Personal Finance Manager 2025 (Free Excel Budget template)

This is a simple free Personal Finance management excel template that focuses on making it easy for you to know what’s happening with your financial situation especially when you have multiple bank accounts, credit card accounts and cash.

This Excel Budget template also helps you set budgets and see how you are actually doing against your budget.

With simple data entry, the template provides you instant access to actionable information in a consumable form that can answer key questions regarding your personal financial situation.

Specifically, the template helps you in knowing the following:

- How much money is in my different bank accounts?

- How much do I owe on credit cards?

- On what items am I spending my money on?

- Am I exceeding my monthly budget? If so, in which categories?

- How are my expenses trending over time?

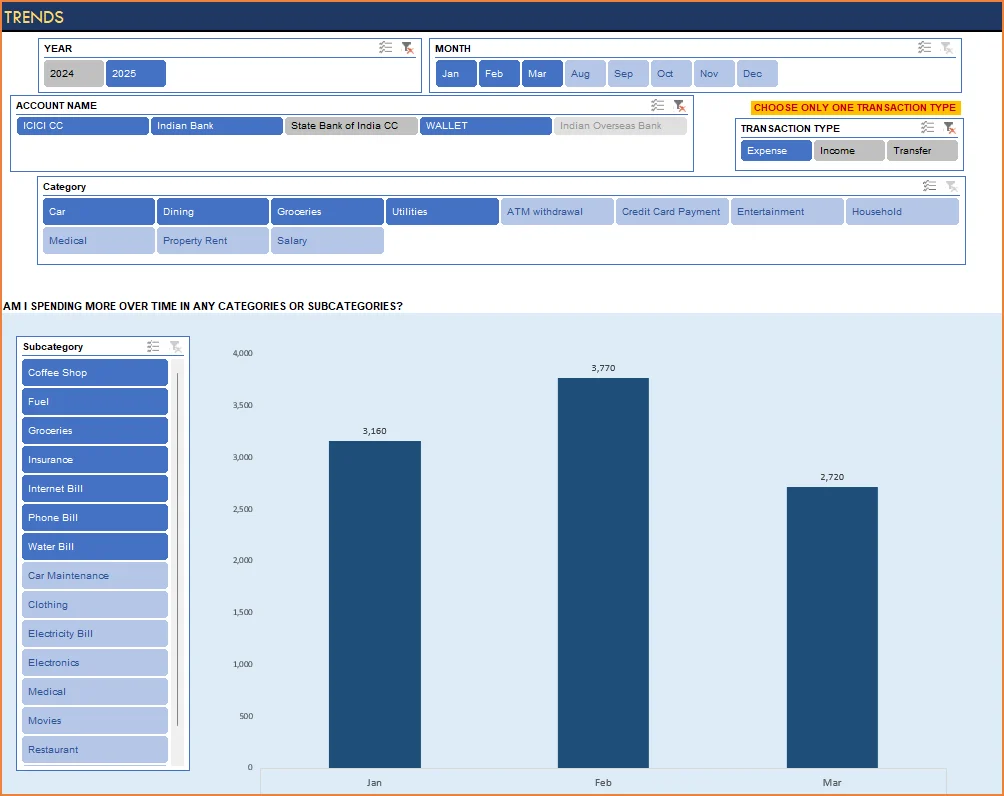

- Am I spending more on any specific expense category over time?

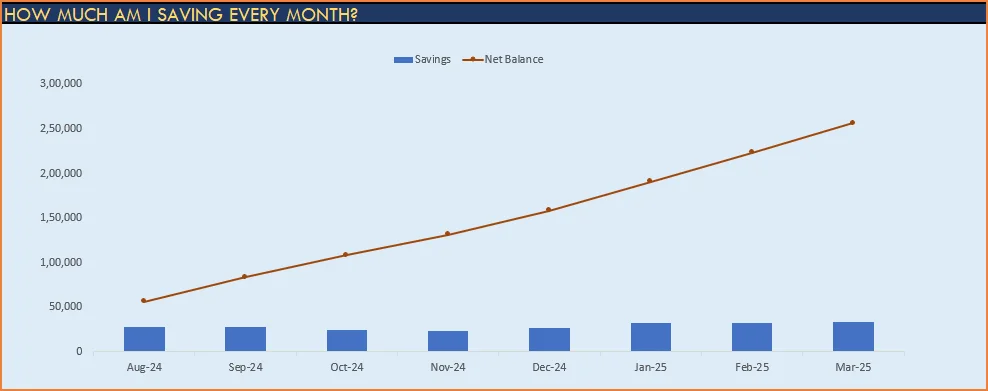

- How much am I saving every month? How does that add to my net balance?

