Personal Finance Manager 2025 (Free Excel Budget template)

This is a simple free Personal Finance management excel template that focuses on making it easy for you to know what’s happening with your financial situation especially when you have multiple bank accounts, credit card accounts and cash.

This Excel Budget template also helps you set budgets and see how you are actually doing against your budget.

With simple data entry, the template provides you instant access to actionable information in a consumable form that can answer key questions regarding your personal financial situation.

Specifically, the template helps you in knowing the following:

- How much money is in my different bank accounts?

- How much do I owe on credit cards?

- On what items am I spending my money on?

- Am I exceeding my monthly budget? If so, in which categories?

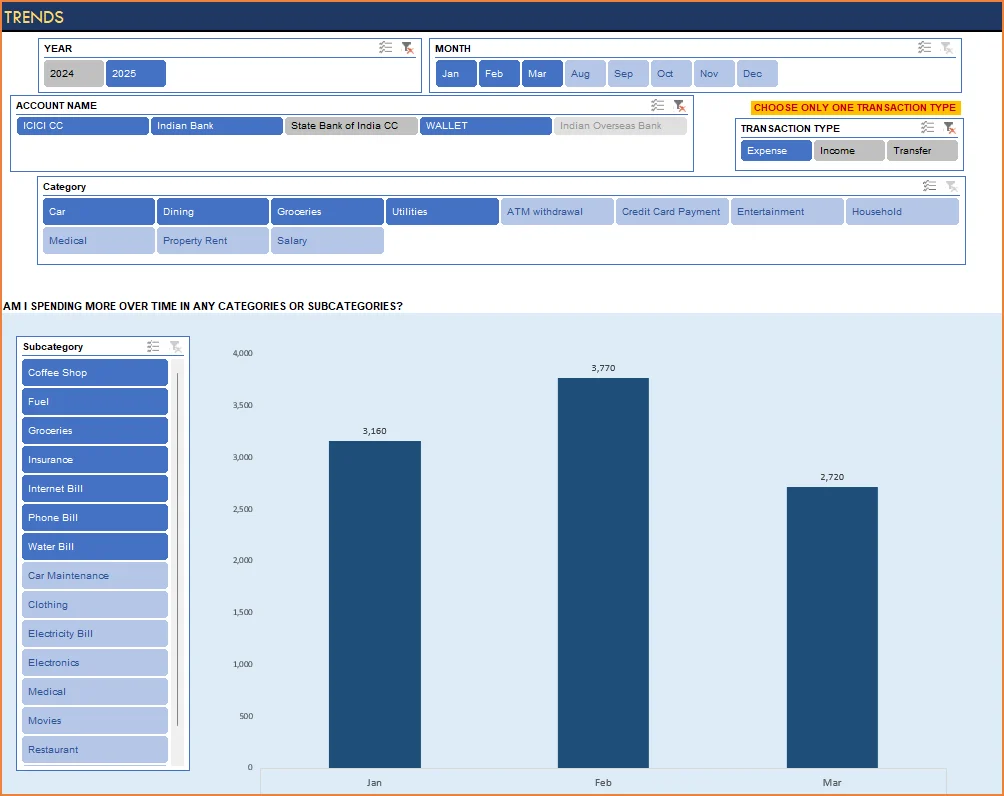

- How are my expenses trending over time?

- Am I spending more on any specific expense category over time?

