Personal Finance Manager 2025 (Free Excel Budget template)

This is a simple free Personal Finance management excel template that focuses on making it easy for you to know what’s happening with your financial situation especially when you have multiple bank accounts, credit card accounts and cash.

This Excel Budget template also helps you set budgets and see how you are actually doing against your budget.

With simple data entry, the template provides you instant access to actionable information in a consumable form that can answer key questions regarding your personal financial situation.

Specifically, the template helps you in knowing the following:

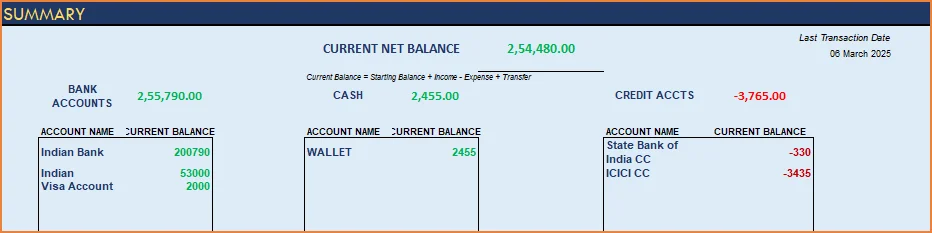

- How much money is in my different bank accounts?

- How much do I owe on credit cards?

- On what items am I spending my money on?

- Am I exceeding my monthly budget? If so, in which categories?

- How are my expenses trending over time?

- Am I spending more on any specific expense category over time?

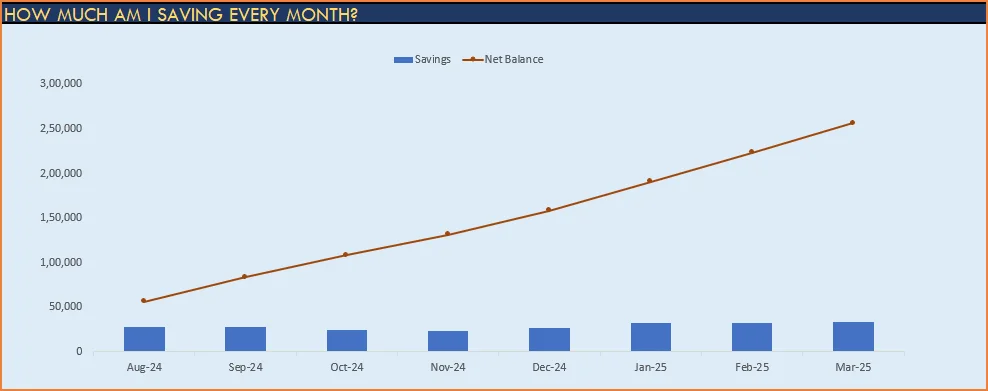

- How much am I saving every month? How does that add to my net balance?

Free Downloads

This version doesn’t use Pivot Tables and Slicers. 4 Charts that are available in Excel 2010 file are not available in this.

Requirements

Excel 2010 and above for Windows

Excel 2011 for Mac

Video Demo

How to track personal finances in Excel?

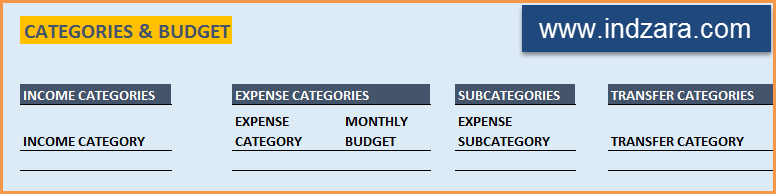

The template has 3 worksheets: 1) Settings 2) Transactions and 3) Report.

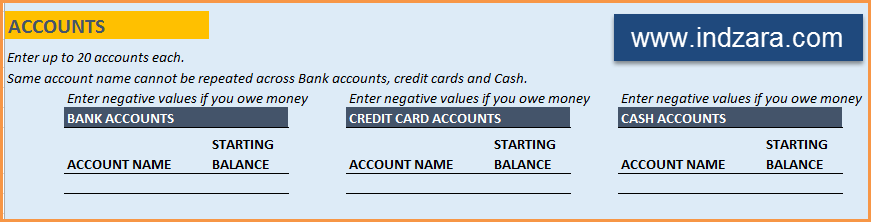

STEP 1: Enter information in Settings worksheet

- Enter Accounts (bank accounts, Credit Card Accounts and Cash Accounts)