Free Downloads

This version doesn’t use Pivot Tables and Slicers. 4 Charts that are available in Excel 2010 file are not available in this.

Requirements

Excel 2010 and above for Windows

Excel 2011 for Mac

Video Demo

How to track personal finances in Excel?

The template has 3 worksheets: 1) Settings 2) Transactions and 3) Report.

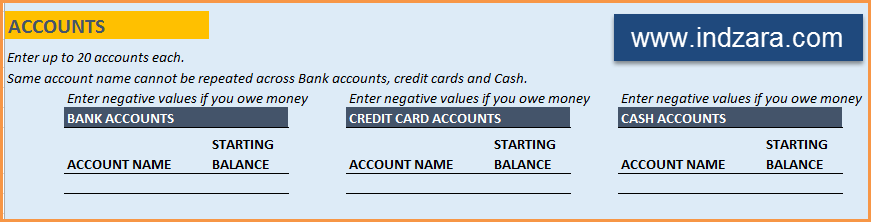

STEP 1: Enter information in Settings worksheet

- Enter Accounts (bank accounts, Credit Card Accounts and Cash Accounts)

- Set your starting balances of accounts

STEP 2: Entering transactions in the Transactions worksheet

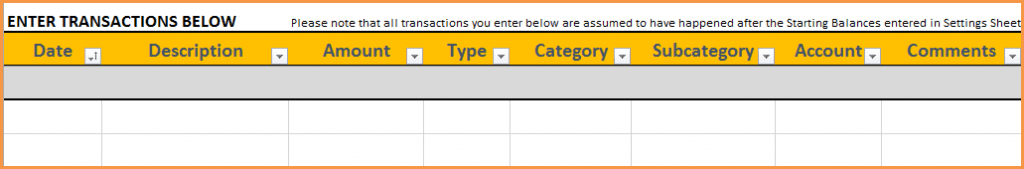

When you open the template, there will be no records in the Transactions worksheet (as shown in the image below). Start entering your own transactions.