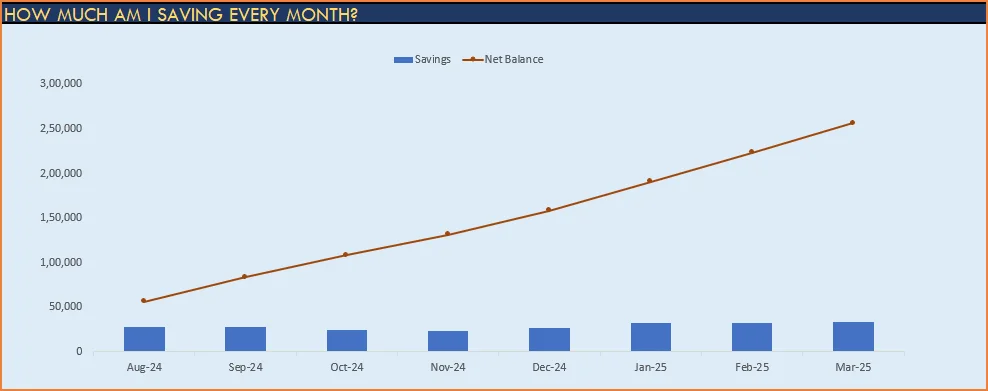

- How much am I saving every month? How does that add to my net balance?

Free Downloads

This version doesn’t use Pivot Tables and Slicers. 4 Charts that are available in Excel 2010 file are not available in this.

Requirements

Excel 2010 and above for Windows

Excel 2011 for Mac

Video Demo

How to track personal finances in Excel?

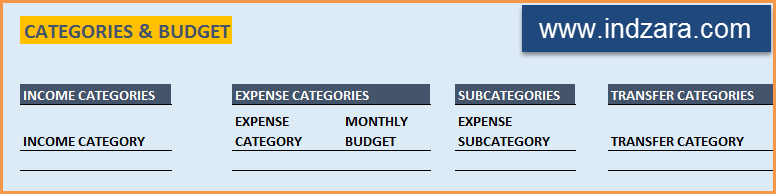

The template has 3 worksheets: 1) Settings 2) Transactions and 3) Report.

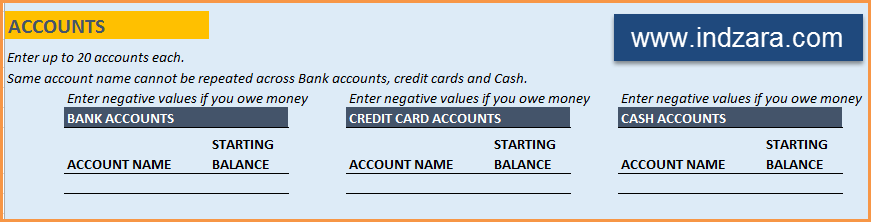

STEP 1: Enter information in Settings worksheet

- Enter Accounts (bank accounts, Credit Card Accounts and Cash Accounts)

- Set your starting balances of accounts

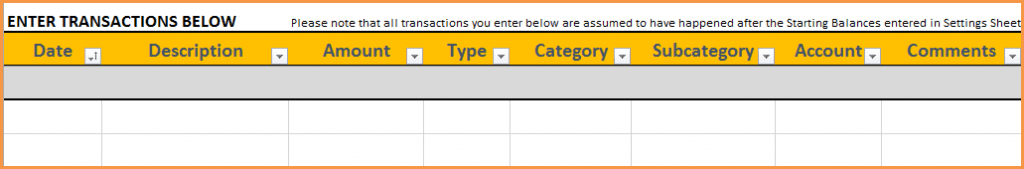

STEP 2: Entering transactions in the Transactions worksheet

When you open the template, there will be no records in the Transactions worksheet (as shown in the image below). Start entering your own transactions.

