You can use this template to build your own Simple Moving Average technical indicator for any stock.

In this article, we will be covering the following.

- Introduction to Technical Indicators

- Simple Moving Average – Concept

- Template and its Features

How to calculate Moving Averages?

Moving Averages is one of the most used technical indicators. It is a simple concept, easy to understand and interpret. It is basically a smoothing device.

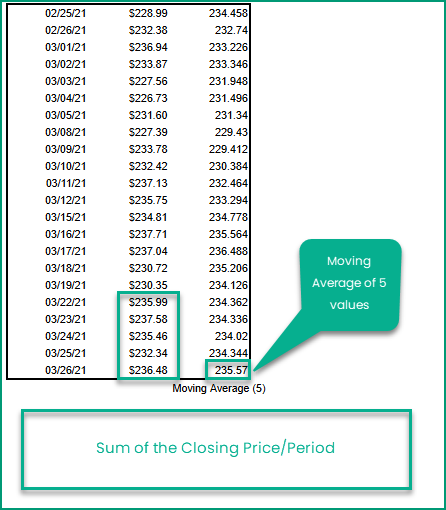

Let’s take a simple example where we have closing price of a stock for each trading day.

To calculate the moving average of 5 periods, for March 26th, we average the price of 5 days (Mar 22nd to 26th).

To calculate the moving average of 5 periods, for March 25th, we average the price of 5 days (Mar 19th to 25th).

A couple of parameters in this calculation are

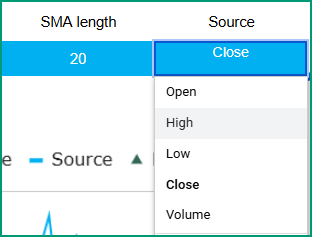

1) Length of the moving average – how many periods to use for calculating average. In the example above, we used 5.

Common moving average lengths are 10, 20, 50, 100 and 200.

If the length is greater, the smoothing effect is greater and the indicator is less impacted by sudden price fluctuations.

2) Source – what value are we averaging. In the example we used the closing price of the stock.

Though Closing price is the most used for calculating simple moving average, you can also use High, Low, Open, and Volume as well.

Trading Signals

Commonly used trading signals using the Moving average method are listed below.

Once again there is no golden rule or a rule that works all the time. Otherwise, everyone will use that rule and make a lot of money easily.

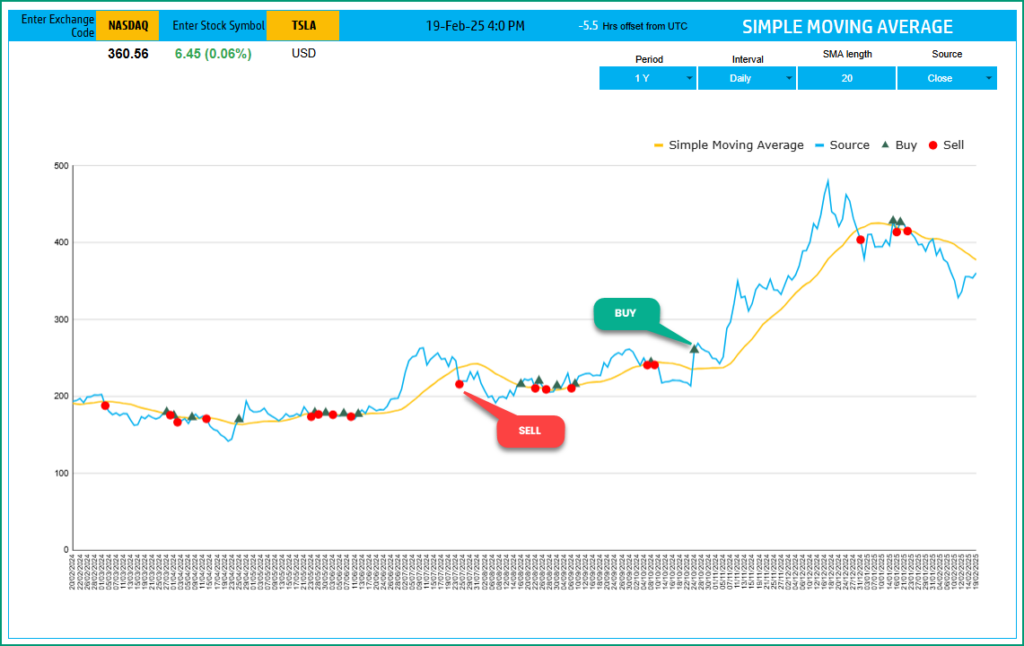

- BUY – If the closing price moves from below the Moving Average line to above the Moving average line, then a Buy signal is generated.

