Personal Finance Manager 2025 (Free Excel Budget template)

This is a simple free Personal Finance management excel template that focuses on making it easy for you to know what’s happening with your financial situation especially when you have multiple bank accounts, credit card accounts and cash.

This Excel Budget template also helps you set budgets and see how you are actually doing against your budget.

With simple data entry, the template provides you instant access to actionable information in a consumable form that can answer key questions regarding your personal financial situation.

Specifically, the template helps you in knowing the following:

- How much money is in my different bank accounts?

- How much do I owe on credit cards?

- On what items am I spending my money on?

- Am I exceeding my monthly budget? If so, in which categories?

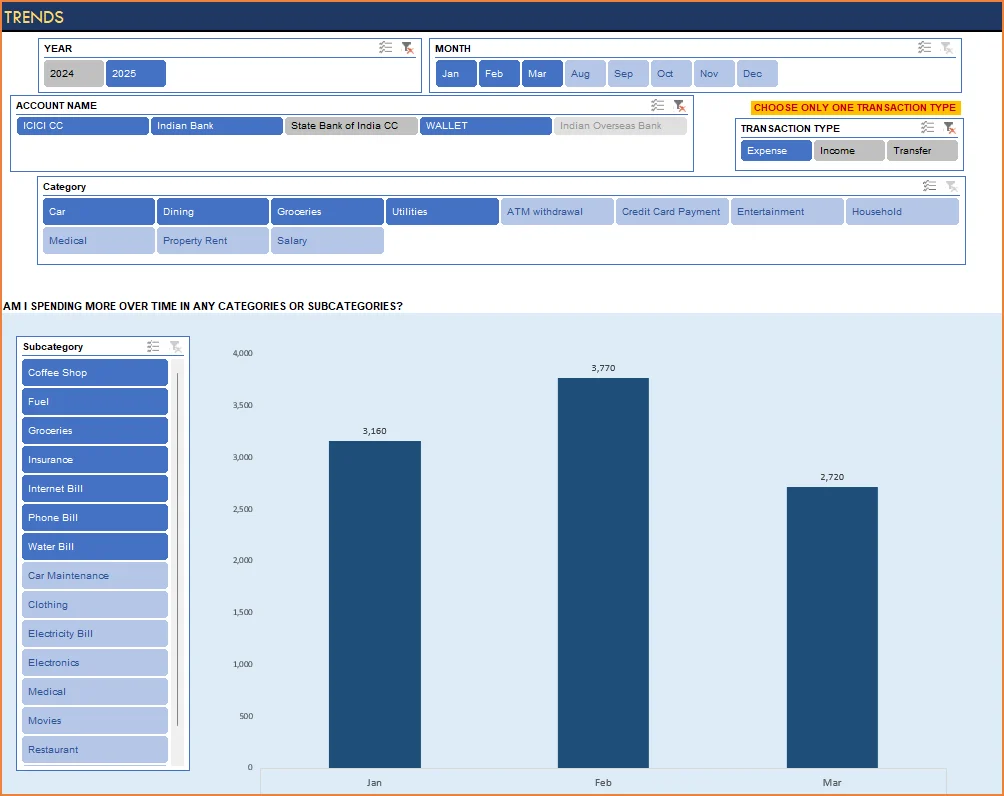

- How are my expenses trending over time?

- Am I spending more on any specific expense category over time?

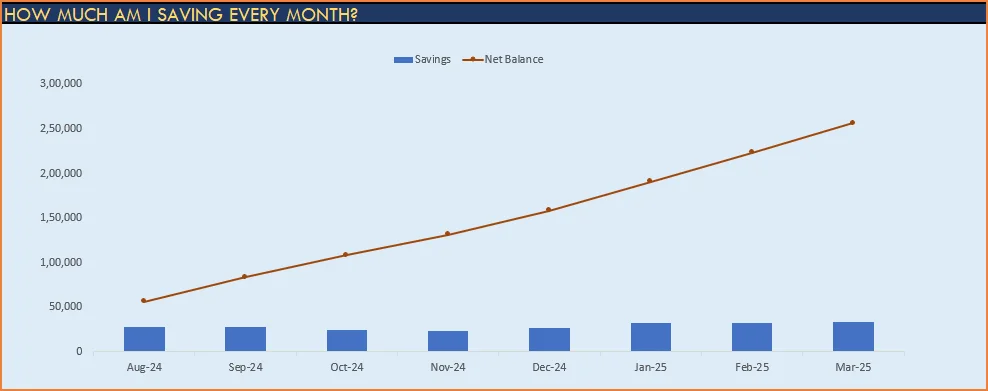

- How much am I saving every month? How does that add to my net balance?