- Set your starting balances of accounts

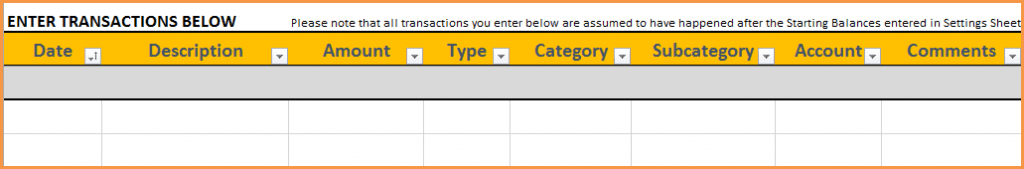

STEP 2: Entering transactions in the Transactions worksheet

When you open the template, there will be no records in the Transactions worksheet (as shown in the image below). Start entering your own transactions.

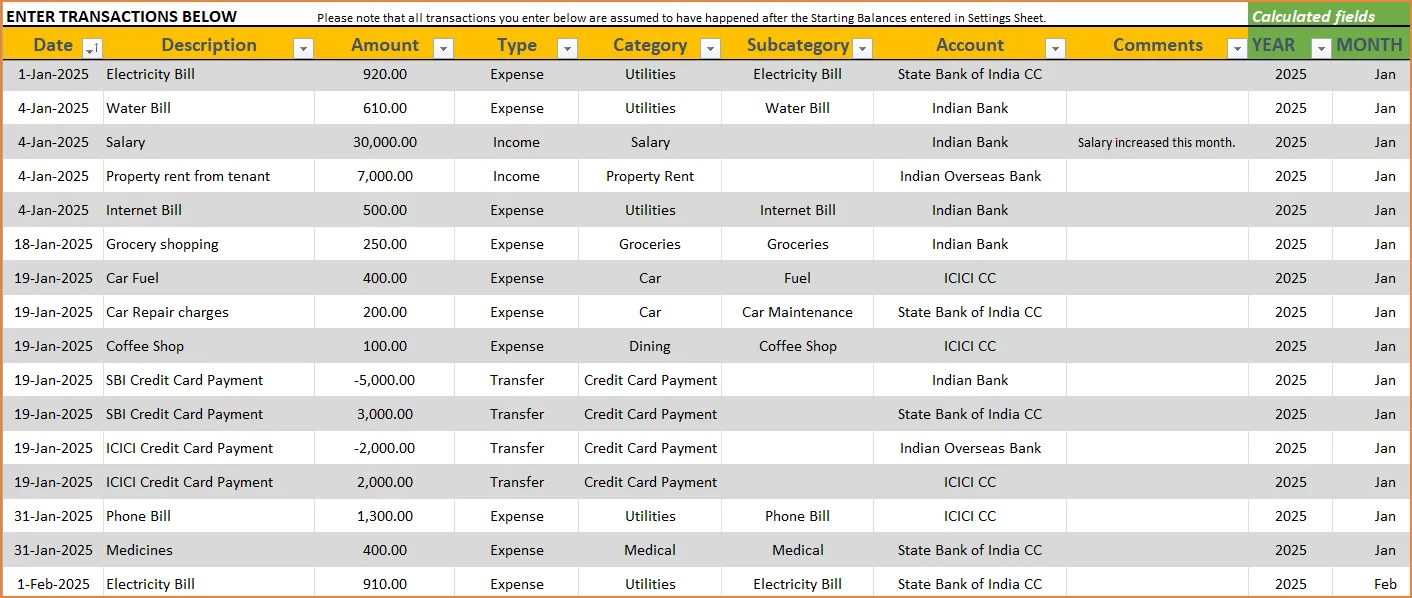

3 Types of Transactions

- Income and Expense: By default, all the Income and Expense transactions should be entered as positive amounts.

- Special case (Refund): If you purchased an item at a store, you would enter an Expense transaction with positive amount. If, a few days later, you returned the item to the store for some reason and get a refund, then you should enter the refund as a new Expense transaction with negative value.

- Transfer: When money is transferred from one account to another, create two records

- ‘Transfer’ type with negative amount from the account you are taking the money from.

- ‘Transfer’ type with positive amount for the account you are depositing the money into.

- Examples of Transfers are Credit Card Payment (transfer from Bank account to Credit Card account) and ATM withdrawal (transfer from Bank account to Cash)

- Drop down menus are available for easy data entry in these fields (Type, Category, SubCategory, Account).

After you enter your transactions, the Transactions worksheet would look like this image below.