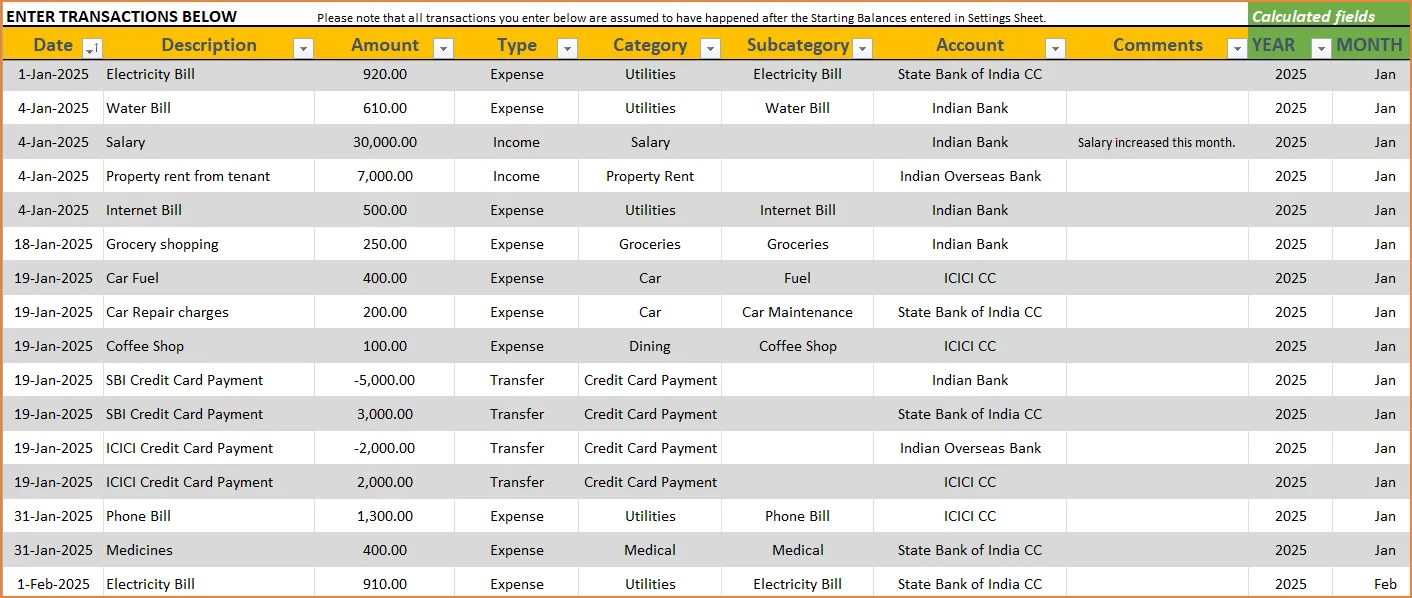

3 Types of Transactions

- Income and Expense: By default, all the Income and Expense transactions should be entered as positive amounts.

- Special case (Refund): If you purchased an item at a store, you would enter an Expense transaction with positive amount. If, a few days later, you returned the item to the store for some reason and get a refund, then you should enter the refund as a new Expense transaction with negative value.

- Transfer: When money is transferred from one account to another, create two records

- ‘Transfer’ type with negative amount from the account you are taking the money from.

- ‘Transfer’ type with positive amount for the account you are depositing the money into.

- Examples of Transfers are Credit Card Payment (transfer from Bank account to Credit Card account) and ATM withdrawal (transfer from Bank account to Cash)

- Drop down menus are available for easy data entry in these fields (Type, Category, SubCategory, Account).

After you enter your transactions, the Transactions worksheet would look like this image below.

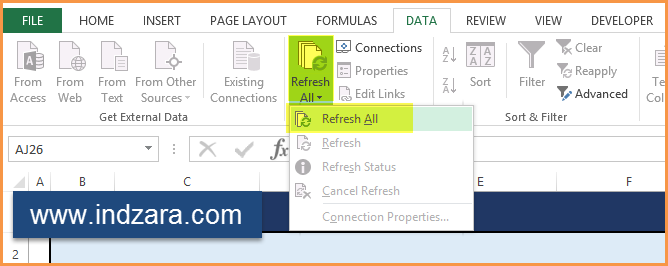

STEP 3: View Report

Since there are pivot tables and charts, please refresh the data by going to Data ribbon and refresh all (or keyboard shortcut Ctrl+Alt+F5) . This updates the charts with your new transactions.