Free Downloads

This version doesn’t use Pivot Tables and Slicers. 4 Charts that are available in Excel 2010 file are not available in this.

Requirements

Excel 2010 and above for Windows

Excel 2011 for Mac

Video Demo

How to track personal finances in Excel?

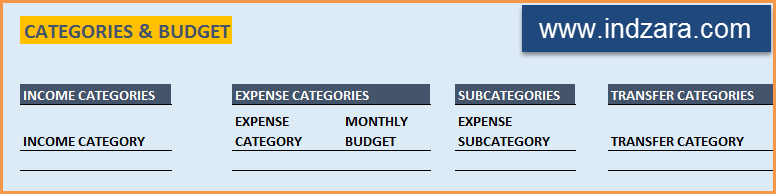

The template has 3 worksheets: 1) Settings 2) Transactions and 3) Report.

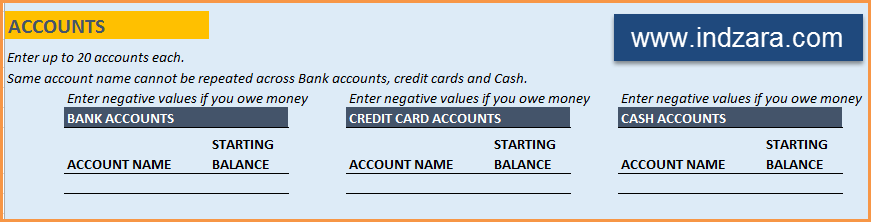

STEP 1: Enter information in Settings worksheet

- Enter Accounts (bank accounts, Credit Card Accounts and Cash Accounts)

- Set your starting balances of accounts

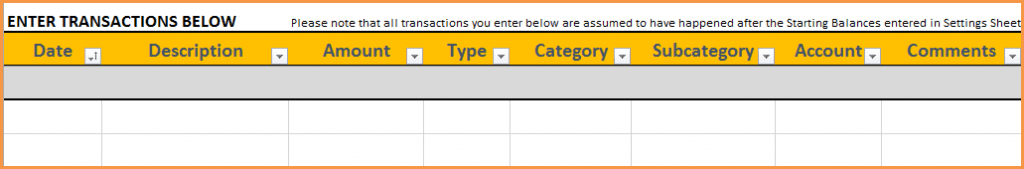

STEP 2: Entering transactions in the Transactions worksheet

When you open the template, there will be no records in the Transactions worksheet (as shown in the image below). Start entering your own transactions.

