Personal Finance Manager 2025 (Free Excel Budget template)

This is a simple free Personal Finance management excel template that focuses on making it easy for you to know what’s happening with your financial situation especially when you have multiple bank accounts, credit card accounts and cash.

This Excel Budget template also helps you set budgets and see how you are actually doing against your budget.

With simple data entry, the template provides you instant access to actionable information in a consumable form that can answer key questions regarding your personal financial situation.

Specifically, the template helps you in knowing the following:

- How much money is in my different bank accounts?

- How much do I owe on credit cards?

- On what items am I spending my money on?

- Am I exceeding my monthly budget? If so, in which categories?

- How are my expenses trending over time?

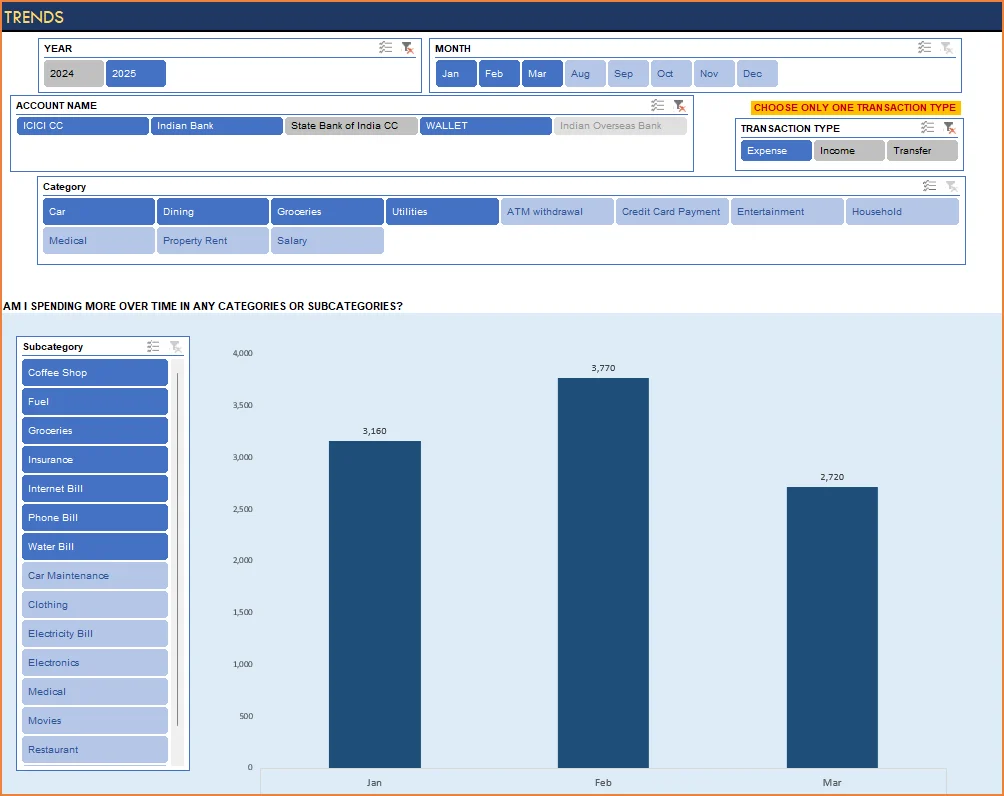

- Am I spending more on any specific expense category over time?

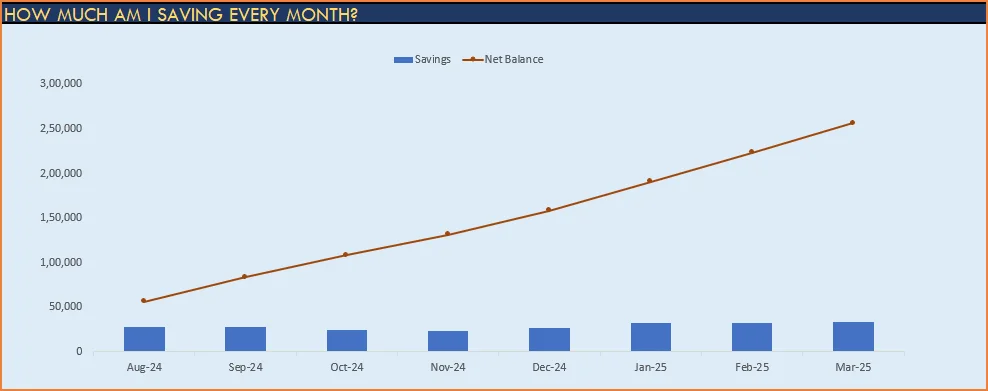

- How much am I saving every month? How does that add to my net balance?

