions, the Transactions worksheet would look like this image below.

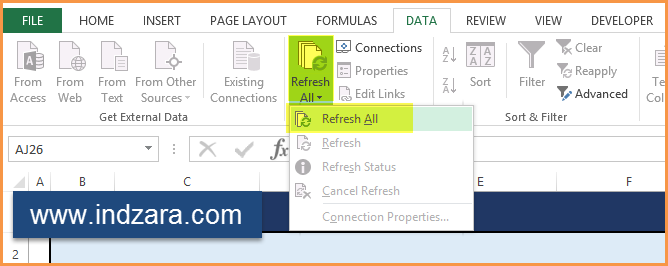

STEP 3: View Report

Since there are pivot tables and charts, please refresh the data by going to Data ribbon and refresh all (or keyboard shortcut Ctrl+Alt+F5) . This updates the charts with your new transactions.

Report sheet is locked to prevent accidental editing of formulas. To unlock, use password indzara

The report has four pages.

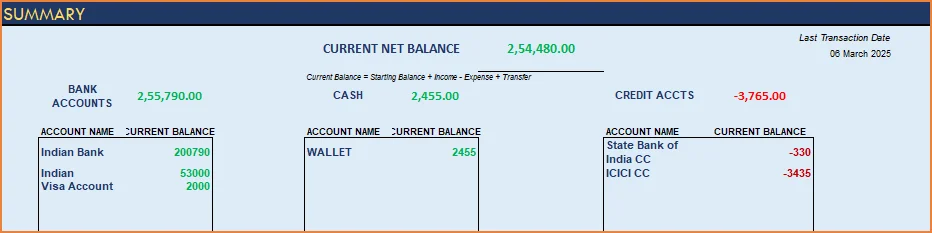

1) Summary

- Summary of your current financial status

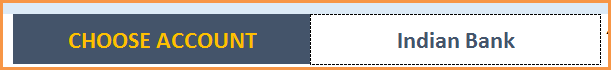

You can find balances for any period in each of your accounts using this personal account template.

This can be helpful when your bank statements and credit card statements actually have their billing cycles different from calendar months. This allows you to compare your statements with the data you have in this template and confirm that you have not missed any transactions.

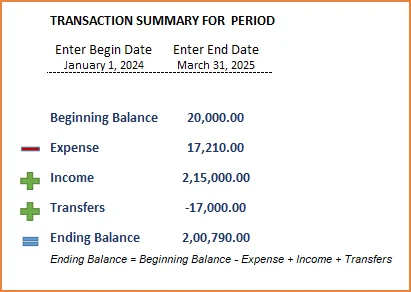

The chart shows the trend of month-end balances in the account chosen.

2) Monthly Financial Analysis

This multiple bank account management excel template can also help in monthly financial analysis. Please choose one month at a time using the slicers at the top.

View total Income, expense and savings

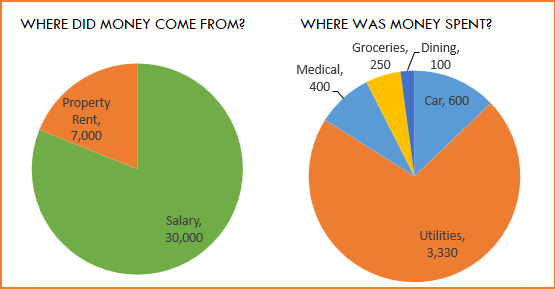

Understand where the money came from and where it was spent, in the month

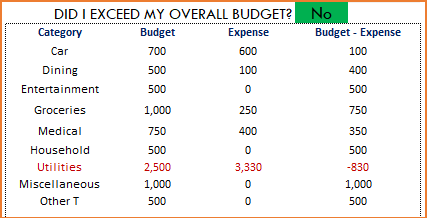

- Track whether you have exceeded the monthly budget.