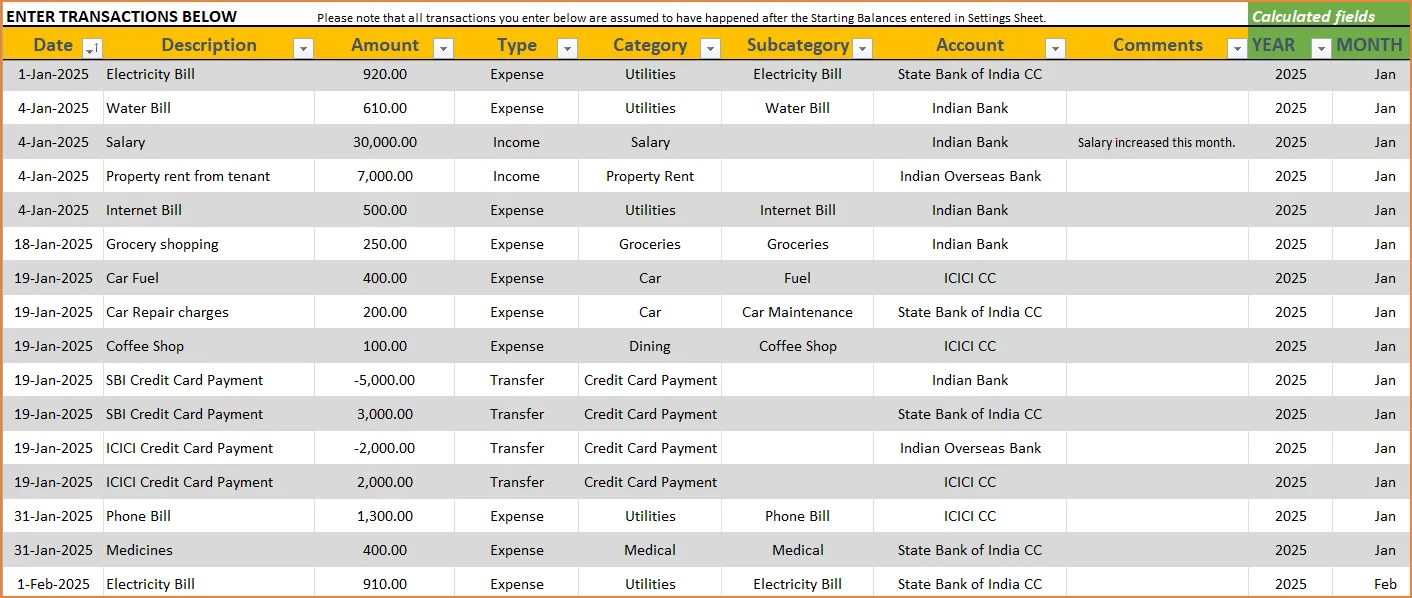

3 Types of Transactions

- Income and Expense: By default, all the Income and Expense transactions should be entered as positive amounts.

- Special case (Refund): If you purchased an item at a store, you would enter an Expense transaction with positive amount. If, a few days later, you returned the item to the store for some reason and get a refund, then you should enter the refund as a new Expense transaction with negative value.

- Transfer: When money is transferred from one account to another, create two records

- ‘Transfer’ type with negative amount from the account you are taking the money from.

- ‘Transfer’ type with positive amount for the account you are depositing the money into.

- Examples of Transfers are Credit Card Payment (transfer from Bank account to Credit Card account) and ATM withdrawal (transfer from Bank account to Cash)

- Drop down menus are available for easy data entry in these fields (Type, Category, SubCategory, Account).

After you enter your transactions, the Transactions worksheet would look like this image below.

STEP 3: View Report

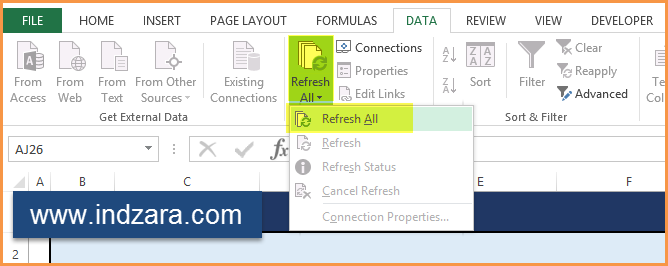

Since there are pivot tables and charts, please refresh the data by going to Data ribbon and refresh all (or keyboard shortcut Ctrl+Alt+F5) . This updates the charts with your new transactions.

Report sheet is locked to prevent accidental editing of formulas. To unlock, use password indzara

The report has four pages.

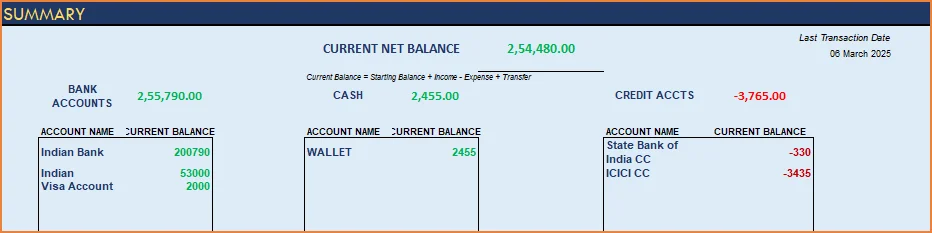

1) Summary

- Summary of your current financial status

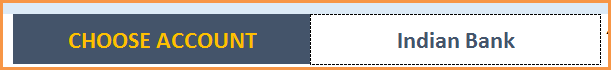

You can find balances for any period in each of your accounts using this personal account template.