- SELL – If the closing price moves from above the Moving Average line to below the Moving average line, then a Sell signal is generated.

SMA Google Sheet Template

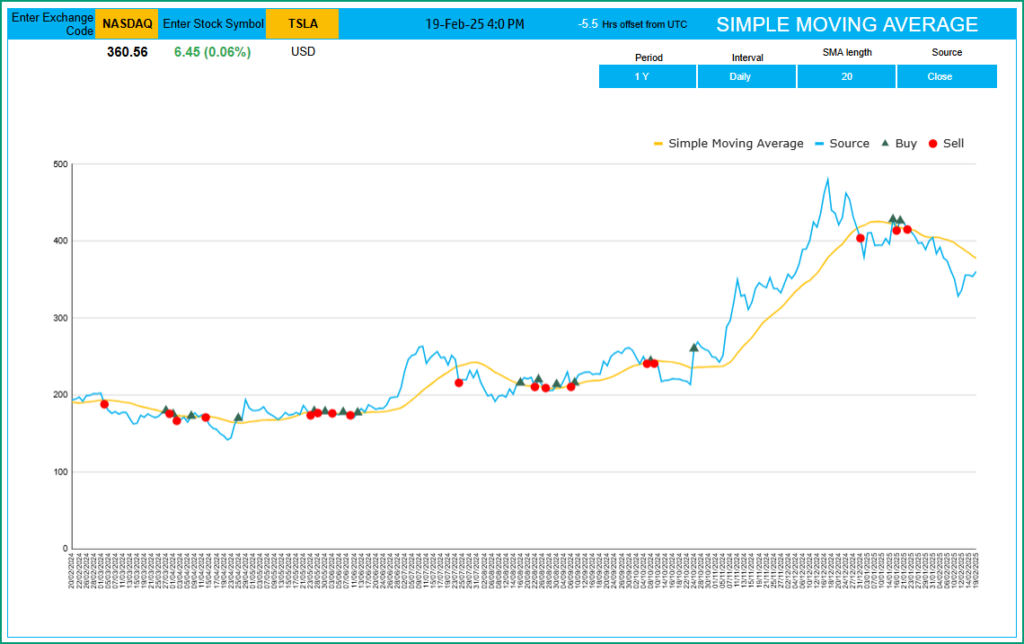

The template will help you create the Moving Average line and also calculate the trading signals instantly for any stock.

Download

How to calculate Moving Averages in Google Sheets?