Free Downloads

This version doesn’t use Pivot Tables and Slicers. 4 Charts that are available in Excel 2010 file are not available in this.

Requirements

Excel 2010 and above for Windows

Excel 2011 for Mac

Video Demo

How to track personal finances in Excel?

The template has 3 worksheets: 1) Settings 2) Transactions and 3) Report.

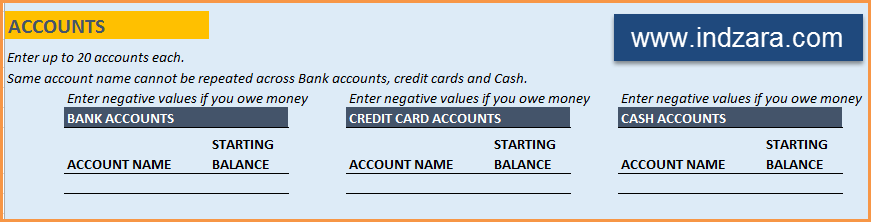

STEP 1: Enter information in Settings worksheet

- Enter Accounts (bank accounts, Credit Card Accounts and Cash Accounts)

- Set your starting balances of accounts

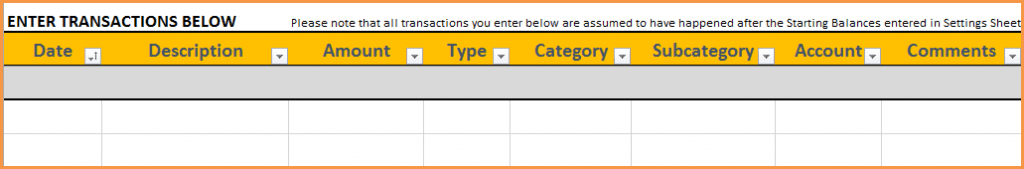

STEP 2: Entering transactions in the Transactions worksheet

When you open the template, there will be no records in the Transactions worksheet (as shown in the image below). Start entering your own transactions.

