Personal Finance Manager 2025 (Free Excel Budget template)

This is a simple free Personal Finance management excel template that focuses on making it easy for you to know what’s happening with your financial situation especially when you have multiple bank accounts, credit card accounts and cash.

This Excel Budget template also helps you set budgets and see how you are actually doing against your budget.

With simple data entry, the template provides you instant access to actionable information in a consumable form that can answer key questions regarding your personal financial situation.

Specifically, the template helps you in knowing the following:

- How much money is in my different bank accounts?

- How much do I owe on credit cards?

- On what items am I spending my money on?

- Am I exceeding my monthly budget? If so, in which categories?

- How are my expenses trending over time?

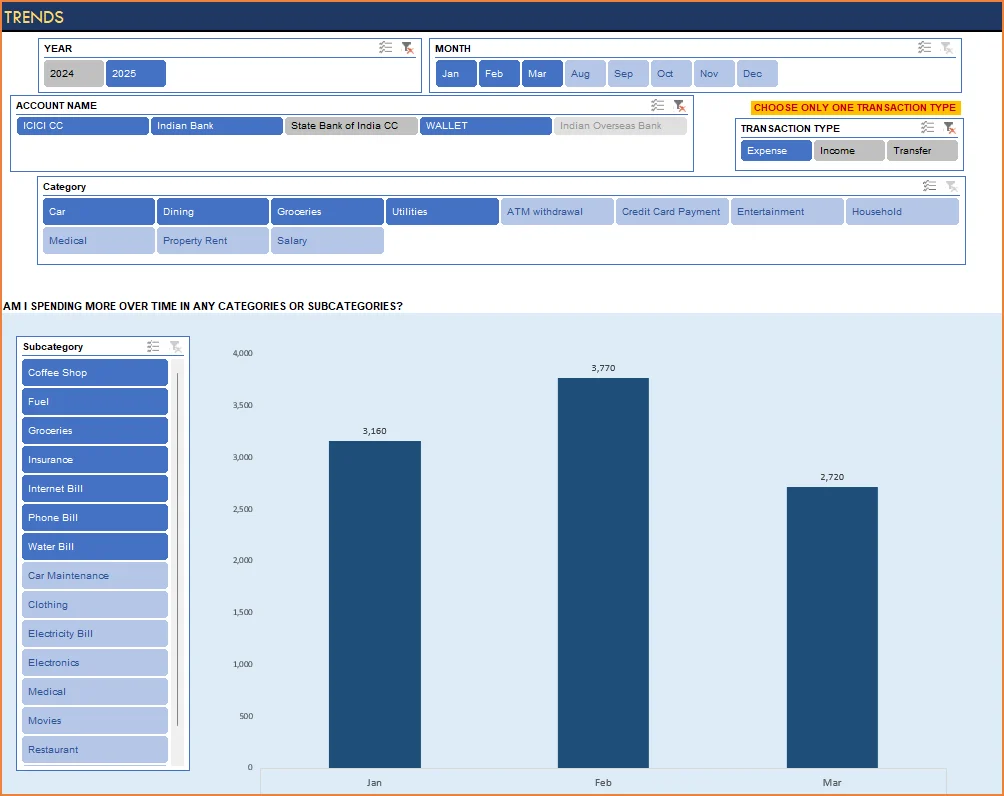

- Am I spending more on any specific expense category over time?

