Personal Finance Manager 2025 (Free Excel Budget template)

This is a simple free Personal Finance management excel template that focuses on making it easy for you to know what’s happening with your financial situation especially when you have multiple bank accounts, credit card accounts and cash.

This Excel Budget template also helps you set budgets and see how you are actually doing against your budget.

With simple data entry, the template provides you instant access to actionable information in a consumable form that can answer key questions regarding your personal financial situation.

Specifically, the template helps you in knowing the following:

- How much money is in my different bank accounts?

- How much do I owe on credit cards?

- On what items am I spending my money on?

- Am I exceeding my monthly budget? If so, in which categories?

- How are my expenses trending over time?

- Am I spending more on any specific expense category over time?

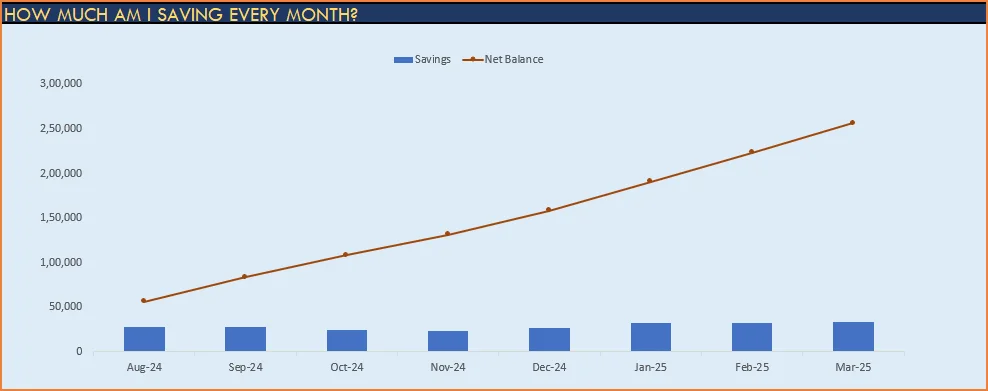

- How much am I saving every month? How does that add to my net balance?

Free Downloads

This version doesn’t use Pivot Tables and Slicers. 4 Charts that are available in Excel 2010 file are not available in this.

Requirements

Excel 2010 and above for Windows

Excel 2011 for Mac

Video Demo

How to track personal finances in Excel?

The template has 3 worksheets: 1) Settings 2) Transactions and 3) Report.

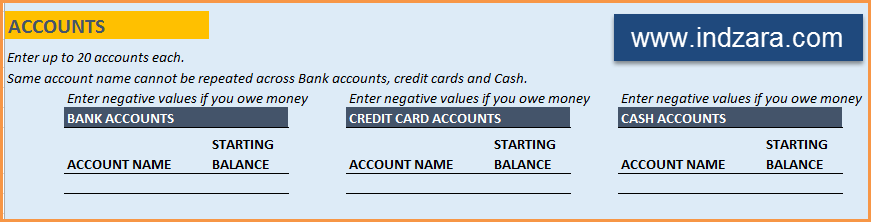

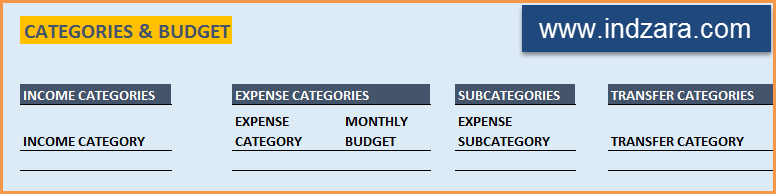

STEP 1: Enter information in Settings worksheet

- Enter Accounts (bank accounts, Credit Card Accounts and Cash Accounts)

- Set your starting balances of accounts

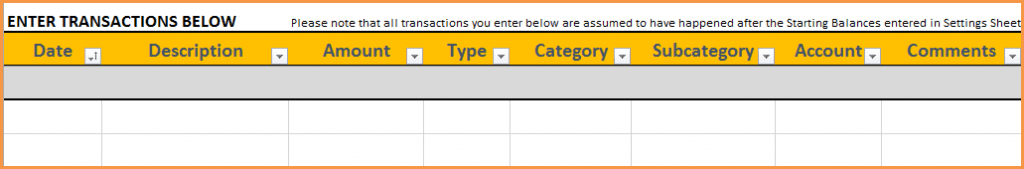

STEP 2: Entering transactions in the Transactions worksheet

When you open the template, there will be no records in the Transactions worksheet (as shown in the image below). Start entering your own transactions.