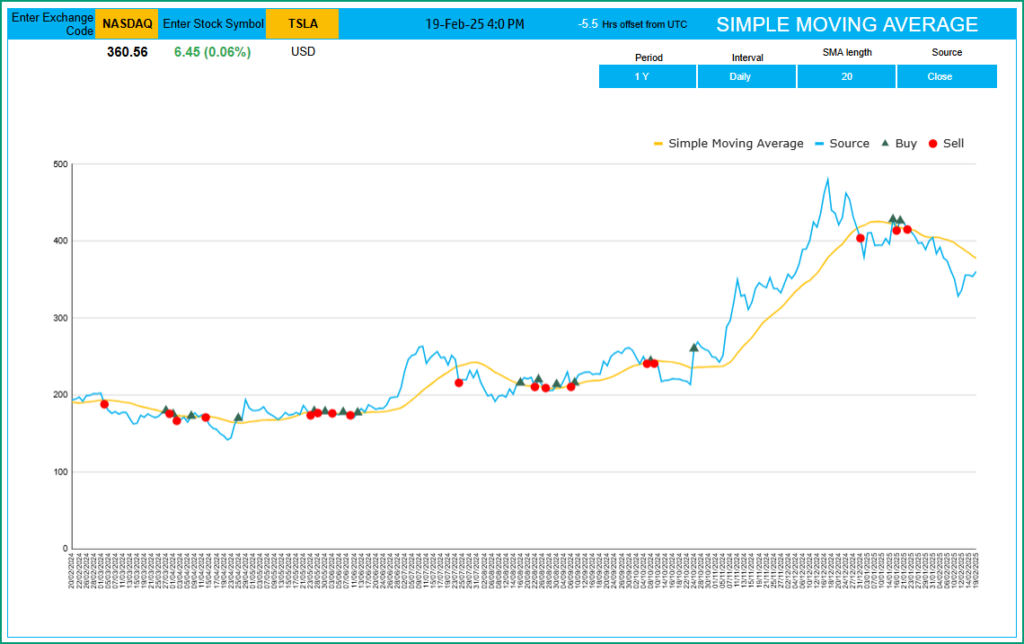

Type in a stock exchange code (like NASDAQ) and the stock symbol (example: “TSLA” for TESLA) as shown on the top left.

Kindly ensure to enter the correct exchange code and stock symbol for Google sheets to recognize the same.

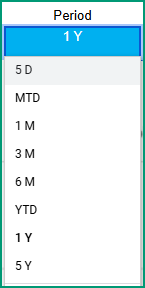

Period

The template can pull up to 1 year of price history by default. You can choose how much history to display on the chart easily using the check box.

The options are 5 Days, 1 Month, 3 Months, 6 Months, 1 Year, Month Till Date, and Year Till Date.

Interval

The template allows price history at 2 different intervals: Daily and Weekly.

Input Parameters

- Source: Closing price is the one that is used for calculations typically. However, you can choose from Open, High, Low, Close or Volume.

- Length: You can type in a length in periods. The commonly used is 14.

The chart will update automatically based on all the above inputs.

Signals

The template shows two types of signals (Buy, Sell) on the chart.

The following rule generates the signals.

- Buy If the value crosses over from below the Moving Average to above the Moving Average

- Sell If the value crosses over from above the Moving Average to below the Moving Average

In addition, if the latest day has a signal, it will be displayed below the current price.

Timezone

On the top right you can see the maximum of the last trade time of these currencies.

The default time that Googlefinance functions provides is UTC. The offset is set to -7 hrs, to convert to pacific time zone.

You can modify this if you need the time in a different time zone.

Visit https://savvytime.com/converter/utc to view offset.

Resources

For Excel Templates for Stock Market, visit indzara.com/stock-market-templates

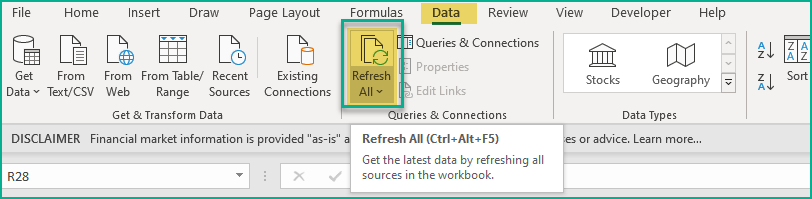

How to refresh?

To refresh the price and other information, just use the regular Excel refresh in the Data ribbon.

-

SMA Strategy Backtester Google Sheets Template$25

-

SMA Strategy Backtester Excel Template$25Rated 5.00 out of 5 based on 1 customer rating

-

RSI Strategy Backtester Google Sheets Template$25

-

RSI Strategy Backtester Excel Template$25

-

MACD Strategy Backtester Google Sheets Template$25

-

MACD Strategy Backtester Excel Template$25

-

Simple Moving Average Stock Screener Google Sheet Template$25

-

Stock Screener Excel Template$97Rated 4.75 out of 5 based on 4 customer ratings

-

Simple Moving Average Stock Screener Excel Template$25Rated 5.00 out of 5 based on 1 customer rating

Feedback

Please share your experience. I expect this to be different with different exchanges and countries. Is it working for you? Is it working differently? I would love to hear from you.

Related Templates

- Exponential Moving Average Indicator in Excel

- Moving Average Crossover Indicator in Excel

- Weighted Moving Average Indicator in Excel

- Moving Average Envelope – Technical Analysis of Stocks

- Bollinger Bands Indicator – Technical Analysis in Excel

Get your copy of 30 free templates now!

Get 30 Free Stock Market Templates!

Thank You !!

Please check your email for the link to 30 templates