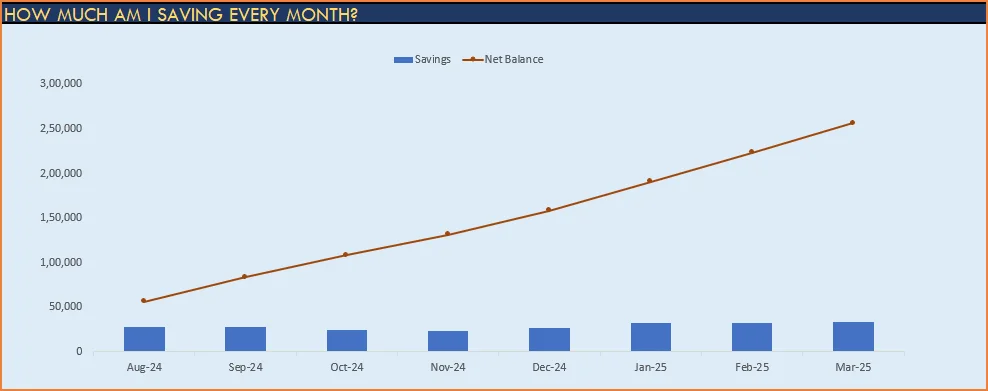

- How much am I saving every month? How does that add to my net balance?

Free Downloads

This version doesn’t use Pivot Tables and Slicers. 4 Charts that are available in Excel 2010 file are not available in this.

Requirements

Excel 2010 and above for Windows

Excel 2011 for Mac

Video Demo

How to track personal finances in Excel?

The template has 3 worksheets: 1) Settings 2) Transactions and 3) Report.

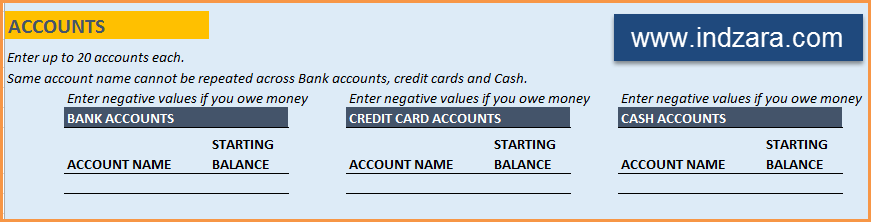

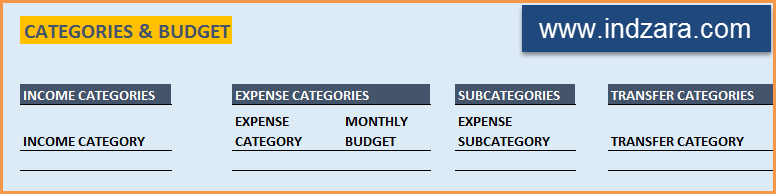

STEP 1: Enter information in Settings worksheet

- Enter Accounts (bank accounts, Credit Card Accounts and Cash Accounts)

- Set your starting balances of accounts

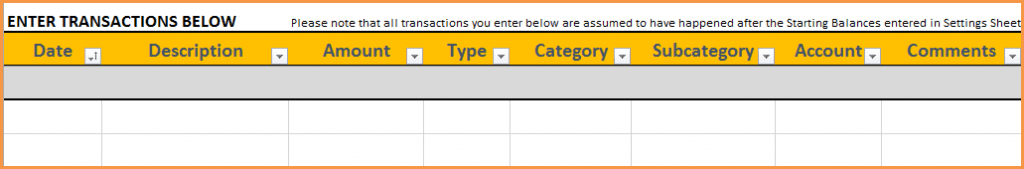

STEP 2: Entering transactions in the Transactions worksheet

When you open the template, there will be no records in the Transactions worksheet (as shown in the image below). Start entering your own transactions.