- Also see the comparison of expenses to budget by each category

- Categories that exceeded budget will be highlighted in red

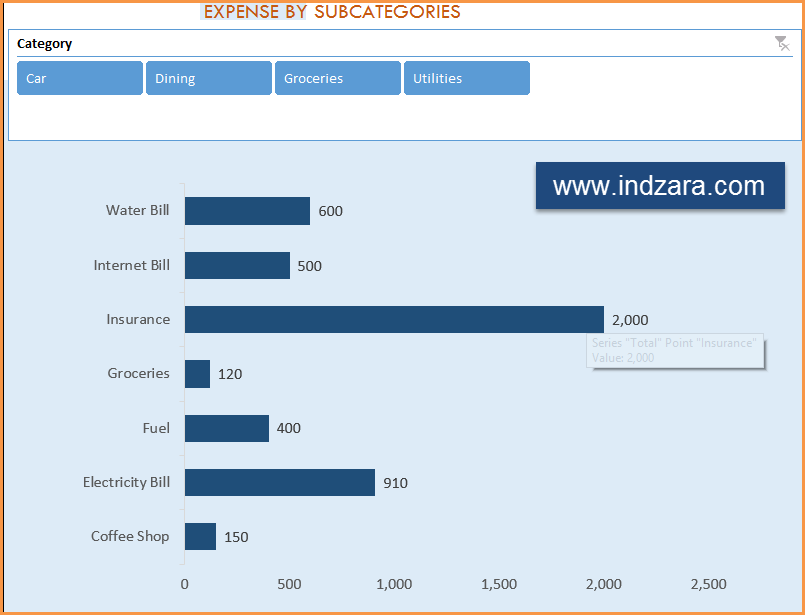

Understand expenses by Subcategories.