STEP 3: View Report

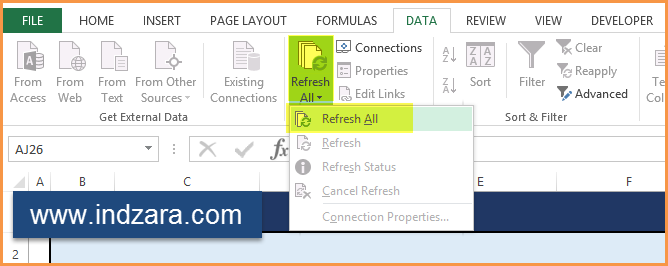

Since there are pivot tables and charts, please refresh the data by going to Data ribbon and refresh all (or keyboard shortcut Ctrl+Alt+F5) . This updates the charts with your new transactions.

Report sheet is locked to prevent accidental editing of formulas. To unlock, use password indzara

The report has four pages.

1) Summary

- Summary of your current financial status

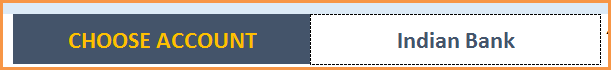

You can find balances for any period in each of your accounts using this personal account template.

This can be helpful when your bank statements and credit card statements actually have their billing cycles different from calendar months. This allows you to compare your statements with the data you have in this template and confirm that you have not missed any transactions.

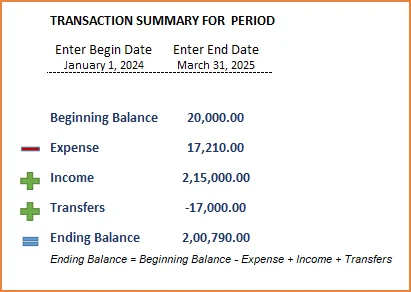

The chart shows the trend of month-end balances in the account chosen.

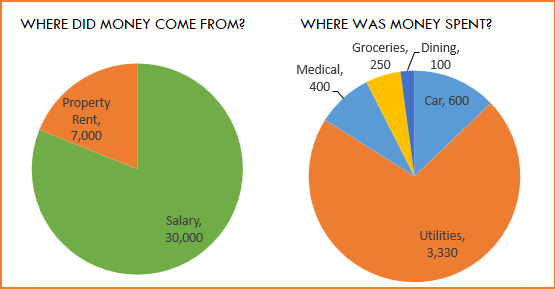

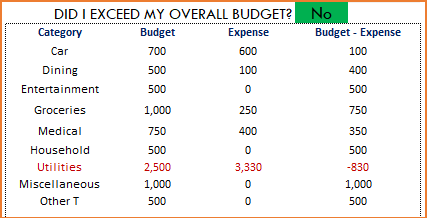

2) Monthly Financial Analysis

This multiple bank account management excel template can also help in monthly financial analysis. Please choose one month at a time using the slicers at the top.

View total Income, expense and savings

Understand where the money came from and where it was spent, in the month

- Track whether you have exceeded the monthly budget.

- Also see the comparison of expenses to budget by each category

- Categories that exceeded budget will be highlighted in red

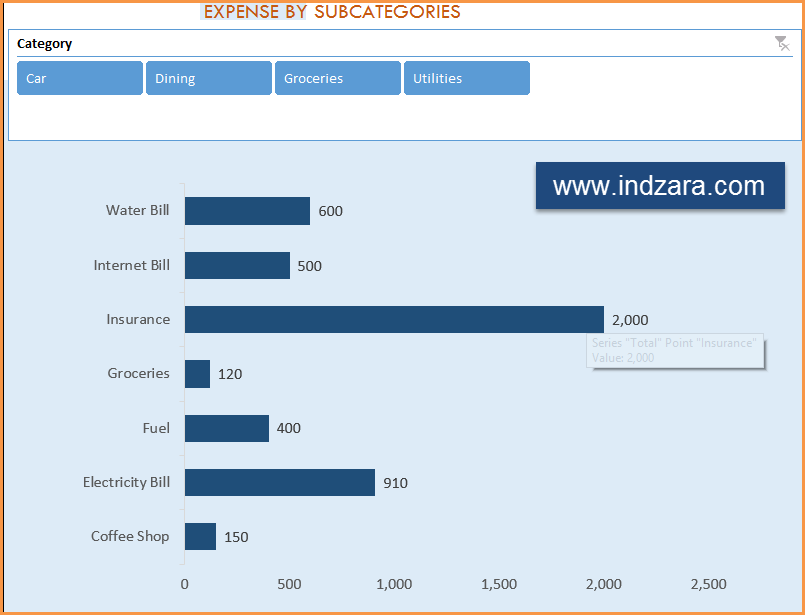

Understand expenses by Subcategories.