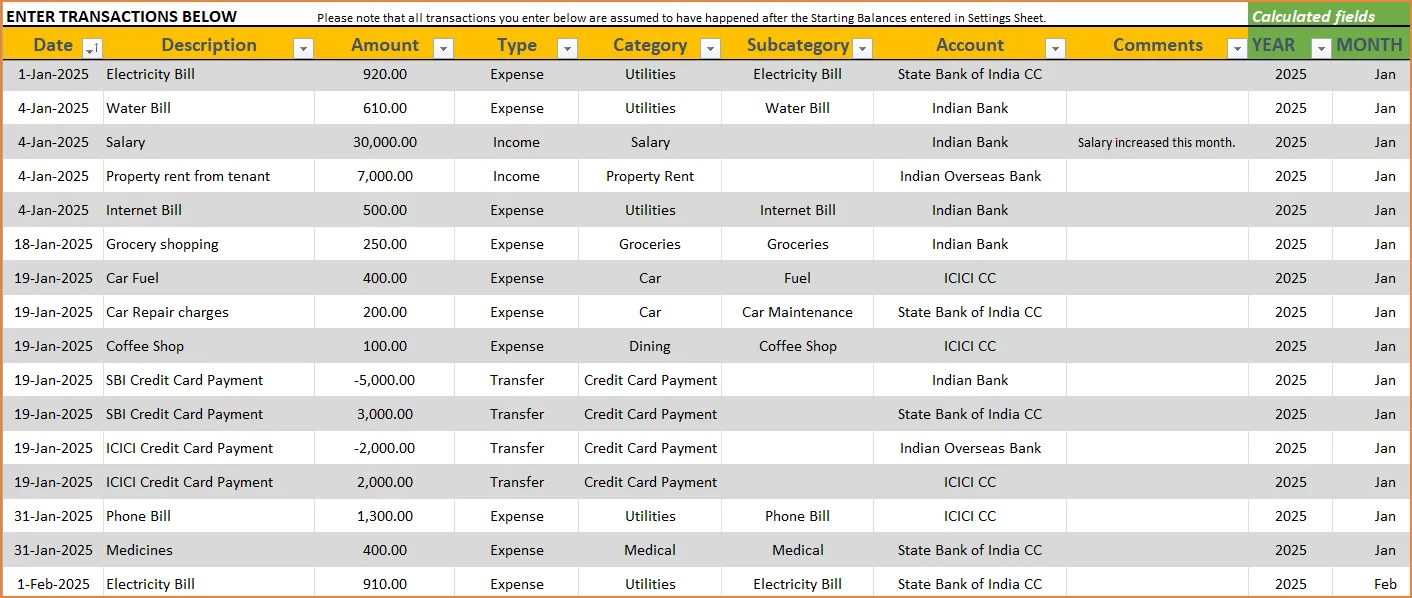

3 Types of Transactions

- Income and Expense: By default, all the Income and Expense transactions should be entered as positive amounts.

- Special case (Refund): If you purchased an item at a store, you would enter an Expense transaction with positive amount. If, a few days later, you returned the item to the store for some reason and get a refund, then you should enter the refund as a new Expense transaction with negative value.

- Transfer: When money is transferred from one account to another, create two records

- ‘Transfer’ type with negative amount from the account you are taking the money from.

- ‘Transfer’ type with positive amount for the account you are depositing the money into.

- Examples of Transfers are Credit Card Payment (transfer from Bank account to Credit Card account) and ATM withdrawal (transfer from Bank account to Cash)

- Drop down menus are available for easy data entry in these fields (Type, Category, SubCategory, Account).

After you enter your transactions, the Transactions worksheet would look like this image below.

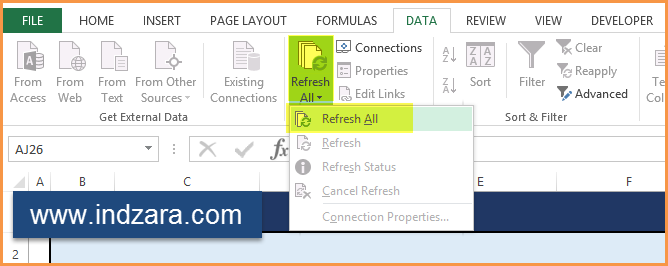

STEP 3: View Report

Since there are pivot tables and charts, please refresh the data by going to Data ribbon and refresh all (or keyboard shortcut Ctrl+Alt+F5) . This updates the charts with your new transactions.

Report sheet is locked to prevent accidental editing of formulas. To unlock, use password indzara

The report has four pages.