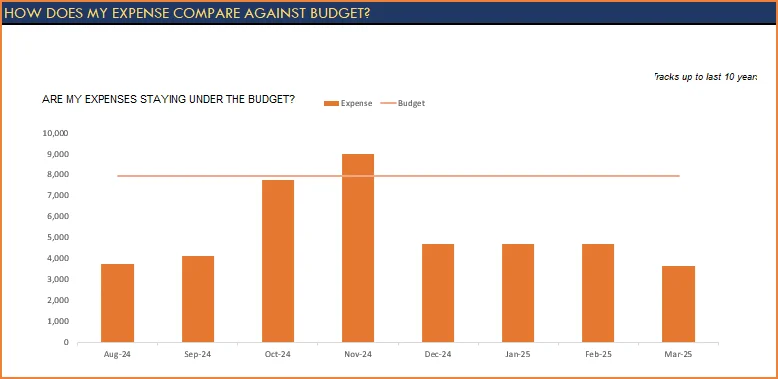

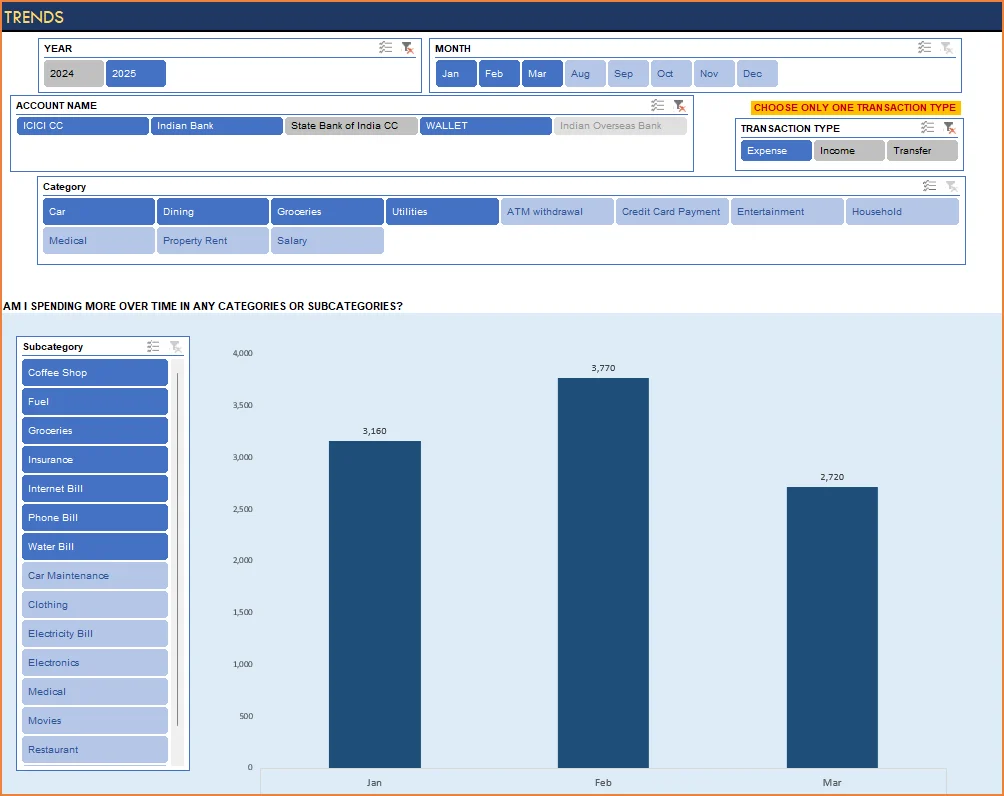

3) Trends of expenses, savings and net balance

Trend of expenses over time and comparing against monthly budget

Trend of savings and net balance over time

4) Trends of transactions by Categories and Sub Categories

I hope you find this personal finance management template excel useful in managing your personal finances easily.

346 Comments

The sheets are protected and hence i’m unable to change anything.

Hello

Please use “indzara” as the password

Thanks

hi I’m unable to refresh data on Report sheet of the file PErsonal Fianance. Hence the years are not changing to current year and date and data is not publishing

Thanks for using our template.

Please share your file along with the list of issues to contact@indzara.com

Best wishes

Hi very nice tool and thanks for making it available for the community. I am intending to use your template to manage invoices for purchased materials not for sales. I am thinking of adding 2 columns, Vendor & Sub-Sub-Category. Will they be taken into consideration by the reports ?

Thanks for using our template.

Please ensure that all the formulas and the links are intact.

In case, the issue persists, please share your file with the list of issues to contact@indzara.com

Best wishes

I’ve noticed that there’s a named range in the template called ALL_ACCTS. This range refers to the following formula:

=OFFSET(Monthly_Summary_Table!$W$4,0,0,Monthly_Summary_Table!$X$2,1)

Screen shot can be seen here:

https://imgur.com/9vvb97L

But I can’t find the Monthly_Summary_Table range. Where is it, and what does it refer to?

It is a hidden sheet. Please unhide hidden sheet Monthly_Summary_Table.

In the Transactions sheet, under the ACCOUNT column is a drop-down list, where I can select different types of accounts, from bank account, to credit card account, to cash account. It references a name ALLACCTS. How did you do that? Is it a table or a named range? I want to add another type of account, namely online account to this ALLACCTS , but I can’t figure out how to do that.

Thanks for using the template. ALLACCTS is a named range which uses a formula with OFFSET function. It will just create a list of accounts pointing to a hidden sheet. In the hidden sheet I combine the different types of accounts into one list.

Best wishes.

Thank you so very much for this amazing template.

I wanted to learn about an issue.

There are transactions and personal lives where we borrow or lend money from friends and family. Can you suggest how we can make an entry for these transactions? Is it possible to create an account for a particular friend, say, Mr. XYZ and adjust the borrowing and lending from and to that friend accordingly so that at a particular point of time it shows the current financial status?

Dear Indzara Team,

Please let me know if you have any answer to my question.

Sorry for the delayed response.

Yes, you are correct. If you need to track specific friend, then a separate account is needed for each friend. If you want to only track total of all friends, then one account for all friends would be fine.

Please let us know if any questions.

Best wishes.

Thank you for offering a free version of your personal finance manager template! I’m very eager to use it, but I see that it is designed for 2011 version of Excel and I’m using Excel version 16 on my MacBook Pro with Mac OS 10.12.6

What do you suggest I do? Can I purchase a template designed for Excel 16?

Or do you recommend I uninstall Excel version 16 and install Excel version 11?

Thank you so much for your generous assistance!

Thanks for using our template.

The latest version of the Personal Finance Manager works on Excel for MacBook 2011 or later editions. Please download the latest edition.

Best wishes

The drop down menus are not working.

It appears to be read only.

How do get a working copy?

Thanks for using our template.

Please use “indzara” as a password to unlock the sheet. In case the issue persists, please email the file with the list of issues to contact@indzara.com

Best wishes

I can’t get the formatting to continue down the rows. Using v.2. I’m sure theres an easy way to extend the formatting.

Thanks for using our template.

Please extend the table below to continue the formatting.

Best wishes

Hi,

For some reason the Report sheet isnt updating. Kindly help

Thanks for using our template.

Please ensure that links and formulas are intact. In case you are not able to sort it, please email your file with the list of issues to contact@indzara.com

Best wishes