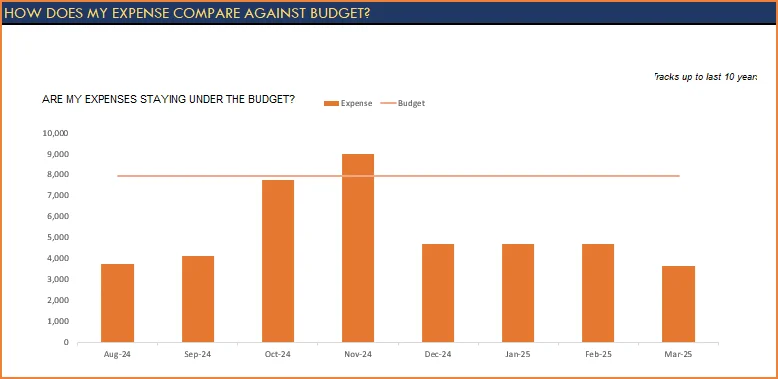

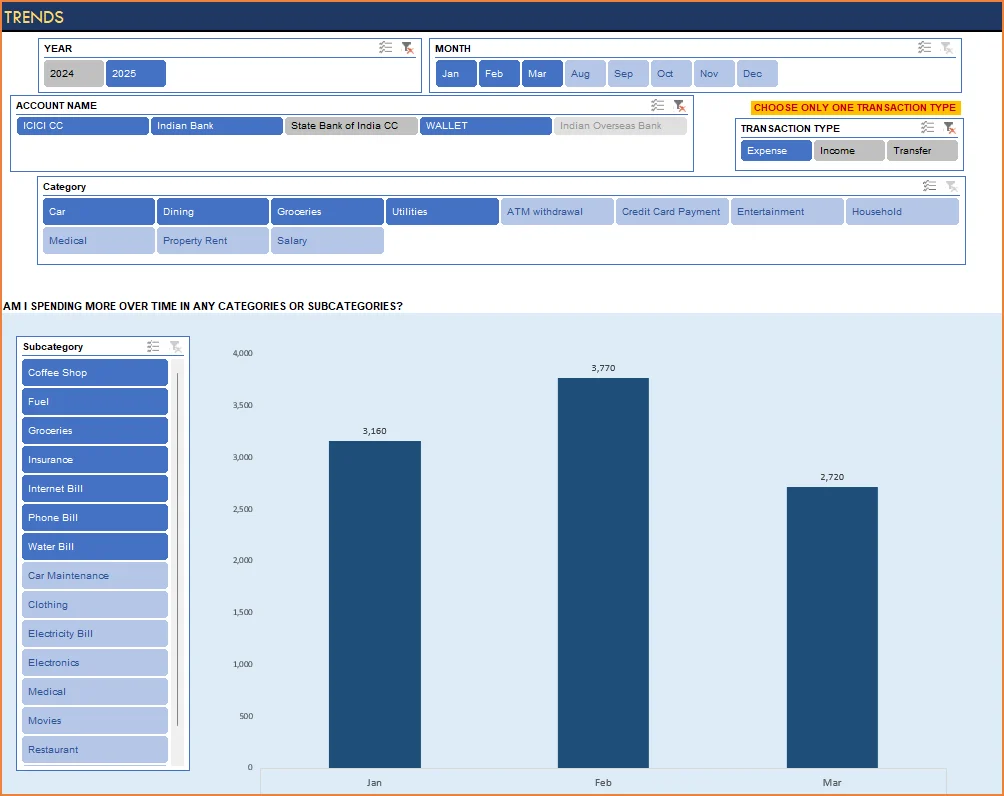

3) Trends of expenses, savings and net balance

Trend of expenses over time and comparing against monthly budget

Trend of savings and net balance over time

4) Trends of transactions by Categories and Sub Categories

I hope you find this personal finance management template excel useful in managing your personal finances easily.

346 Comments

how does one log 2 types of currencies, pertaining to 2 different bank accounts in different countries

Hello

Transactions can be logged in one currency only.

Best wishes

Hello dear

I need this templates for MAC if you could please provide me the templates .