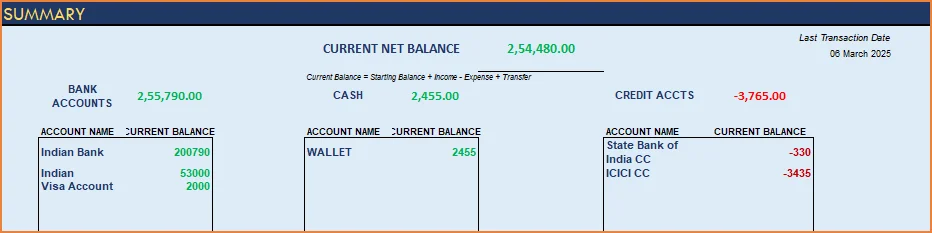

1) Summary

- Summary of your current financial status

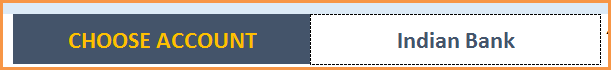

You can find balances for any period in each of your accounts using this personal account template.

This can be helpful when your bank statements and credit card statements actually have their billing cycles different from calendar months. This allows you to compare your statements with the data you have in this template and confirm that you have not missed any transactions.

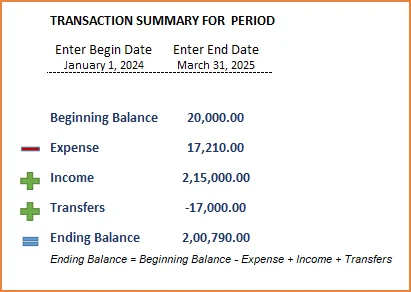

The chart shows the trend of month-end balances in the account chosen.

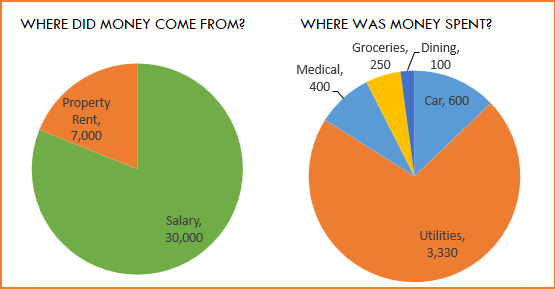

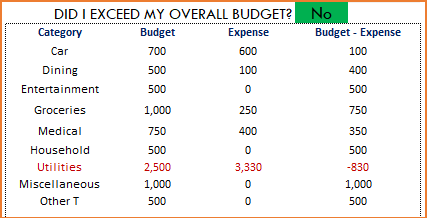

2) Monthly Financial Analysis

This multiple bank account management excel template can also help in monthly financial analysis. Please choose one month at a time using the slicers at the top.

View total Income, expense and savings

Understand where the money came from and where it was spent, in the month

- Track whether you have exceeded the monthly budget.