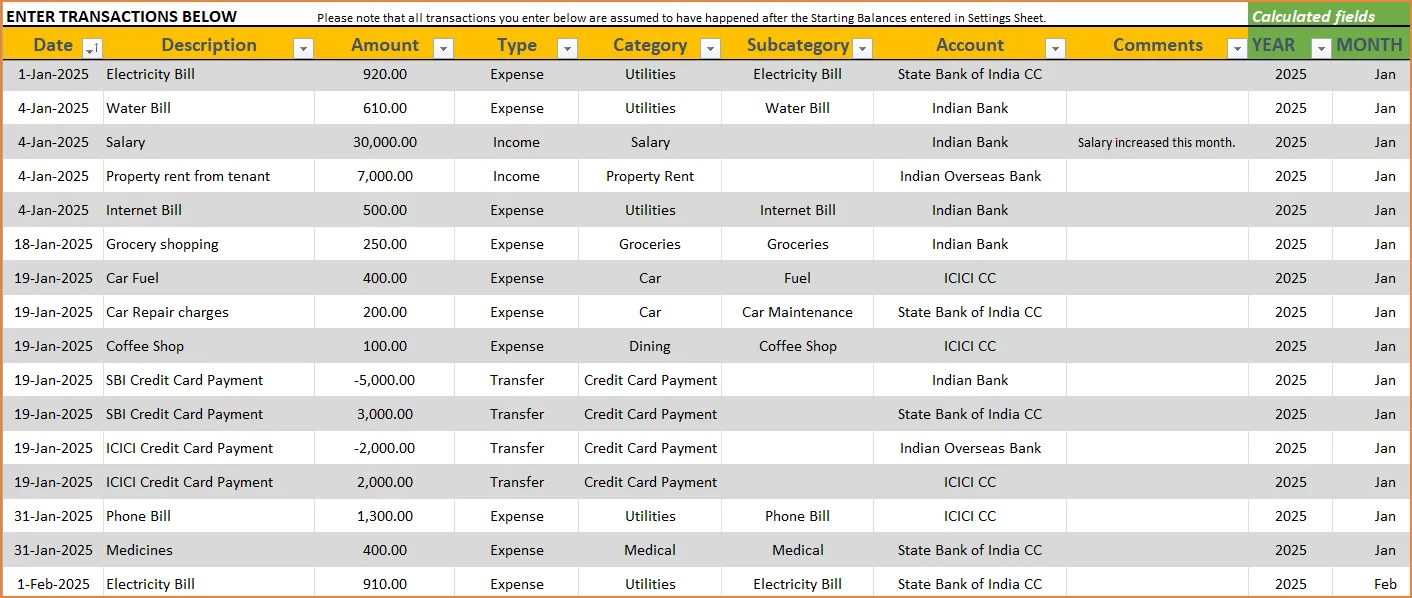

3 Types of Transactions

- Income and Expense: By default, all the Income and Expense transactions should be entered as positive amounts.

- Special case (Refund): If you purchased an item at a store, you would enter an Expense transaction with positive amount. If, a few days later, you returned the item to the store for some reason and get a refund, then you should enter the refund as a new Expense transaction with negative value.

- Transfer: When money is transferred from one account to another, create two records

- ‘Transfer’ type with negative amount from the account you are taking the money from.

- ‘Transfer’ type with positive amount for the account you are depositing the money into.

- Examples of Transfers are Credit Card Payment (transfer from Bank account to Credit Card account) and ATM withdrawal (transfer from Bank account to Cash)

- Drop down menus are available for easy data entry in these fields (Type, Category, SubCategory, Account).

After you enter your transactions, the Transactions worksheet would look like this image below.