Report sheet is locked to prevent accidental editing of formulas. To unlock, use password indzara

The report has four pages.

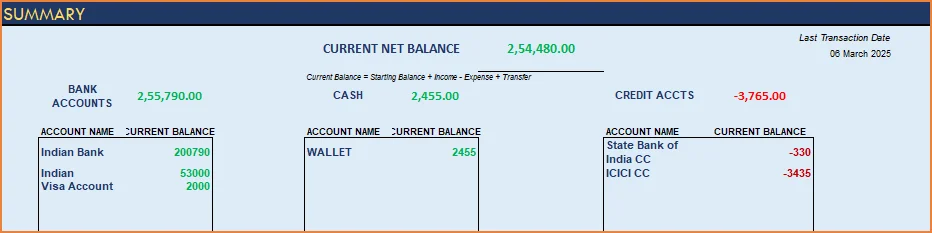

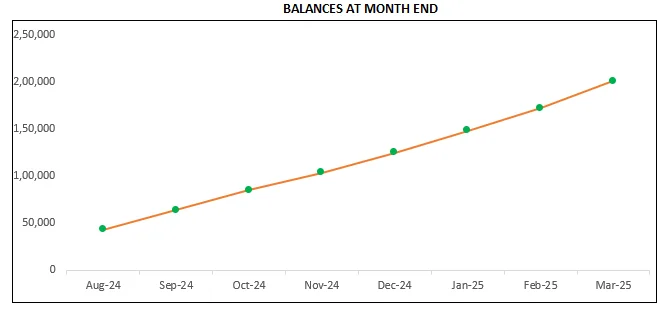

1) Summary

- Summary of your current financial status

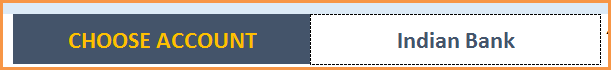

You can find balances for any period in each of your accounts using this personal account template.

This can be helpful when your bank statements and credit card statements actually have their billing cycles different from calendar months. This allows you to compare your statements with the data you have in this template and confirm that you have not missed any transactions.

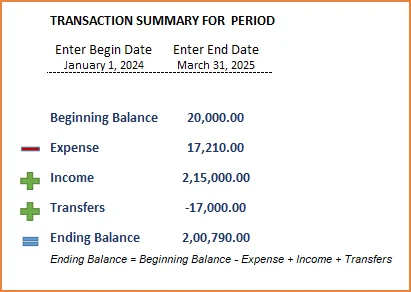

The chart shows the trend of month-end balances in the account chosen.

2) Monthly Financial Analysis

This multiple bank account management excel template can also help in monthly financial analysis. Please choose one month at a time using the slicers at the top.

View total Income, expense and savings

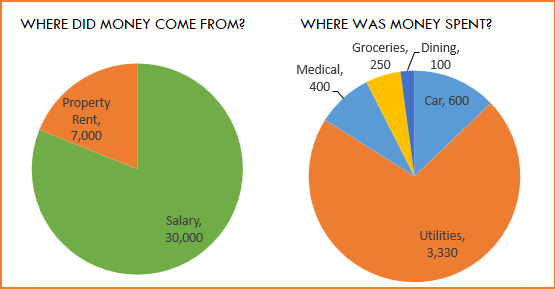

Understand where the money came from and where it was spent, in the month

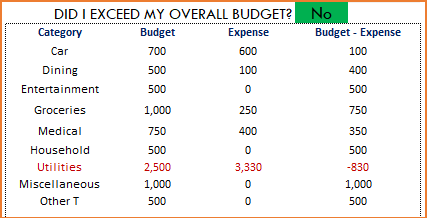

- Track whether you have exceeded the monthly budget.