This can be helpful when your bank statements and credit card statements actually have their billing cycles different from calendar months. This allows you to compare your statements with the data you have in this template and confirm that you have not missed any transactions.

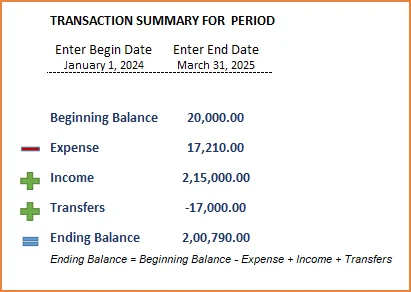

The chart shows the trend of month-end balances in the account chosen.

2) Monthly Financial Analysis

This multiple bank account management excel template can also help in monthly financial analysis. Please choose one month at a time using the slicers at the top.

View total Income, expense and savings

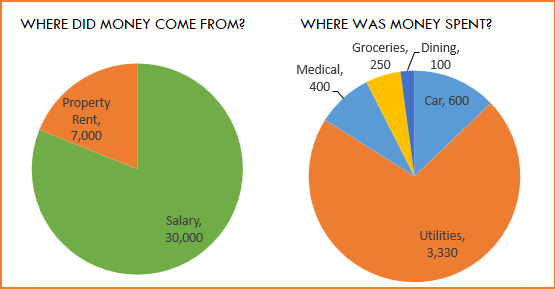

Understand where the money came from and where it was spent, in the month

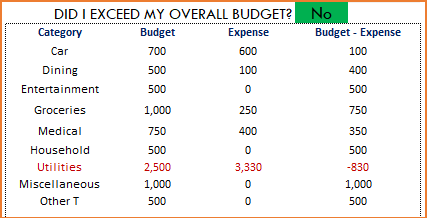

- Track whether you have exceeded the monthly budget.

- Also see the comparison of expenses to budget by each category

- Categories that exceeded budget will be highlighted in red

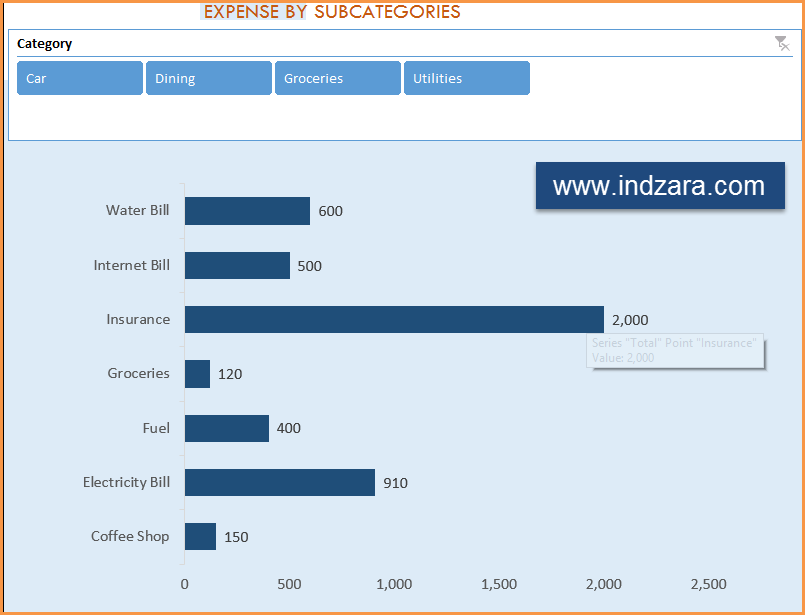

Understand expenses by Subcategories.