STEP 3: View Report

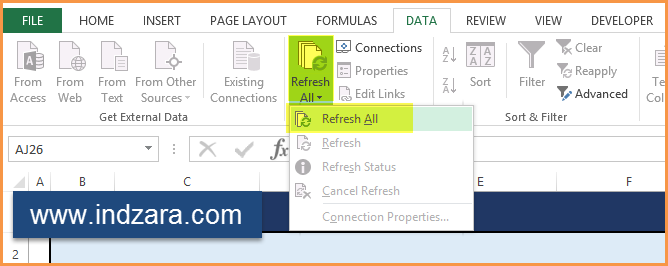

Since there are pivot tables and charts, please refresh the data by going to Data ribbon and refresh all (or keyboard shortcut Ctrl+Alt+F5) . This updates the charts with your new transactions.

Report sheet is locked to prevent accidental editing of formulas. To unlock, use password indzara

The report has four pages.

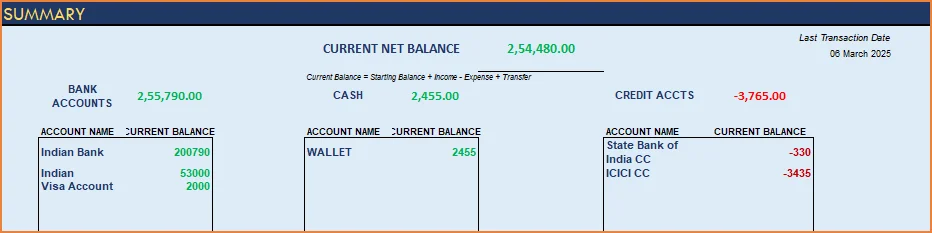

1) Summary

- Summary of your current financial status

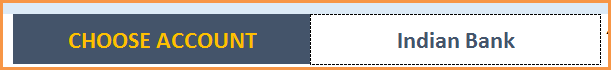

You can find balances for any period in each of your accounts using this personal account template.

This can be helpful when your bank statements and credit card statements actually have their billing cycles different from calendar months. This allows you to compare your statements with the data you have in this template and confirm that you have not missed any transactions.

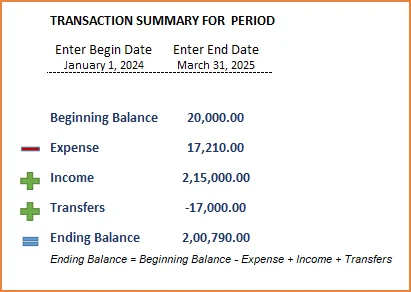

The chart shows the trend of month-end balances in the account chosen.

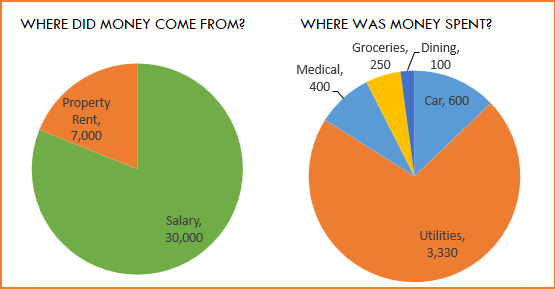

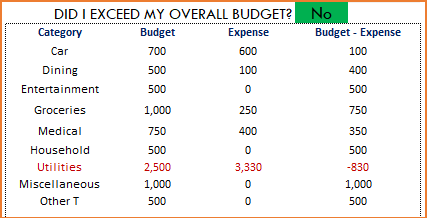

2) Monthly Financial Analysis

This multiple bank account management excel template can also help in monthly financial analysis. Please choose one month at a time using the slicers at the top.

View total Income, expense and savings

Understand where the money came from and where it was spent, in the month

- Track whether you have exceeded the monthly budget.