Thanks

Hello

You can download a copy for MAC from https://indzara.com/2013/05/personal-finance-manager-excel-template/. It’s the second option in the free download section.

Best wishes

Hi Indzara Team,

Thanks for your feedback on updating the PIE CHART section of the reports. Request you to please advise if there is a similar method to exclude certain income and expense categories for the following reports:

1) How does my expense compare against the budget ?

2) How much I am saving every month ?

Appreciate your inputs on the same.

Thanks and Regards,

Hi,

Good Morning. Thanks for building the awesome template. I have been using this as a primary tool to track income and expenses. Request you to please advise if in the PIE CHART option which we have in the reports section, we can exclude certain income and expense categories / subcategories.

Appreciate your inputs on the same.

Thanks,

Dhruv

Hello Dhruv,

Please unhide the sheets and deselect the categories that are not required from the Pivot tables.

Best wishes

Hi Indzara Team,

Thanks for your feedback on updating the PIE CHART section of the reports. Request you to please advise if there is a similar method to exclude certain income and expense categories for the following reports:

1) How does my expense compare against the budget ?

2) How much I am saving every month ?

Appreciate your inputs on the same.

Thanks and Regards,

Dhruv

Hello

Please refer to the reports tab. It gives you a graphical representation of your expenses with respect to your budget. Also, shows savings every month.

Regards

Hi Indzara team,

I am using 2010 v2 sheet on macOS highSierra v10.13.2. on excel for Mac 2017 and the monthly review is not showing the plot, which i really miss about, cos it gives the overview. Can you maybe help why this might be?

Thanks.

Hello

This sheet is tested on 2011 Excel for Mac OS and after.

If it does not show results properly. Please send a copy of your file to contact@indzara.com

Best wishes

Love this template and used it for 2017. Now that I am entering 2018 transactions, they are not showing up on Year slicer. I can select 2017 but the rest of the buttons listed are 42737, 42737 etc. Is there a way to correct this?

Hello,

Thank you for using the template.

Please ensure that you hit “Refresh All” in the data ribbon. The data in the transaction sheet needs to be updated to reflect the fresh inputs.

Let us know if that works.

Best wishes

Hello indzara , Thanks for your Template .I am now using your financial Template proudly.However , I would like to change chart color and its row thickness. May I know its password to edit it.Thanks with best Regards

Hello

Thanks for using the template.

The password to unprotect the sheet is “indzara”

Best Wishes

I have entered all income and expenses payment from Bank account. Entered Opening balance in Bank account. All expenses charts are updated with refresh. But Bank account summary – Op+Income-Exp is not getting updated

What could be my error ?

Sorry for the delayed response.

Please check the start and end dates. If there are further questions, please email file to contact@indzara.com

Best wishes.

Additionally, everytime I close the file, I get an error. I am afraid I will not be able to access this file in sometime. Please help resolve as I would like to continue using the excel sheet. Thank you

ERROR:

Microsoft Error Reporting log version: 2.0

Error Signature:

Exception: EXC_BAD_ACCESS

Date/Time: 2017-08-24 11:28:02 +0000

Application Name: Microsoft Excel

Application Bundle ID: com.microsoft.Excel

Application Signature: XCEL

Application Version: 14.2.2.120421

Crashed Module Name: MicrosoftChartPlugin

Crashed Module Version: 14.2.2.120421

Crashed Module Offset: 0x00158ceb

Blame Module Name: MicrosoftChartPlugin

Blame Module Version: 14.2.2.120421

Blame Module Offset: 0x00158ceb

Application LCID: 1033

Extra app info: Reg=en Loc=0x0409

Crashed thread: 0

I am really not sure what the error is. It says the MicrosoftChartPlugin crashed. Are you using any other add-ins/plugins in your Excel installation?

I have not had any issues with the file. I am using Excel 2016 for Windows.

Best wishes.

Hello,

Your Personal finance manager excel sheet is amazing! Will you be releasing a new version with pivot tables and slicers for excel 2011 for Mac soon?

Also, how does one log 2 types of currencies, pertaining to 2 different bank accounts in different countries?

Thanks

Thanks for the feedback. Glad to hear.

If you are using Excel 2016 for Mac, you can try the Personal Finance Manager file (windows). I believe the pivot tables and slicers may be supported (but not all the pivot charts, may be). But it does not work in earlier versions of Excel for Mac.

There is currently no built-in support for 2 currencies. We have to convert them to one currency and enter. Or we have to maintain them in 2 separate accounts which do not transact between each other.

Best wishes.