- Also see the comparison of expenses to budget by each category

- Categories that exceeded budget will be highlighted in red

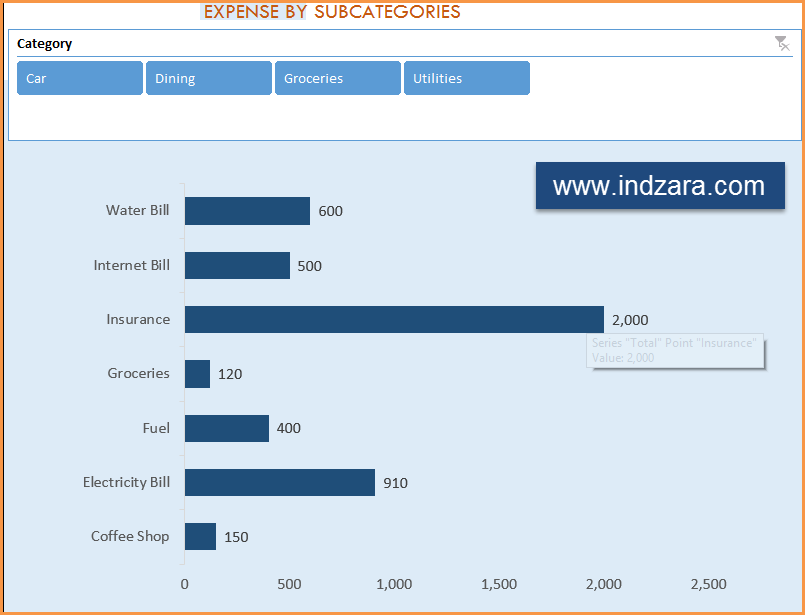

Understand expenses by Subcategories.

3) Trends of expenses, savings and net balance

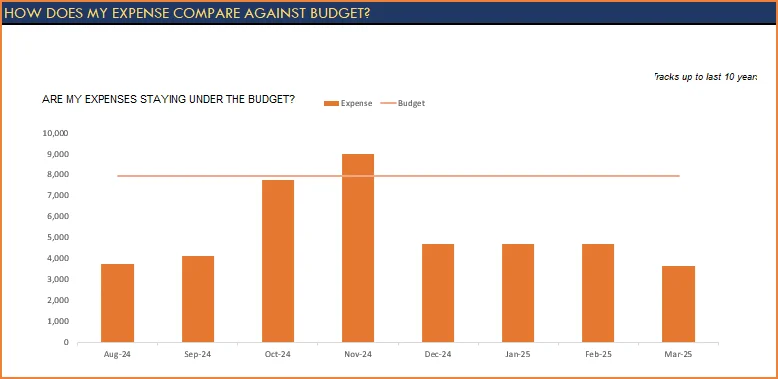

Trend of expenses over time and comparing against monthly budget

Trend of savings and net balance over time

4) Trends of transactions by Categories and Sub Categories

I hope you find this personal finance management template excel useful in managing your personal finances easily.

348 Comments

Hello Indzara!!!!

First of all, I would like to tell you that I’m HUGE FUN of your work which is AWESOME!!!! Thank you for providing us with such a useful and fantastic tools to make us lives easier!!!

I recently downloaded this excel, but I have a problem with the “Transactions sheet”. For some reason, after I completed some of the lines with a few transactions and every seemed to be ok so far, I continued with a few more, and suddenly the cells which automatically filled with the month, stopped and changed to “MMM”. As a result, I cannot have the reports as supposed to be… I tried to erase the dates and fill in them again from the start, but it didn’t work out.. Can you please help me?

Thank you for showing interest in our template and sharing your valuable feedback and you are welcome.

Yes, we are glad to assist you. Please share your sheet to us at the below link:

https://support.indzara.com/support/tickets/new

Best wishes.

Hello again!

Well, I figured out that the problem was the conflict between the languages…different language at laptop, different language in excel and so on…. I’m apologizing for the inconvenience!!!

Many bravo again for your awesome work!!!

Kindest Regards,

Hi

This excel sheet is fantastic. Is there a new upgraded version of this template

Thank you for showing interest in our template.