- Also see the comparison of expenses to budget by each category

- Categories that exceeded budget will be highlighted in red

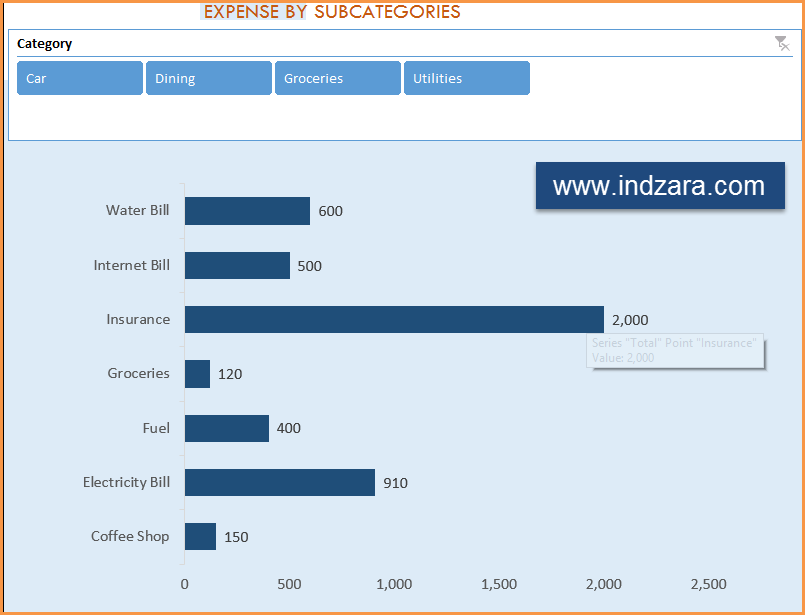

Understand expenses by Subcategories.