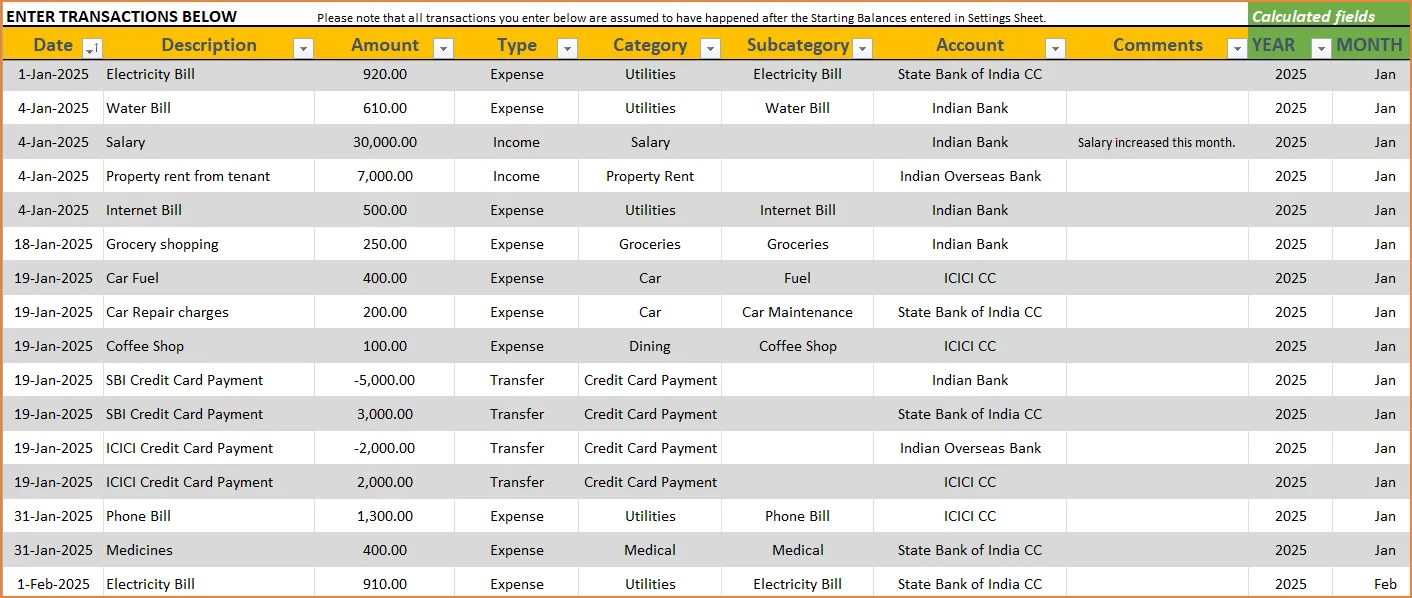

3 Types of Transactions

- Income and Expense: By default, all the Income and Expense transactions should be entered as positive amounts.

- Special case (Refund): If you purchased an item at a store, you would enter an Expense transaction with positive amount. If, a few days later, you returned the item to the store for some reason and get a refund, then you should enter the refund as a new Expense transaction with negative value.

- Transfer: When money is transferred from one account to another, create two records

- ‘Transfer’ type with negative amount from the account you are taking the money from.

- ‘Transfer’ type with positive amount for the account you are depositing the money into.

- Examples of Transfers are Credit Card Payment (transfer from Bank account to Credit Card account) and ATM withdrawal (transfer from Bank account to Cash)

- Drop down menus are available for easy data entry in these fields (Type, Category, SubCategory, Account).

After you enter your transactions, the Transactions worksheet would look like this image below.

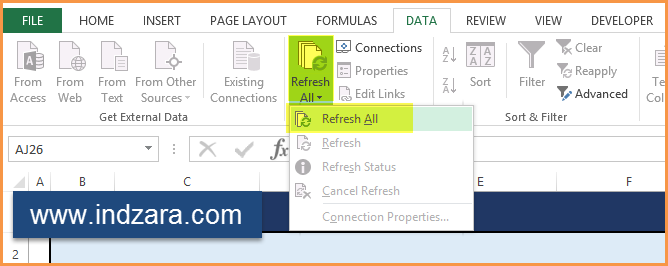

STEP 3: View Report

Since there are pivot tables and charts, please refresh the data by going to Data ribbon and refresh all (or keyboard shortcut Ctrl+Alt+F5) . This updates the charts with your new transactions.

Report sheet is locked to prevent accidental editing of formulas. To unlock, use password indzara

The report has four pages.