3) Trends of expenses, savings and net balance

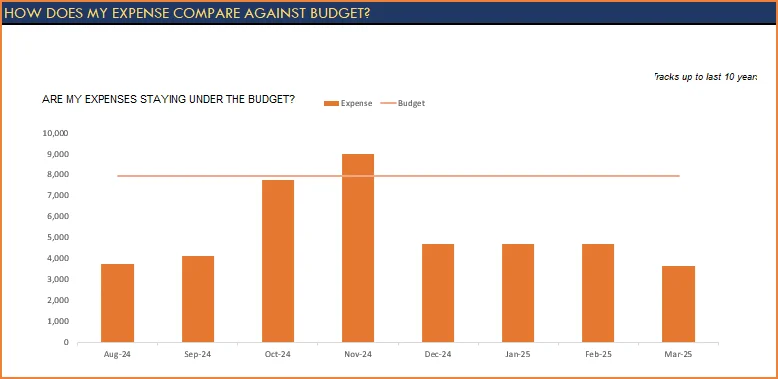

Trend of expenses over time and comparing against monthly budget

Trend of savings and net balance over time

4) Trends of transactions by Categories and Sub Categories

I hope you find this personal finance management template excel useful in managing your personal finances easily.

346 Comments

Thank you fur this amazing template, i have one doubt can we add personal finance borrowing details? for example, i borrowed Rs. 10000 from A. later i returned Rs. 5000. If there is any option for personal ledger?

You are welcome. Thank you for showing interest in our template.

You can enter Borrow as a credit card and track the borrowed amount and paid amount.

Best wishes.

Dear Sir

Integration of 1 to n subcategories per main category and related evaluation options & Give to add & remove category & subcategory

2) Tracking of fixed vs. variable expenses

3)How to Split expenses & Income

4) How can add More types like (Expense,income ,transfer,Journal,advance,Saving Exps.

5) can you add PMT (Cash,Bank Direct,Check,Direct deposit,Credit card,Debit card,Gift card,Other)

6)Cycle (Regular,Irregular)

7)Nec/Lux (Necessity,Luxury)

8)Memo (use for Spilt Transaction)

9)needs,wants,savings

10) can you add Symbol of category

11)fix expense,variable expense

If select tpes in Expense Showing only expense relate category in dropdown if select expense particular expense categaory like utilty sowing in subctegory dropdowna only utility realted

Thank you for sharing your requirement.

We take customization projects for a fee. We will review your requirement and send you the estimation through email by tomorrow.

Best wishes.

Hello, I just started using this template and I see is very complete, but I would like to add another pivot table in the report slide that presents me the actual budget for each category, and if I did not use all the budget for each category in the ” month 1″ adds that amount to the initial budget of each category of the “month 2”

Category Initial budget (same for each month) Expense Month 1 Initial budget Month 2

Food $100 $50 ( $100 + $50 of the first month)

Car $350 $250 ( $350 + $100 of the first month

Is there any possibility of doing that ? and How?

Thank you for using our template and sharing your valuable feedback.

Yes, it is possible. We take customization projects for a fee. Please write to us at the below link for estimation:

https://support.indzara.com/support/tickets/new

Best wishes.

this template is very helpful for me, i really like the format

but i want to adjust something, is there any way to adjust the “did i exceed my overall budget” tab, not monthly

for example, from 25th august to 25th september

Thank you for using our template and sharing your valuable feedback.

Yes, it is possible. Formulas in the hidden Monthly_Summary_Table needs to be modified. For example, we used EOMONTH function to get the last date of the month, you will need to add 25 in it.

We take customization projects for a fee. To proceed further with the customization from our end, please write to us at the below link for estimation:

https://support.indzara.com/support/tickets/new

Best wishes.

I just wanted to say thank you for this brilliant and helpful template. It has become so handy for me as I use it everyday. I wanted to know if there is a way to have automatic reminders for daily/weekly/monthly deposits/bill payments so that there is less potential for these type of things to be missed when entering it manually. For example, how can I have a popup or some sort of notification every month that I have a phone bill for company XYZ due on the 15th of the month for $100?

Thank you for using our template and sharing your valuable feedback.

The requested feature to pop up a remainder on certain dates is possible using Macro but we do not use macro in 99% of our template to ensure it is simple enough for our customers to go through the template modify it as per their requirement.

You can use our Event Calendar template to schedule your bill payments and it will show the same on the calendar. Following is the link to the template for quick reference:

https://indzara.com/product/event-calendar-maker/

Best wishes.