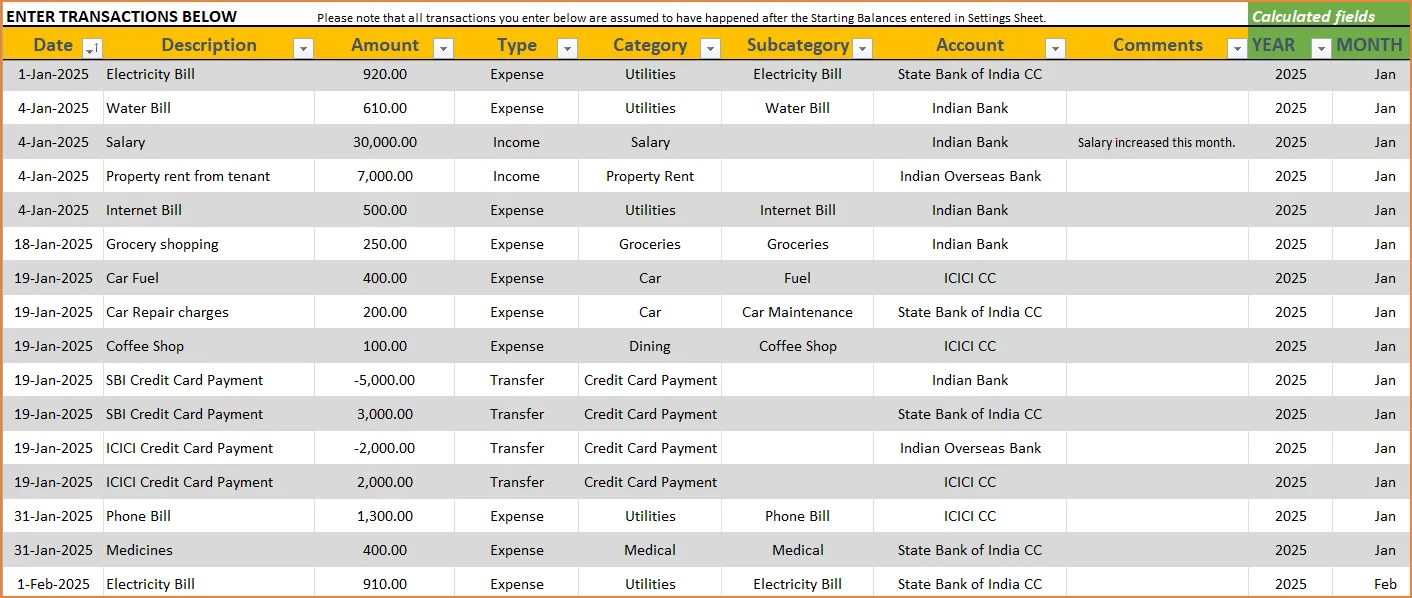

3 Types of Transactions

- Income and Expense: By default, all the Income and Expense transactions should be entered as positive amounts.

- Special case (Refund): If you purchased an item at a store, you would enter an Expense transaction with positive amount. If, a few days later, you returned the item to the store for some reason and get a refund, then you should enter the refund as a new Expense transaction with negative value.

- Transfer: When money is transferred from one account to another, create two records

- ‘Transfer’ type with negative amount from the account you are taking the money from.

- ‘Transfer’ type with positive amount for the account you are depositing the money into.

- Examples of Transfers are Credit Card Payment (transfer from Bank account to Credit Card account) and ATM withdrawal (transfer from Bank account to Cash)

- Drop down menus are available for easy data entry in these fields (Type, Category, SubCategory, Account).

After you enter your transactions, the Transactions worksheet would look like this image below.

STEP 3: View Report

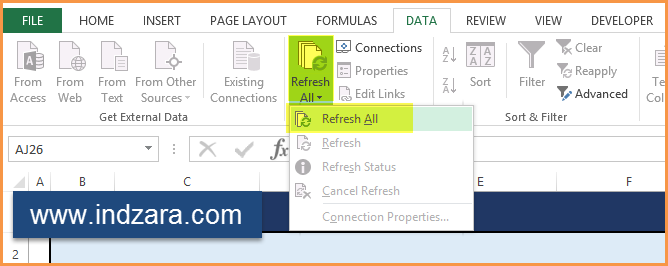

Since there are pivot tables and charts, please refresh the data by going to Data ribbon and refresh all (or keyboard shortcut Ctrl+Alt+F5) . This updates the charts with your new transactions.

Report sheet is locked to prevent accidental editing of formulas. To unlock, use password indzara

The report has four pages.

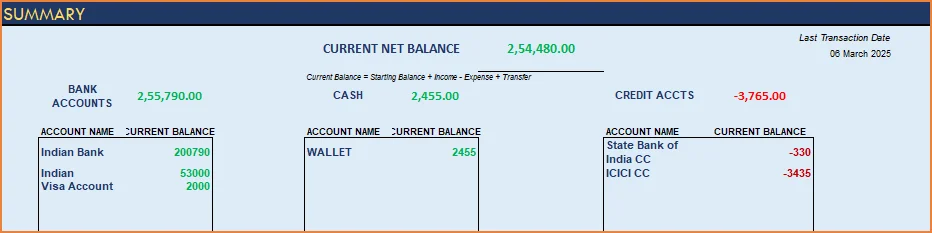

1) Summary

- Summary of your current financial status

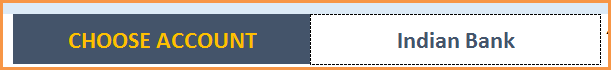

You can find balances for any period in each of your accounts using this personal account template.

This can be helpful when your bank statements and credit card statements actually have their billing cycles different from calendar months. This allows you to compare your statements with the data you have in this template and confirm that you have not missed any transactions.

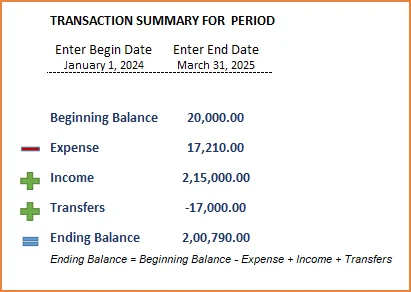

The chart shows the trend of month-end balances in the account chosen.