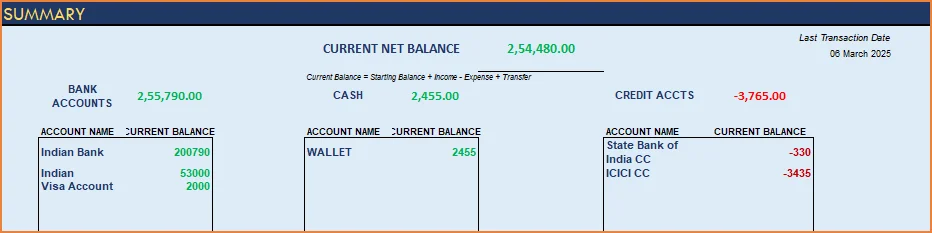

1) Summary

- Summary of your current financial status

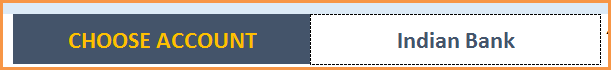

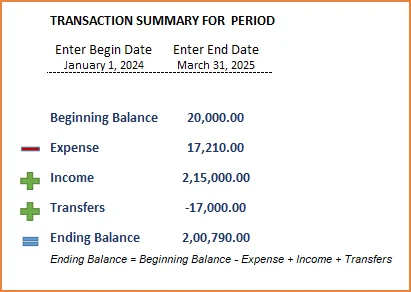

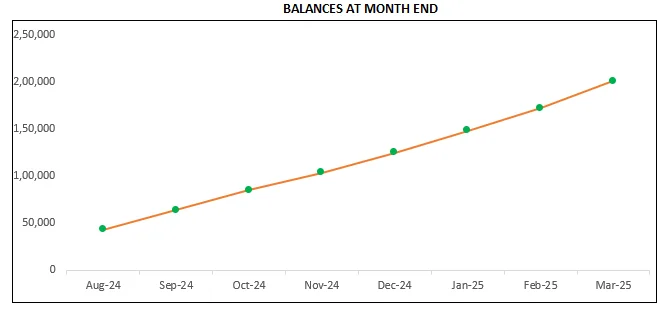

You can find balances for any period in each of your accounts using this personal account template.

This can be helpful when your bank statements and credit card statements actually have their billing cycles different from calendar months. This allows you to compare your statements with the data you have in this template and confirm that you have not missed any transactions.

The chart shows the trend of month-end balances in the account chosen.

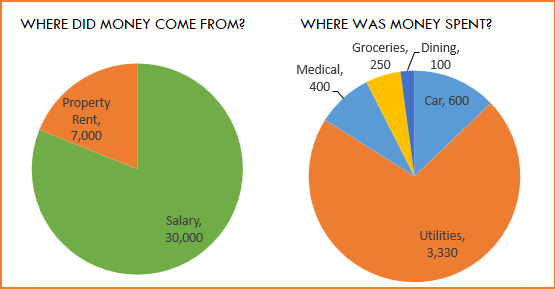

2) Monthly Financial Analysis

This multiple bank account management excel template can also help in monthly financial analysis. Please choose one month at a time using the slicers at the top.

View total Income, expense and savings

Understand where the money came from and where it was spent, in the month

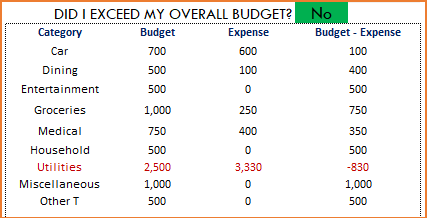

- Track whether you have exceeded the monthly budget.

- Also see the comparison of expenses to budget by each category

- Categories that exceeded budget will be highlighted in red

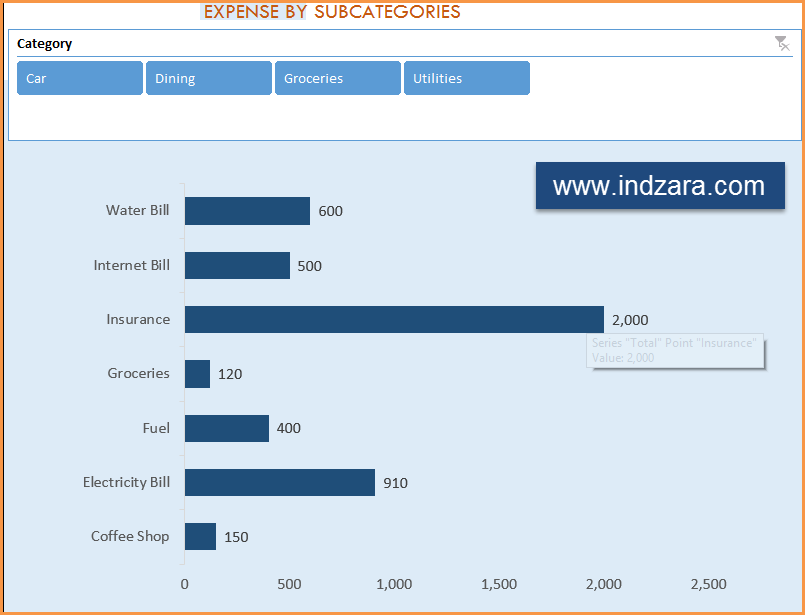

Understand expenses by Subcategories.