We have a premium version of the template for small business. Following is the link to the template for quick reference:

https://indzara.com/product/small-business-finance-manager-excel-template/

Best wishes.

Hi

And awesome template!!!

I loved your work. However I have few doubts and addition request if possible to this template as given below.

1) If we have borrowed money which is our debt as loans or specifically borrowed from close friends where to account that as we would be closing on monthly or yearly etc.

2) Is it possible to see our total income, expense and saving per month in one graphically represented chart.

Thank you again for sharing this with us.

Accept my Gratitude.

Thank you for sharing your valuable feedback.

1. If it is a long term loan it can be added as a credit card balance and if it is one time, take it as a expense.

2. Adding all income and excel in one chart will make the chart clumsy.

Best wishes.

Amazing!!

Is there any possibility to, also, create subcategories for income?

Thanks for the amazing work!

Thank you for sharing your valuable feedback and you are welcome.

I would like to inform you that the requested feature is currently available in our Small Business Finance Manager template. Following is the link to the product:

https://indzara.com/product/small-business-finance-manager-excel-template/

Best wishes.

Hello Sir,

Your template is very helpfull! I learn a lot from your templates.

Could you explain what is happening in the table on the hidden sheet “Monthly_Summary_Table”

I understand that all te graphs are made from this table. It would be very helpfull if i undersood what for formulas are there. (it is protected so i cannot check it out myself)

Kind regards,

Wesley

You are welcome. Glad to hear.

Please use indzara as password to unprotect and view the formulas.

Best wishes.

Thanks for this great personal finance template.

My only comment is that I cannot seem to see and enjoy many of the charts you cited above.

Thanks for using our template.

This template works well in Excel 2010 or later editions. Please check your version of Excel. In case it’s still not working, please email your file along with the list of issues to support@indzara.com

Best wishes

Thank you so much for this template. It is really useful and comprehensive!!

Would like to seek your assistance please as it seems that the report section (budget part) does not seem to be updating? I have input the monthly budget but it seems the categories and amounts are not appearing in the report. Can you help me please?

You are welcome. Glad to hear.

If the values do not appear, typical reason is that the entries are made outside the table.

Please email file to support@indzara.com along with your question. We are happy to review and help. Please remove any sensitive data before sending file.

Best wishes.

Hi indzara

You have done good work thinking all these over and helping people who find difficult to manage the finance . It would be very helpful if you can think of Adding the SIP fund tracker , Shares Tracker to see the asset live updated in this . It would be good if you think of adding LIC & Other saving stuff all together.

It will be much better if you can think to make it a app because Most of the time the spendings happen on the go and we might miss or forget to enter it in excel later as the excel in mobile is tedious to enter these data.

Thanks for using our template and sharing your valuable recommendations.

We will try to incorporate them into our future releases.

Best wshes

I’m using this template past six months it works good,

I’ve one doubt in this excel sheet, Credit accounts paid amount also a part of monthly expense but it not show in monthly financial analysis . how to add credit amounts to expenses .

I request you to clarify this .

Regards,

Thanks for using the template.

If you are referring to credit card payment, it should be considered as a transfer transaction and hence not part of expenses. As we are entering each expense transaction already we should not enter the credit payment again as an expense.

Please let us know if any questions.

Best wishes.

Thank you very much, for your kind reply…..

Regards

Hi Indzara,

First of all I would like to express my sincere gratitude for the sharing of these valuable resources.

I am facing an issue with this excel sheet; it is getting corrupted when I use it for some time. Also very difficult to save transactions on the go.

I request you to share Google sheet equivalent for this excel sheet. It would mean a lot to many of us.

Thanks a lot.

Thanks for using our template and sharing your positive experience.

This template is designed to work on MS Excel. The list of template compatible on Google sheets are at https://indzara.com/free-google-sheet-templates/.

We are in the process of making other templates compatible with Google Sheets gradually.

Best wishes