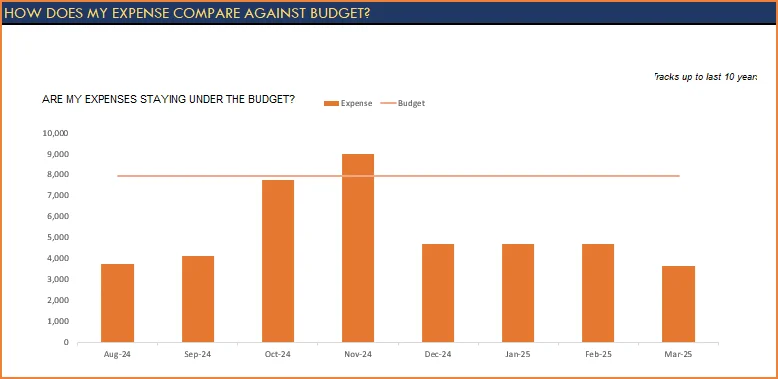

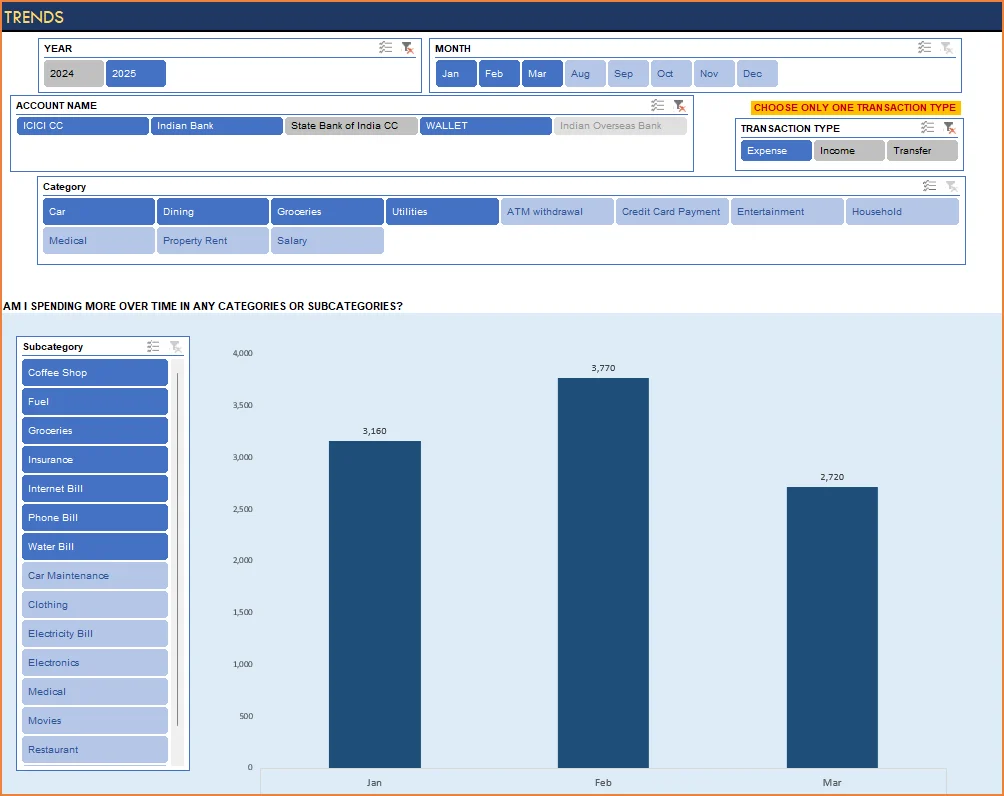

3) Trends of expenses, savings and net balance

Trend of expenses over time and comparing against monthly budget

Trend of savings and net balance over time

4) Trends of transactions by Categories and Sub Categories

I hope you find this personal finance management template excel useful in managing your personal finances easily.

346 Comments

Hi, Thank you for the templates. They are wonderful. However, I have more credit cards than the spaces available for them. How can I add them to the template without affecting it?

Thanks for your compliments. As I say in a previous comment, adding more accounts would require inserting new rows, data validation changes, and formatting changes in all the sheets. You can unlock the file using the pwd indzara and make the changes. Unfortunately, it is not a simple one-step task. I am sorry. I will keep in mind that there is a need to have option for more accounts. Best wishes.

Hi. Congratulations for your work. How can you block the cells limiting the scroll bars. Thank you.

Thank you. You can select the rows (or columns), Right Click and choose ‘Hide’. The extra rows and columns are just hidden. You can unhide and bring them back if needed. I hope I answered your question.

How do I add more accounts?

Adding more accounts would require inserting new rows, data validation changes, and formatting changes in all the sheets. You can unlock the file using the pwd indzara and make the changes. Unfortunately, it is not a simple one-step task. I am sorry. I will keep in mind that there is a need to have option for more accounts. Best wishes.

hi,

i have seen your Personal Finance Manager (Excel template) and its one of the best i came across.

but one little problem is while closing template its showing “EXCEL HAS STOPPED WORKING” every time. when i reopen template all the data is lost.

can you plz help what to do ?

Thank you.

I do not come across this error. Which version of Excel and what operating system do you use?

i am using excel 2010 and operating system windows 8.1

I am using Windows 7 and I have tested in Excel 2010 and 2013. I don’t get this error. I am sorry I am unable to help further. I hope to have computers with different operating systems soon. I should be able to test then.

Best wishes.

hi,

iam not able to do referesh all .not appear DATA Coloum in my personal finance manager excel template.

I am not sure I understand your question. Please explain what you mean by not being able to refresh. Which column is missing?

Hi,

Do u have any template for 2007 version

Hello,

I am sorry I don’t have one yet. I will post it when I build it.

Thanks,

Thank you for your post. This is excellent information. It is amazing and wonderful to visit your site. It really gives me an insight on this topic.Here you can find many more tips about Self Improvement and Personal Finance.

Hi guys,

congratulations, your templates are great.

Thank you very much.

Hi ind zara,

This is EXACTLY what I have been trying to create for myself for about a year now… I have tried multiple formats and multiple templates and this is by far the most comprehensive and useful of any I’ve been able to find or create myself. I had a little trouble figuring out how to delete your dummy categories from the reports section in the beginning, but finally got it. My only suggestion for improvement might be to incorporate a debt section. In my case, I don’t have credit cards, but I do have debts such as student loans as well as owing my mom money. Maybe it is possible for you to create a section for those issues.

Thank you for providing such a great template for anyone to download!

Thank you for the compliments. Comments like yours give me the motivation to continue to share. Thank you.

I will consider incorporating debts in my next version. If it’s you owing some money to your mom (or any such scenarios), can you try using a dummy credit card name and entering that amount as balance. Because I am not calculating any interests automatically in the template, you can include such balances in the template like a credit card balance. I may be missing something. Please correct me if I am misunderstanding.

That’s actually what I’m doing for now. Using the credit card section for general debt is working well and I have been able to estimate when I’ll have me debts payed off by using your template. Great motivation to keep saving. Thanks!

I am glad to hear such positive stories. Best wishes.

It says I need a password to edit my own things into it. Is there something I need to do to get rid of the password?

The template is password protected to prevent unintended modifications to the formulas. It should not prevent the user from entering your own data to work with the template. Please clarify what you are trying to edit. You can use the word ‘indzara’ to unlock.