- Also see the comparison of expenses to budget by each category

- Categories that exceeded budget will be highlighted in red

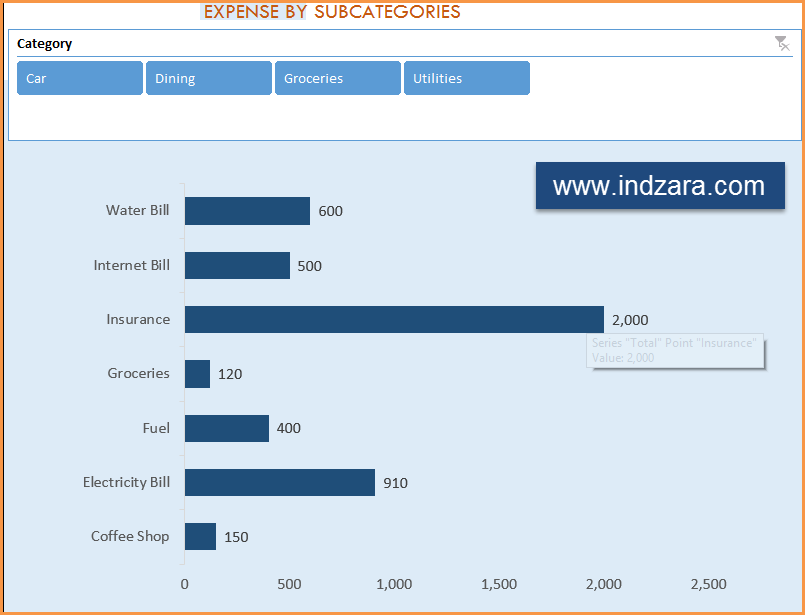

Understand expenses by Subcategories.

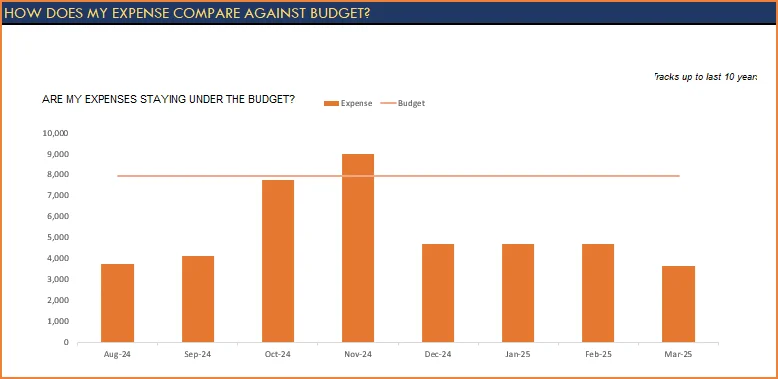

3) Trends of expenses, savings and net balance

Trend of expenses over time and comparing against monthly budget

Trend of savings and net balance over time

4) Trends of transactions by Categories and Sub Categories

I hope you find this personal finance management template excel useful in managing your personal finances easily.

346 Comments

Wooow!! This is exactly what I wanted and you made my day happier. Thank you so much for the endless works behind this beautiful Excel Sheet.

You are welcome. Very glad to know. Thanks for taking the time to provide feedback. Best wishes.

Thank you for a fantastic template. Is it possible to create more rows on the Transactions worksheet? On the version I have, everything works great up until Row 205, after this point it stops working.

Thanks in advance.

You are welcome.

There is no row limitation. The row height may be the default row height after 205. But the functionality does not change. Please send screenshot and highlight what is not working. indzara@gmail.com. Thanks.

Hi, Strange occurrences where the Category drop down box arrow is missing from some lines and not all the Categories are being shown on the list when I click the top Category tab.

I have some pics which hopefully will show what I am trying to say.

How can I upload the pics for your attention.

Thanks for sending the email with screenshots. I will respond to your email shortly. Thanks & Best wishes.

Dear sir

Monthly and yearly report is not work at below format is not working …please let me know what to do..

indzara_Personal_Finance_Manager_2010_v2

Thanks for the comment. Which Excel version are you using? What have you entered and what does ‘not working’ mean? If the data is input inside the tables correctly, and the data is refreshed, the report should update. Please let me know exactly what has been entered and what the issue is. Thanks & Best wishes.

Hi there, Can I use this for multiple currencies? I am paid in Euros but have a UK credit card also, so I use two different accounts depending on where I am. Or should I use two spread sheets? One for my UK accounts and one for my euros?

I know that is says for use with dollars and rupees, so does that mean I shouldn’t use it at all?

Thank you!

The template is currency agnostic now. You can format the cells with any currency format as needed.You can have both accounts (euros, UK) in the file as long as they don’t have to be converted. If you are expecting two currencies to co-exist with conversion rates, that is not built in. Please let me know if there are any questions. Thanks & Best wishes.