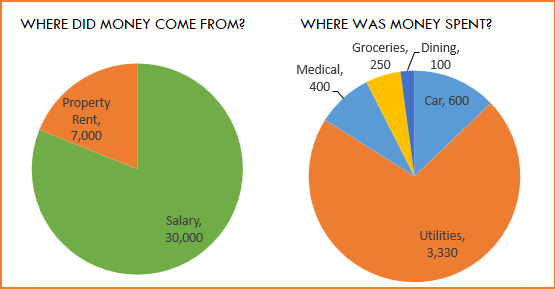

2) Monthly Financial Analysis

This multiple bank account management excel template can also help in monthly financial analysis. Please choose one month at a time using the slicers at the top.

View total Income, expense and savings

Understand where the money came from and where it was spent, in the month

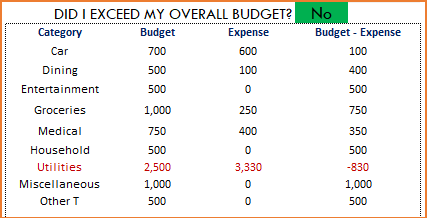

- Track whether you have exceeded the monthly budget.

- Also see the comparison of expenses to budget by each category

- Categories that exceeded budget will be highlighted in red

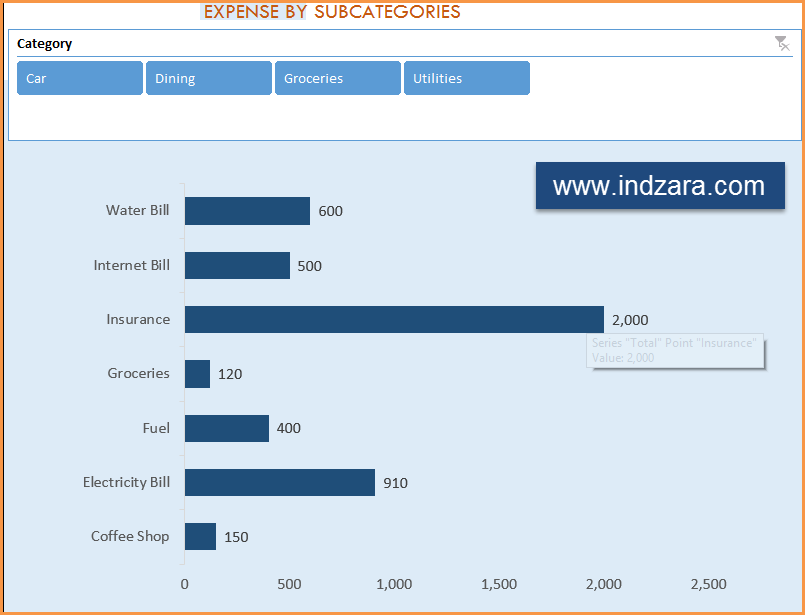

Understand expenses by Subcategories.

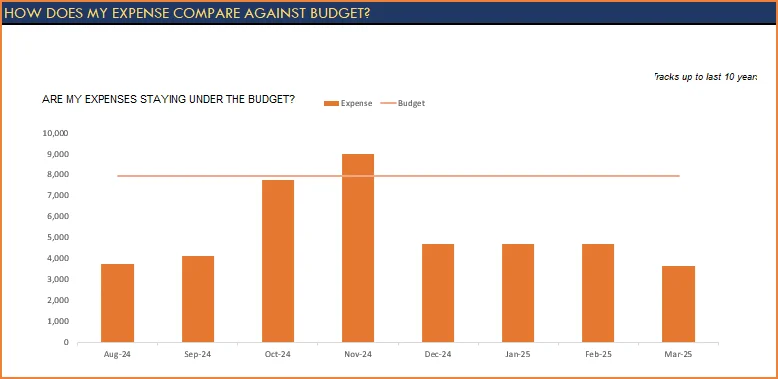

3) Trends of expenses, savings and net balance

Trend of expenses over time and comparing against monthly budget

Trend of savings and net balance over time

4) Trends of transactions by Categories and Sub Categories

I hope you find this personal finance management template excel useful in managing your personal finances easily.

346 Comments

Hello,

Thank you for this powerful tool. It is exactly what I was looking for. I just have a logistical question. If I am taking money out of my checking account and plan on spending that money and not recording what I’m spending it on, wouldn’t that be considered an expense instead of a transfer? I guess I am unclear why an ATM withdrawal is considered a transfer.

Thank you. I am glad you like the template.

