Personal Finance Manager – Excel Template v2

Hello Everyone,

I am glad to announce that the Personal Finance Manager template has been upgraded with the following key enhancements. The files are available for download in the same page.

- Increased number of accounts – Now can handle 20 bank accounts, 20 credit card accounts and 20 cash accounts.

- Increased number of categories and subcategories to unlimited

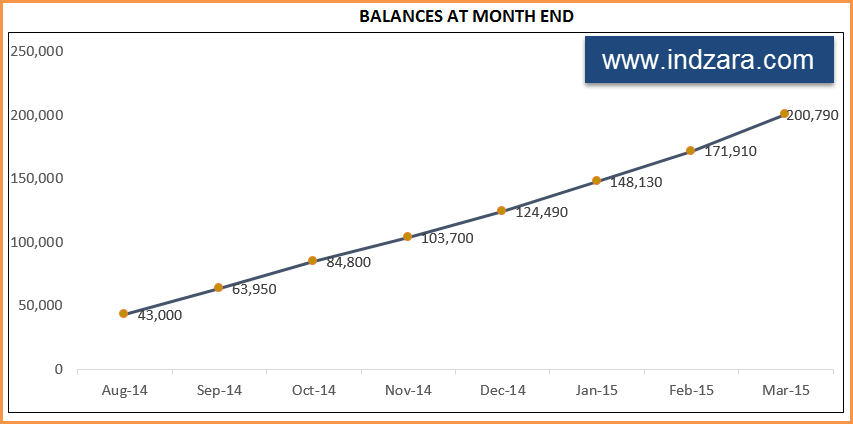

- Added new chart on account balance trends

- Improved Year – Month slicers in the Report sheet. I am using calculated fields (Year, Month) in the Transactions sheet.

- A new version compatible with Excel for Windows 2007 and Excel for Mac 2011 has been added.

Please try the new version and provide feedback.

19 Comments

Good software to start with. Excellent Effort. One doubt is that Why not more than 3 Banks are not reflecting in Transaction or Report even though i entered upto 6 banks. Any trick to make this work. All is Well

Thank for using our template and sharing your valuable feedback.

Requesting to share your sheet to support@indzara.com with some screenshots highlighting your concern to check further.

Best wishes.

Hi, many thanks for the amazing template. could you tell me how can I include my savings to this sheet?

Many thanks in advance.

Thanks for using our template.

This feature is not included in the present version. We will try to incorporate it in future releases.

Best wishes

hi,

Thank you for this wonderful financial template. I want to bring it to your notice that there are no specific categories for investments. Is there a way to add a category to the current template? thank you

Thanks for sharing your positive experience.

We have not included investments as a category yet. We will try to incorporate same in the future releases.

Best wishes

Why can’t I see ‘ did I exceed my overall budget ‘ ? Even when I have filled them in setting section.

Overall budget exceed status shown on Apple whereas the same is not getting in Windows.

Please advise

Why can’t I see ‘ did I exceed my overall budget ‘ ? Even when I have filled them in setting section

Please email file to contact@indzara.com

Best wishes.

Thanks for this wonderful Template. While this is good for monthly expenses ? How would you suggest factoring in expenses which happen may be once or twice a year- such as Insurance premiums, property tax, vacations etc. Typically for expenses like these, we save certain amount every month and pay it once a year or so. Hence can’t accurately predict it in Monthly budget under expense category.

You are welcome. You are correct. Non-monthly expenses can show up as exceeding budget when they happen. This is a feature I need to figure out for future version.

Thanks for feedback.

Best wishes.

Hi,

I have started using this template and it is awesome for my person financial management. I have friends and family members to whom either I have lent to or borrowed money from. How to keep track of such transactions?

Thanks. Please try creating dummy bank accounts in the name of each friend and enter transactions accordingly. Best wishes.

hi what the password for ur excel sheet

Password is indzara

Iam unable to refresh the report and the year is not getting updated

Please clarify what ‘unable to refresh’ means. Are you refreshing with DATA — refresh option, but report data is still the same? Please send file or screenshots to indzara at gmail and I will be happy to address your questions. Thanks. Best wishes.

Is it possible to make Expensive subcategory linked to Categories? Like a dropdown that will show only subcategories linked to the category already selected.

Yes, this can be done. There might have to be some limit on the number of categories, to enable this feature. I need to consider this for the next version. Thanks & Best wishes.