Hello Indzara,

Thanks a lot for your suggestion and link to your tutorial, it’s so awesome that you reply to the comments!

I’ve been trying to program this function (running balance for each account after each transaction) into your finance manager but I haven’t been able to do it correctly. There is a lot of criteria and ranges I am not sure what to input. Could you program this for me and I’ll send you a paypal donation? I already spent a lot of hours trying to do it without success.

I am using this manager for my business so I really need the running balance on the last column of the transactions sheet. If you could program this correctly I will be willing to send you a fair amount for your time and knowledge. I am sure this feature will be very useful to all your customers as well. Please let me know if you agree, here is my email for any further questions, max.azcona@gmail.com. Thank you very much for your awesome excel template Indzara, hope to hear from you soon!

You are very welcome. I am glad to help. Please try this formula in a new column created in the TRANSACTIONS table.

=SUMIFS([Amount],[Date],”<="&[@Date],[Account],[@Account],[Type],"Income")+SUMIFS([Amount],[Date],"<="&[@Date],[Account],[@Account],[Type],"Transfers")-SUMIFS([Amount],[Date],"<="&[@Date],[Account],[@Account],[Type],"Expense") Basically this will add up (Income + Transfers - Expense) as of the current transaction date for that specific account. Please let me know if there are any questions. Best wishes.

Hello!

Thank you for this great tool! It has been really helpful. One question, how could I program another column on the transactions sheet showing the active balance after each transaction?

I really need to see the balance on certain days after certain transactions and the report section only shows the net balance. I would really appreciate if you could help us out with this, thank you very much!

Have a great day!

You are welcome. I have not had the time to build this. But this would be my suggestion: we need a formula with SUMIFS function. Sum all transactions with INCOME type + Sum all transactions with TRANSFER type – Sum all transactions with EXPENSE type where Account = ‘the account in the current row’ and transaction Date <= 'date in current row' This should give the balance for that account as of that transaction date. For help with SumIF function, please see my video https://youtu.be/jM1AuYmFdAc. Please let me know if this doesn’t help. Thanks & Best wishes.

hi thank you for your great work i want conirme that is work perfect on office 2016 for mac i have the version excel for mac v 15.17 and there is no problem.

Best regards

Great. Thank you for the update. Glad to know. Best wishes.

Hi,

Sorry for the long delay of response.

On Mac, v15.17, reports are not working. I see only ones and zeros in front of the subcategories).

Thanks.

Thanks for the update. Please send the file or screenshots to indzara at gmail dot com. Thanks.

I sent you the file. Did you receive it?

Yes, I have received your file. I opened the file in Windows Excel 2016 and some things appear different from your screenshots. I will install Excel 2016 in Mac this week and I will let you know. I am tied up with other projects and hence there may be a delay. Thanks & Best wishes.

Thank you very much.

Thanks for your patience. I installed Excel 2016 for Mac and found that 4 charts in the Windows version file still don’t work in Mac. This is because they use pivot charts and Excel 2016 for Mac still does not support pivot charts.

The data can be found in the hidden sheet (pivot_tables) where it is correctly displayed. However, the charts in the REPORT sheet are not picking up that data.

Thanks & Best wishes,

Thank you.

Hi,

Thanks for this great tool, really appreciated here.

Are you planning an update for Office 2016 for Mac? Maybe this new version is compatible with the features not available for Office 2011.

Thanks again.

Thanks for the kind words.

I have not used Office 2016 for Mac yet. If you have one, please try this template and let me know. According to Microsoft’s news, Slicers are available now for Mac. So, I am assuming this template now works in Mac. Thanks.

Thanks for this – had got tired of wrangling with tools like YNAB and (being on Mac) I missed MS Money… Anyway, this is really simple and easy to understand. Thanks for building this!

Only downside of the Mac / Office 2007 version is the lack of Income By Year. Still, not the end of the world. Thanks!

You are very welcome. I am glad you find it useful. Best wishes.