You are absolutely correct. If you do not plan to track the cash withdrawn, then it is an expense immediately. If you plan to track the cash, then it would be a transfer and every time the cash is used to spend, then it would be recorded as expense.

Best wishes.

Congratulations INDZARA!!! Nice template and it very hand to use.

Is there any possibilities that portfolio tracker and or the savings uder fixed deposites, mutual funds could be maintained under the same workbook.

Thanks for the feedback. The template could be extended, but I haven’t had a chance to do that yet. It is in my list of things to do.

Best wishes,

We hope the new version would come soon with all the things on “TO DO LIST”.

All the best and Thaks for creating such a nice template.

Thank you.

Hi sir,

this is an excellent template.i have a question,i take a lone from

bank of india and credited this in another bank how i entry those

accounts and what type of entry both positive or one positive

one negative and what type of categories income and transfer

or only transfer

with regards thanking you

Kaushik Mukherjee

Thank you. I am glad that you like the Excel template.

I suggest that you treat the loan as a credit card account. Name the account ‘Bank of India Loan’.

Enter ‘Expense’ transaction for the ‘Bank of India Loan’ account.Create a new expense category ‘Loan Taken’

Enter Income transaction for the bank account that you are depositing the money into. Create a new income category called ‘Loan’.

Please try the above and let me know if this helps.

Thanks & best wishes.

Hello Indzara,

Thank you very much for the template.

Is there a way to have some accounts in different currencies and have the exchange rates reflected when a transfer is made from one account to another account in a different currency?

All the reports and results, budget etc could be expressed in only one base currency, but the exchange rate should be updated periodically.

Is there a way to add this multi-currency functionality?

Thank you very much again.

I believe it is possible to add multiple currencies, but it would require some formulas. Automatically getting the exchange rates is a different topic though and I have not attempted to do so yet. Definitely interesting additions to think about. Please feel free to edit the template if you plan to, and let me know. Thank you.

I find your template planning quite useful for making up my capital account for filing IT returns. If two more types asset and libilities are added then it becomes a complete accounting package. I am sure you must have thought about it but

probability some difficulties are there. I am just trying to learn spreadsheet software.

But I am not able to save categories and subcategoriesevend though the setting pages show them but when I go to input

transactions those don’t appear. Instead categoreis shows error 508, subcategories shows err 509, subcategores shows all, top10, standard filters as selection account shows err 502, comments also shows all, top10, standard filters.

Is there any button to save the settings before entering transactions?

Your reply will be greatly appreciated.

I am sorry for the delayed response. I didn’t get an e-mail notification for this comment which I should have.

The settings should take effect immediately. I am not familiar with errors you are referring to. Please send me the file and I will look into it.

Thanks,

Hi,

I don’t know if this was discussed in the prior threads. I indicated our monthly budget on the settings tab and it worked out just fine. But then, there were some items that required cutting back. If i trimmed the budget down on the settings tab, the prior months would get affected and it will looked over budget. Any remedies to this problem? Thanks!

You are correct. Currently there is only one budget that you can set in the template. I need to think of a way to accommodate varying budgets. I have added this to the list of potential enhancements. Thank you.

Hi,

how

I don’t know if this was discussed in the prior threads. I indicated our monthly budget on the settings tab and it worked out just fine. But then, there were some items that required cutting back. If i trimmed the budget down on the settings tab, the prior months would get affected and it will looked over budget. Any remedies to this problem? Thanks!

Hi,

Sorry for my previous feed back.Every thing works fine. Thank you for your excellent template

Not a problem. I am glad that everything works for you. Thanks for taking the time to let me know. Best wishes.

Hi Indzara,

Thank you for the great Finance Manager. I have downloaded the latest version indzara personal finance manager 2010 v2 and I am using office 2013. When I enter the income it is not reflected in the balances. What may be the reason for it?

Dear sir,

Thank you very much for the templates. I was so impressed. May I ask if you have the excel templates for managing inventory and sales for manufacturers where the raw material are the input and the out put are semi-finished products and finished products. If so, may I learn the details of that spreadsheet? Besides, may I order an spreadsheet with our requirement? Please respond me when convenient. Thank you in advance for your response.

Sincerely,

Dorothy Ha.

For the ‘manufacturing’ scenario, how many raw material items would be needed to create one product? I plan to create a template for that in the future. Unfortunately, I cannot take up custom projects now due to time restrictions. Thanks for the interest.

Best wishes,