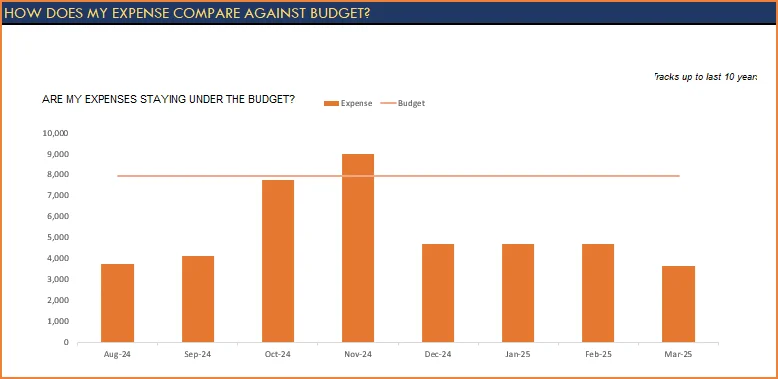

3) Trends of expenses, savings and net balance

Trend of expenses over time and comparing against monthly budget

Trend of savings and net balance over time

4) Trends of transactions by Categories and Sub Categories

I hope you find this personal finance management template excel useful in managing your personal finances easily.

346 Comments

Hello Prabhu, I am sorry. Unfortunately, it is not compatible with Excel versions for Mac.

Hi Ind Zara,

This is Prabhu here. Excellent template that you have made. After i spent an hour inputting my data into the transaction table, i was quite disappointed to learn that the tables and graphs are not visible on pg 2,3,4.Please help. I am using excel 2010 on mac OSX.

thanks

Hi Ind,

Thanks for the template. Looks great, but I’m a bit confused with transfer transactions specifically on Credit Card. You stated to enter 2 records for this type of transaction, however any Credit Card balance is caused by the expense you made using the card and this transaction is already captured as part of expense record. Why do you think isn’t needed to record Credit Card transactions this way?

Thanks,

Manish

Hello Manish,

Thanks.

You enter credit card expense transactions as just expense transaction (one per expense). However, your credit card payments (you pay the credit card company monthly by transferring from your bank accounts typically) are transfer transactions and they should be entered twice (one for your credit card account and other for the bank account where you take the money from). I hope that clarifies.

Hi Ind,

Thank you for this template.

Just wondering how to add sub categories (30 needed) and categories

You are welcome.

Subcategories are easier to add. Insert more rows below row 37. Change (expand) the Named range (Subcategories) in the Name manager in the Formulas ribbon. That should do it.

Categories are not so straight forward, since I use them in the reports and you need to make some modifications to that worksheet as well.

WOW this is an amazing template I really see myself using this template for the years to come in order to keep track of my money thank you so much for sharing it to everyone that need’s to get organized KEEP UP THE GREAT WORK!!!

Now if you’ll excuse me I am going to check out the rest of your site to see if there’s anything else I can use to get better organized you guys have my full support. 🙂

Thank you very much.

I want to understand about personal finance so I can understand to use my cash smartly at an starting age and generate income perform for me and not the other way circular.

Thank you. Small businesses can also use this template. Please share your requirements. You can e-mail at indzara at gmail, or use the contact form on the right sidebar.

Dear Sir,

We are very thankful for such a great excel. please let us know if you can do needful for us by creating the same finance manager excel sheet which we can use of our enterprise. By means of this we can get the business status of about profit and loss a/c

Thanks – Arjun Patil

Hi indzara thanks for your template. How to add year 2014 into sheet report?

nevermind for last question. I found it when I refresh report. silly me 🙂

the one I can’t yet solve is why every I close the program, excell get hang qnd blank and window error message pop up then restart the excell?

I use generic 2010 template and Im using excel 2010 in windows 7 64bit version

You are the third person I know who has come across this error. I don’t get this error and I don’t know why it happens for you. I would really like to understand. I will do some research on this. Thanks for letting me know.

Hi, would you mind sharing in a bit more detail how did you refresh the report. 🙂 Thank you. And certainly thank you ind zara for this beautiful and useful spreadsheet.

You are welcome.

Please go to the Data Ribbon and select refresh all. This updates the charts with your new transactions.

Does this version works on Mac

I don’t have a Mac and am unable to test it. I expect some of the features in the template not to be compatible with Mac versions of Excel. Thanks.